Have a look at this 100 year (actually, 105-Year) chart. I colored each “Market” appropriately — Green for Bull, and Red for Bear — to more clearly show what happens.

Bull markets get ahead of themselves. At their ends, they tend towards excesses that take a very long while to recover from.

When a long Bull runs end, it takes quite a while before the next one begins. Some of this is related to the destruction of capital crashes cause; Much of it has to do with the psychological damage suffered by investors. As we have seen more recently, that damage — plus 46 year low interest rates — helped push former market investors into real estate. We have yet to see their unbridled love affair with sotcks rekindled. What will be the catalyst to get them back into equities? My best guess is a sustained move upwards.

Regardless of the actual cause, in the past century, every Bull Market has been followed by a significant refractory period. From the looks of the time-lengths of red, it appears almost generational in nature. The damage is repaired when a new crop of investors — without crash scars — finally appears.

>

100 Year Dow Chart

Is it possible that an 18 year Bull market (1982-2000) could be followed by a 2

1/2 year Bear (March 2000 peak to October 2002 low), and then launch into another multi-decade (2003-2018) Bull? Sure, anything is possible. But as the chart above plainly shows, it would be historically unprecedented.

One other thing worth noting: The steepness of the gains from 1924-1929 are very much parallel to the 1996-2000 moonshot. Both ended with near 80% drops (Dow for 1929, Nasdaq for 2000).

It took 25 years — until 1954 — for the Dow to regain its 1929 highs. I don’t believe it will necessarily take that long for Nasdaq — but I am aware of the outside possibility.

~ ~ ~

Sources: The raw data for this comes from Stock Trader’s Almanac, which Jeff Hirsch kindly provided.

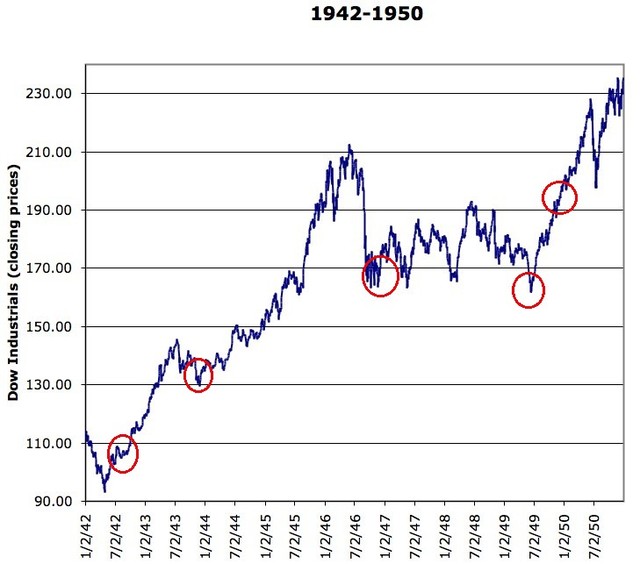

The concept for this was shamelessly lifted from Rydex. But their chart (see original here) was flawed — I found where they delineated the post 1929 crash Bull and Bear Cycles, and the post WWII Bull, was wanting. Rydex’s chart had a 25 year post-1929 Bear, followed by an 11 year post WWII Bull market. That seemed wrong, especially whent he market had been going up for much of that 1940-1946. So I adjusted the start to more clearly reveal the post WWII Bull beginning around 1946.

Picking a beginning to the Bull is subjective — you could start it from 1940, or from the 1942 low, or the 1943 high, but then it includes a major correction in 1945 — the Dow dropped from over 211 to 163 (23% — but not in a day, like 1987). So while I could have placed the beginning as late as 1949 or as early as 1940 or 1942/3, I somewhat arbitrarily placed the start of the Bull at 1946 . . .

Where does the Bull Market start?

(click for larger chart)

See also:

Looking at the Very Very Long Term

http://bigpicture.typepad.com/comments/2003/11/looking_at_the_.html

Dow Jones Chart (1900-2004)

http://bigpicture.typepad.com/comments/2005/08/dow_jones_chart.html

I’m wondering how this would look on a log scale.

that is a log scale! (the 100 year chart)

100

1000

10,000

The little chart was too short a time period for Log to be much use . . .

fascinating graphs Barry.

If I am adding correctly this morning, the graphs show 63 years of bear markets and 46 years of bull markets. The graphs also show an upward drift over time (the upward drift over long periods is probably more than inflation and returns on bonds). So the graph would lend one to believe that bear markets do exist, yet gains also are real and may happen in concentrated moments. Thus, one might not see a big reason to try to time the market and bail on U.S. equities in the near future; such behavior may cause one to miss big rallies that are important to long-term returns. Things such as an individual’s specific situation may be more relevant to asset allocation.

One also might argue that over time, we may see a shift toward more green and less red in your graph, or at least an equal split of red and green. The 8 year bull market of the 1920s may be matched by an 8 year bear market of the early 2000s (note “may” – i am not saying this how likely I think this is).

This said, I am quibbling. Your graph does seem to indicate that bear markets can be long and jagged. The graph may support the idea that the current bear market may take years to change to more bullish behavior.

My problem with these kinds of analysis is that you can get many different results depending on your perspective. You could have bear weeks and bull weeks. Or, this could be looked at as one very solid bull century.

Something which jumped out at me – I see some short bulls and bears in the 2 overall “bear” sections pre-1948. After that, the 2 bears (granted the current one is very short) seem ‘flat’ more than anything else. Do you think this might be because of the far stronger regulatory environment in place after the New Deal? (it sort of looks like the post-WWII bull market starts back a bit in your red section as well).

M1EK

Very interesting observation-> it looks like more-modern bear markets are not as volatile as older bear markets. It might be regulation. However, it also might be improvements other than regulation – more education, more products to manage risk, etc. Who knows for sure.

Cool! I’ve seen the chart before (or versions of it) but I don’t believe I’ve ever seen a similar chart for other major indices (SP500, Russell 2000, etc.) which might help answer the question of where the bull and bear markets begin, since I would expect the larger indices to be less subject to volatility.

If you’re interested in other charts showing stock market performance over 105 year periods (1900-2004), I’ve linked to (and created at least one) here for the S&P 500, although the information is presented very differently.

Great chart. Would be interesting to see the chart vs. other major asset classes -say bonds and real estate. I wonder if this would show that bull markets begin not with a new generation, but when the next big asset class gets played out?

I date the start of the post WW II bull market in 1949

because that was when the PE bottomed at 6.4 vs

7.4 in 1942.

If you look at the long term history of the market you find that the frequency of bear markets has declined. From 1900 to 1945 the market was in a bear market almost 50% of the time — that is why the dividend yields accounted for so much of the total return before 1945. From about 1950 to 1980 the market was in a bear market about 25% of the time — the classic four year cycle. But from 1980 to 2000 the market was in a bear market only about 12% of the time. I define a bear market as a market drop that carried the market below its year ago level– so the 1987 drop is a bear market even though the y/y ch did not turn negative until well in the 1988 recovery.

I believe the major reason the frequency of bear markets has lengthened is the Fed learning to do a better job and secular changes in the economy that dampening the economic cycle.

Historically, the Fed tightens until they start to see the impact in the data — since monetary policy works with long and variable lags this means they tightened too much. But in the mid-1990s Greenspan quit tightening before the economy was damaged too much. This was the one big thing he learned from 1987 and one of the big difference between him and earlier feds.

Sorry, comments were posted before I had a chance to review them.

should read — so 1987 is a bear market even though the y/y ch did not turn negative until well into the 1988 rebound.

Whew!!! All I know is I’m glad I put all my investment dollars in GM stock and Ford corporate bonds. There’s nothing like a same haven.

Remember what’s good for GM is good for America.

Seriously, great bit of observation. The economist Joseph Shumpater theorized about bull and bear markets having long runs and I think this here plays out his theory quite well.

I don’t think we’ll see an 18yr bear run but hey who knows. I think we got a real chance to watch technology gains shorten the bear runs by speeding up the business cycle. Conversely, the Bulls should be shortened as well.

Doesn’t Ford stock pay around a 5% dividend?

I don’t really Know? But then again somebody told me about a “junk status” rating or something. I think its hogwash. Ford, GM come on everybody reading this drives either a Ford or a GM car…Right?

5% dividned? Sweet!!!!! Can’t wait the start counting the money. (Cigars all around!!!)

This time is NOT different.

Barry,

I found it rather interesting to compare your chart with the DOW/Gold ratio for the same period as shown in the article below. The correlation seems fairly close.

http://www.gloomboomdoom.com/marketcoms/mcdownloads/051212.pdf

After the 1929 peak in this ratio, the market tanked for a couple years, recovered somewhat over a couple years, then went more or less sideways for 10-12 years. After the mid-sixties peak, we had the well known 18 year sideways market. The ratio peaked again around 2000 and has been gradually declining since. However it is still well above the level from which these long term bull market moves have begun. One might argue that we have already had the equivalent of the early 30’s plunge but if this historical precedent is meaningful, then it would be difficult to make a case for another raging bull market any time soon. At best we might expect another 10-12 years of sideways action.

As an aside, some commenters here have wondered if the Fed actually causes inflation. Another chart in the same article seems to leave little doubt. The chart shows the purchasing power of a dollar from more or less the birth of the currency to the present. Before the creation of the Fed, the value seems to vary up and down but remains constrained within a range between about $0.50 and $1.50(?). After the Fed was created, the value never breached $1.00 again (to the upside) and eventually began a long uninterrupted decline to the point where it is worth about $0.07 today. Now maybe the Fed isn’t solely to blame but they certainly haven’t helped.

Some Last Week Of Trading

I find it interesting that everyone assumed, including yours truly, that in a flat year the last low-volume week of the year would be up. It isn’t. It will cover one more model I have that was screaming duck since Tuesday, but after the close

Beauty is in the eye of the beholder and I love your chart. It shows just how scared Chicken Little must be. The sky really must have been falling from 1903 to 1919, 1932 to 1946, 1973 to 1983 and from October 2002 to now.

I just had my best ever one year returns in stocks, beating my prior best year of 1975. For someone to color the period from November 1974 to June of 1983 red and call it a bear market is myopic. The average small cap stock during this time went up 1500 plus percent. (see Ibbotson and Associates for data)

To say that it could happen but is unlikely to happen for stocks to drop a couple of years and then resume the upward climb totally ignores the history of the market. Indeed, it has been typically true that panics have lasted only a year or two.

Barry, your idea that the technology boom in the 1990’s makes the 2000’s very different is weak. Henry Ford invented standardized auto parts in 1906 and the assembly line in 1914. He made investors very wealthy during the time you have colored red. Then when GM took the lead, after the crash of 1919 to 1921, the market really caught fire as the technology went “mainstream”.

In the next few years, the internet will go “mainstream” just like the car business did from 1921 to 1929. GM made investors a lot more money from 1921 to 1929 than did Ford from 1906 to 1919. Google was one of my big winners this past year and, without doing the math, I suggest that Google has already made more profit than any of the early internet plays; and, it ain’t over yet. If you want to forecast a collapse in the market, you should consider a delay of 5 or 6 years. Like I said on your previous post, history repeats.

You have exposed one of my fears about the market today. A stagnant market could be worse than a bear market, as it seems more difficult to take advantage of the bargains at the bottom. If the market takes a ten to twelve year “rest” than I have to work that much harder to hit the valleys and avoid the peaks. Whereas even a 20%-25% correction over the next couple of years could offer me some bargains that would only strengthen my current position on the slide. When the market recovers, which it will do, it would create an much higher overall realized gain. Well, I am not a contrarian, but I don’t like a stagnant pond either.

I Go Stinky!!!

If I fart how bad will my farts stink!!!!People say i smell like poop!!!!

my farts have stank for hundreds of years!! ime I farted and it stank badly!!! So next time you fart..think of me and maybe it will stink more than you expect out of your bum hole!!!

well if you think that you are special cuz you have stinky farts than that is alright!!!i am just trying to say that i fart and sometimes poo will come out when i least expect it!!!I stunk up my house so bad once that my dog and cat passed out cuz of the stinky creamy green farts!!!!

you know i fart about 27 times a day and they smell bad!!! I have a friend that farted and the power went out cuz it smelled so bad!!!have you ever farted and poo shot out your ears!!!!it happened to me when i was in the bathroom!!!it took forever to clean the dirt outta my ears that day… farts remind me of music!!!very smelly music that comes out of your butt during long days of work making poo come out of your gas filled bum hole!!!!!!

sometimes i get poo stains in my underwear because i just cant hold it in for long enough and i start to feel bad when poo comes of my poophole….and when i pooop green poops they smell the worst because people say that poop is the reason that poop poops outta your smelly stinky bum hole!!!!!!

Well i have to go poo so i will see you all l8er!!!!remember if it is poop you want it is poop you need to smell poopie about!!!!!

w

l

Did you save the farts? They can be held

for investment grade equities.

The farts can be added to your investment

portfolio. FFFFFFFFFFFllaarrrrrrrtttttttt.

DOW just touched a high of 14000

So is a Bull run confirmed

I like the way this graph was set up. As a new investor, it helps to really understand how the market has played out through history. This graph is alot like a roadmap. As a sage old black Baptist preacher, with the gritty voice would say it, “Ya can’t tell where you’re goin’, ‘less ya look back where ya been.” From the looks of this “map” the road leads us up overall with a few periods of “non-progression”.

One thing that I noticed is that even during the middle of the Great Depression, from ’32 to’36, in 4 years, the Dow TRIPLED in value! If you were to ask me, I would say that the Bull Market actually started in ’32 then ended in ’64-’65. This would make the 20 yr Bull Mkt a 32 yr bull mkt.

‘100 years of DOW bull bear period chart.’ On questions of the possibility of another ‘multi decade bull run’ as historically unprecedented by comparing steepness of gains and subsequent post depression losses from 1924-1929 period to post .com 1996-2000 era…

Comparing the steepness of rise in 1924-29 to 1996-2000 is comparing apples to oranges. This is quite a broad-brush treatment of Dow 100 year charts. Even if one discounts the GDP/capita and population increases, in addition to technological advancement, death of distance, and huge globalisation, this interconnected world is a different world from the 1924-29 gold-backed straitjacketed economy era. (in 1930 there was no Bernanake put)

One needs to look at the phenomenal change in the total world real GDP (Billions of 1990 International Dollars) in 1900 of 1.102 trillion$, in 2000 to 38.80 trillion$, and rise in global population in 1900 from 1.6-8 billion to 6.2 billion in year 2000. Companies like Google, Microsoft could not be created in 1924-29. Dow capitalisation in its last 100 years of steep rise takes into account most of the unaccounted capitalisation of the World Economy, 1-2000 AD.