Nice piece by BMO Nesbitt on why investors fail:

“Individuals have historically underperformed the markets, earning just 2.6% vs. the S&P 500 gain of 12.2% between 1984 and the end of 2002*. Research in the U.S. has shown that this dramatic underperformance comes as a direct result of client behaviour, or more specifically, the attempt to avoid bad performance while seeking out better returns.“

* “Quantitative Analysis of Investor Behavior“, Dalbar Inc., July 2003

What’s the cause of this underperformance? Assuming there is an appropriate asset allocation plan in place (Diversification in styles, geography, managers, and appropriate weightings for each security), what is the dominant problem for most investors?

In a word, EMOTION.

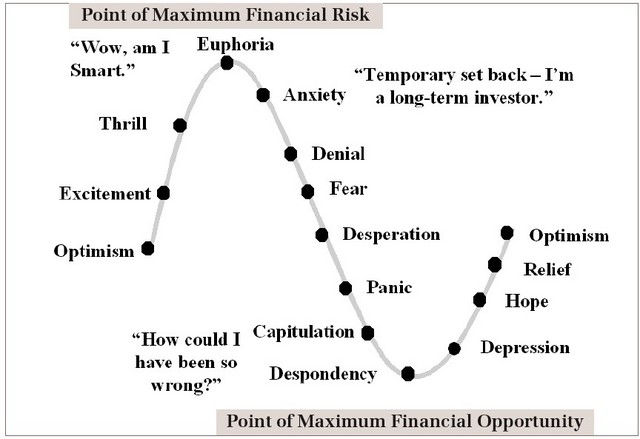

Here’s a look at the classic cycle of investor sentiment:

Sentiment Cycles within the Market (a/k/a Investor Emotions)

click for larger graphic

Major emotional risks equity investors face include:

• Herd mentality

• Likely investment at the top (Buy High)

• Likely withdrawals at the bottom (Sell Low)

• Deviation from long-term strategy and discipline

We discussed the biology of this previously in Know Thyself.

>

Source:

Why Investors Fail! (pdf)

Stephen Biddle,

BMO Nesbitt

http://www.bmonesbittburns.com/IA/IAHomepage/NewsToBrowser.asp?IA_ID=SBIDDLE&LANGUAGE=EN&NEWS_ID=51

could it be that the success of hedge funds historically has been the underperformance of retail investors? Meaning, that while individuals were buying high and selling low, hedge funds were on the other side of that trade.

Why Investors Fail?

There is a nice post on The Big Picture blog telling why investors underperform the market.

Individuals have historically underperformed the markets, earning just 2.6% vs. the S&P 500 gain of 12.2% between 1984 and the end of 2002.

Why Investors Fail

Barry Ritholtz, Chief Market Strategist for the Maxim Group and author of the excellent blog, The Big Picture, posts a piece by BMO Nesbitt on why investors fail:

Why Investors Fail

Barry Ritholtz, Chief Market Strategist for the Maxim Group and author of the excellent blog, The Big Picture, posts a piece by BMO Nesbitt on why investors fail:

Besides the factors you cite, there is the problem with commissions and high turnover. There’s also a problem dealing with information about companies, since the stock analysts they rely on for evaluation of stock values work for the brokerage houses rather than them, and brokerage houses love individuals to trade (and incur higher transaction costs as a result).

Guys like Bogle, Buffet, Malkiel, Ellis and others have repeatedly pointed out that most individual investors see better returns through passive investing, but who wants to listen to them? We want our Cramers and our Lynch’s, telling us that with a little pluck and research we can take on the pros at their own game and beat them.

Are You Psycho?

Do you swing around violently every trading day chasing your tail? Don’t blame it on Mister Market. Look in the mirror. The financial markets are a lot like Sybil. Every day has a different personality. Get your head together…don’t…