This is the first of 4 charts I plan on revealing this week. Each one will hopefully shed some insight into what we may expect in 2006.

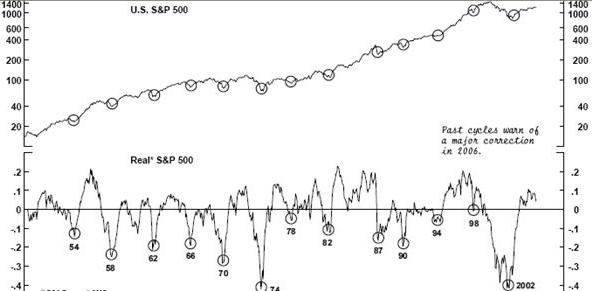

This chart shows what is known as the 4 year or Presidential Cycle. The theory behind this is that U.S. markets have a tendency to make a high in the 4 year, and a low in the 2nd year of a president’s term. It has held up quite well historically, with the notable omission of 1986 (Recall, however, what happened in 1987).

click for larger graphic

The chart suggests that a cyclicality is at play in direct contradiction to the random walk thesis. Given the upward bias of markets over time, regular corrections may be inevitable. What is truly astonishing is the very human tendency to downplay or even ignore these periodic dislocations.

This is not unlike yesterday’s discussion of earthquakes, volcanoes and tsunamis.

>

I pulled this from my files, but unfortunately, I cannot find a source. It looks similar to work by Investech’s Jim Stack; I emailed them to confirm this. If anyone has any insight into where this may have come from, please let me know . . .

UPDATE 1: December 27, 2005 11:03am

William Hester has several excellent charts on the subject here:

Average Gain in Year Two of Presidential Cycle Hides Important Declines

http://www.hussmanfunds.com/rsi/prescycle.htm

>

UPDATE 2: December 27, 2005 5:03pm

James points us to BTR Capital Management (PDF) and this chart, which looks remarkably similar:

click for larger chart

and, it looks better in red!

try BCA Research?

I am a cycle follower, and incorporate the 4-year cycle into my investing. But there is also a more ominous cycle developing as well, specifically the 40-year cycle. For simplicity, take a look at the 8-year perods of Oct 1928->Oct 1934 and Oct 1966->Oct 1974. The next trough in the 40 year cycle is Oct 2006->Oct 2014.

To narrow things down further, the months Nov-Apr are typically above average months of return; while May-Oct are below average (7.5% vs. 1.2% since the 1970s).

Based on this, I am looking at the following scenario for the market:

Nov 2006 -> April 2006 : last of the good gains (maybe we’ve already had them???)

May 2006 -> Oct 2006 : Negative returns, possibly minor, or with modest attempts to recoup losses.

Oct 2006 -> Oct 2014 : This will be a very tough period, with large losses possibly close to the level of the Great Depression.

That sure looks like Stack’s work. Regardless, over the last fifty years, the second year of a Presidential cycle is the ONLY year with a cumulative negative return. That ain’t pretty. That said, the entire year is never a waste and a bottom is usually set that precedes a healthy rally. And if you like to short, then you get a double bonus of a potentially volatile year.

I look at every Tom, Dick and Harry form of analysis and then throw in a few of my own. Nothing is infallible. I enjoy reading of long wave cycle work but I tend to view it as more anecdotal than something I can trade on. Especially since I believe long wave cycles are likely to be affected by shortened economic downturns that are becoming more of a norm as companies, governments, central banks and consumers all have access to data in nearly real-time instead of months later. ie, Cycles aren’t a mystery but based on boom/busts that are repeatable in some shape or form while excesses are wrung out. Just an opinion. Curious as to yours Jack.

Shorter term, I tend to use market internals sentiment as a range bound trading medium since they seldom erode over time. I still believe we are going to get an unhappy beginning of ’06 that will be followed with our buddies at the Fed saving the day. That is the only flaw I see with the bearish argument for something beyond a few quarter’s time. They are already active in the repo market. That supports a premise I have had for a long while which is the Fed isn’t serious about fighting inflation. Or more reasonably put, the Fed is less concerned about inflation than the economy. If given a choice between the economy and inflation, they will cave to save the economy because they are more worried about deflation. And, that is what I believe they will do again. And frankly, given the potential mess, they likely should be inflating the hell out of our economy when messy situations arise. ie, I believe we’ll likely never see a repeat of Japan in the US. In fact, I’d argue Japan’s recent resurgence is owed in large part to our central banker’s assistance with policy and a plan of how to get out of that mess.

So, I see a tremendous opportunity over the next handful of years. Technology is developing new markets at a dizzying pace that I cannot remember ever seeing and we are seeing capitalism of some sorts spread like we’ve never seen it spread. Downside risk: China craters. If not, I think the market needs to shake out hedge funds, deritatives traders and all of the other speculators who have no fear because this market refuses to go down. Does that mean DJI of less than 10K? Likely in my estimation. IMO

I’d agree that longer-term forecasting is definitely less scientific than short-term, and involves alot of “what-ifs”. That is precisely why, longer-term cycles should not be dismissed so lightly. Personally, I am more apt to rely on history as a predictor of the future, than my own emotion-derived thoughts and beliefs.

A book that has given me alot of insight into the power of history as a precursor, is called “Generations” by two “historian-type” fellows (Strauss and Howe). Written in 1984, it made many “predictions” about the future of society, based on “generational cycles” occuring back to the 1500’s. The last few chapters discuss these predictions. Now that the book is over 20 years old, its hard not to be impressed, with the level of accuracy of those predictions.

In “Generations”, as well as one of their followup books, “The Fourth Turning”, Strauss and Howe mention a “Crisis Era” that occurs on a cyclical basis and is scheduled to occur within the next decade.

I am not, by nature a doomsayer, but, to me, it seems that pieces are coming together for a potential “economic” crisis. Perhaps you have heard of a recent book called “The Coming Generational Storm”, about an economic based upheaval sure to affect the US (also within the next decade or so).

Keep in mind, while technology and the power of capitalism may indeed bring opportunities, (and I do hope that they do), this same belief was also abundant in the years and months and weeks prior to the Great Depression.

Just would like to say, thank you for the opportunity to read your great blog. Your analysis is superb!

Jack

More on the Presidential Cycle

This post from Barry Ritholz is relevant to another post on the same issue presented here on December 16.

Some Last Week of Trading

I find it very interesting that everyone assumed (including yours truly) that in a flat year the last low-volume week of the year will be up. It isn’t. It will cover one more model that I have that was screaming duck since Monday, but after th

Some Last Week Of Trading

I find it interesting that everyone assumed, including yours truly, that in a flat year the last low-volume week of the year would be up. It isn’t. It will cover one more model I have that was screaming duck since Tuesday, but after the close

Anecdotal, the intrest rates always appear the lowest in the spring of a presidential election year.

Joe.