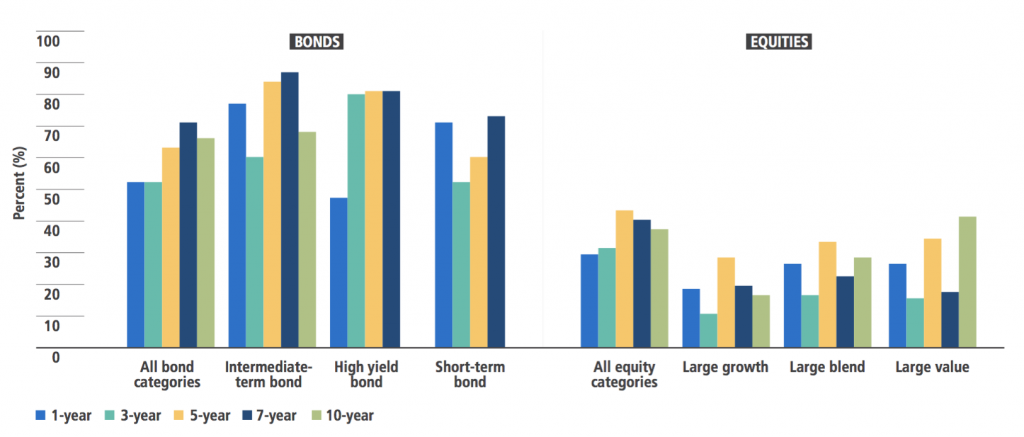

Percentage of active mutual funds and ETFs that outperformed their median passive peers (after fees)

Source: PIMCO

PIMCO makes the case for why active management seems to works better for fixed income investments than it does for equity, using Morningstar data:

We look at performance numbers and find that, unlike their stock counterparts, active bond mutual funds and exchange-traded funds (ETFs) have largely outperformed their passive peers after fees. We offer conjectures as to why bonds are different from stocks. This may be due to the large proportion of noneconomic bond investors, the benchmark rebalancing frequency and turnover, structural tilts in fixed income space, the wide range of financial derivatives available to active bond managers, and security-level credit research and new issue concessions.

The entire thing is worth your effort to read, as are most of the 12 bullet points, but here are the reasons that resonated most with me:

1. Active Bond Funds Outperform their Passive peers;

2. Active Bond Funds and ETFS (largely) outperform their benchmarks;

3. Off-Index and Active Share Matter.

Go check out the full PDF.

Source:

Bonds Are Different: The Active Advantage

JAMIL BAZ, RAVI K. MATTU, JAMES MOORE, HELEN GUO

PIMCO, APRIL 2017 https://www.pimco.com/en-us/insights/viewpoints/quantitative-research-and-analytics/bonds-are-different-active-versus-passive-management-in-12-points

See also:

Bonds Are Different: The case for active management in fixed income investing is strong.