MacroAdvisors goes out on a limb to make the call that the “Chances of a “Double-Dip” are Essentially Nil.”

They do so based on a recession probability model:

>

The probability is estimated as a function of the term slope of interest rates, stock prices, payroll employment, personal income, and industrial production. (And the latter is estimated as a function of the term slope, stock prices, credit spreads, bank lending conditions, oil prices, and the unemployment rate).

Media commentary is leading in the pro-double dip camp:

• Bloomberg.com – Video: Shiller Sees `Significant’ Double-Dip Recession Chance

• NPR.com – Several factors point to double-dip recession

Former Labor Secretary Robert Reich explains why there’s not enough oomph in our current economic situation to promote a recovery.

Reich also says the economic boosters we currently rely on are running out: 75 percent of stimulus has been spent and the Fed is worried that zero interest rates will cause more inflation down the road. Some economy-watchers were hoping U.S. exports would give recovery a boost, but with uncertainties in Europe promoting the dollar as a safe haven, exports have become more expensive. Despite recent positive news of slow but steady economic growth from Fed Reserve Chairman Ben Bernanke and others, Reich says it’s not enough. “In a typical recovery, we would expect far better. And we’ve fallen into a far deeper hole than in a normal recession, so the recovery has to be much bigger.” So why is this recovery so different? “Most recessions are caused by the Fed overshooting in its efforts to control inflation and raising interest rates to high,” Reich says. “So it’s pretty simple for the Fed to reverse course, cut rates and get the economy back on track. But the Great Recession was caused by the bursting of a giant housing bubble, which directly reduced the value of most people’s biggest assets. Consumers can no longer use their homes as ATMs.”

• The Sacramento Bee – Is a double-dip recession ahead?

The economy “is pulling back to reality,” said Jeff Michael, director of the University of the Pacific’s Business Forecasting Center. “The most likely reality is a slow recovery. The data is going to bounce around a bit.” Consumers account for about two-thirds of all economic activity. A one-month drop in spending isn’t a cause for panic, but it is worrisome. The economy continues to face fundamental stumbling blocks, said Chris Thornberg of Beacon Economics consulting in Los Angeles. “I worry about the ability of the expansion to continue,” he said. “The banks are still a mess. Millions of people are still having trouble with their mortgages.”• The Wall Street Journal – Auto-Sales Optimism Fades

Just a few months ago, optimism was rising in the auto industry that new-vehicle sales would make a strong rebound this year after falling to historic lows in 2009. New data, however, suggest the recovery isn’t as strong as it appeared earlier in the year. The increase in auto sales in the first five months of 2010 has been driven by higher sales to rental-car companies and other commercial fleets—not sales to consumers, who are now showing signs of more pessimism about the economy, as well as a halting interest in buying new cars. “The industry is on the mend but there are reasons for caution,” said John Hoffecker, a managing director at AlixPartners LLP, a consulting firm that recently surveyed consumers as part of its annual study of auto-industry trends. “We’re still waiting for consumers to come back into dealerships,” Mr. Hoffecker said in an interview.

more commentary after the jump

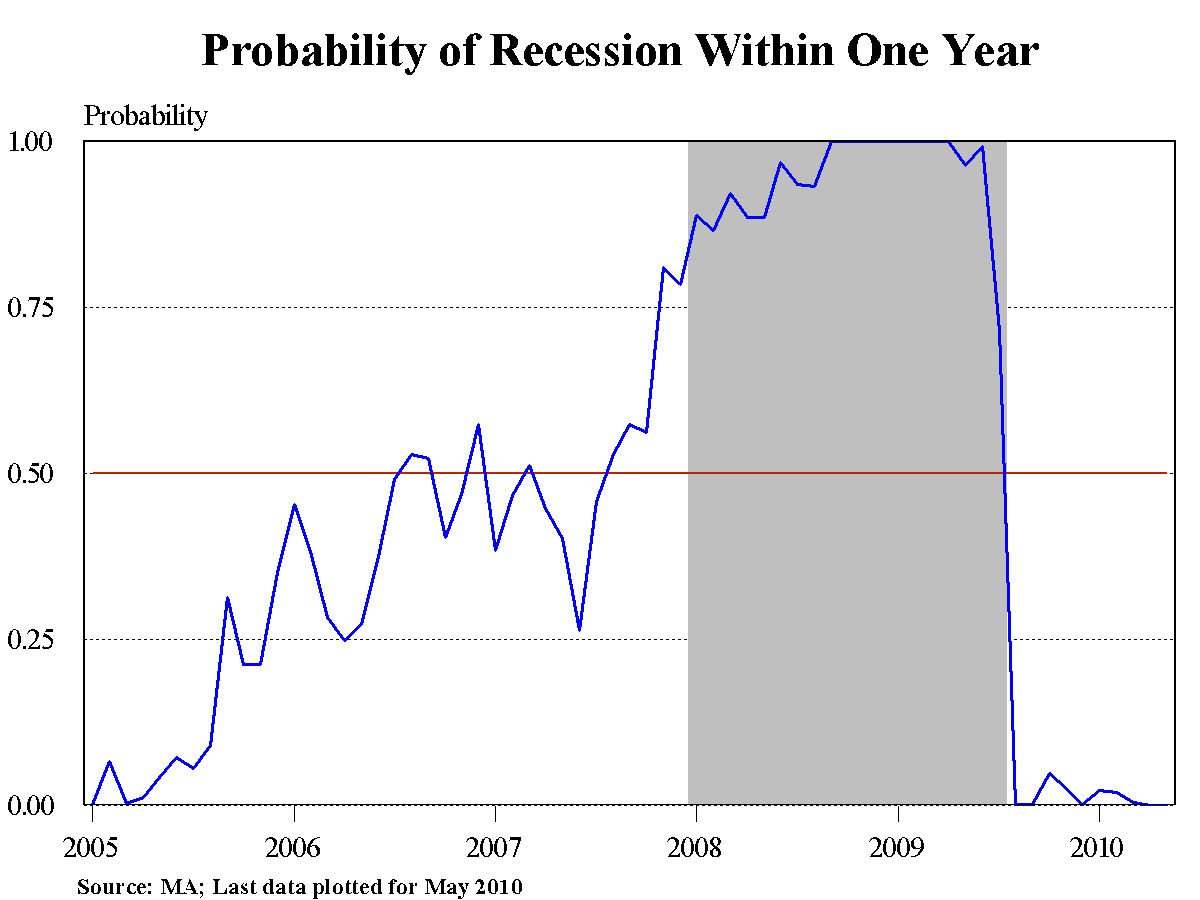

Early in the recovery many forecasters, concerned that the nascent expansion was fueled only by temporary inventory dynamics and short-lived fiscal stimulus, fretted over the possibility of a double-dip recession. Now, with the emergence of the sovereign debt crisis in Europe, that concern has re-surfaced. Certainly we recognize that the debt crisis imparts some downside risk to our baseline forecast for GDP growth. However, based on current, high-frequency data — most of which is financial in nature and so is not subject to revision — we believe the chance of a double-dip recession is small.

One way we assess these odds is with a simple but empirically useful “recession probability model” in which the probability of experiencing a recession month within the coming year is a weighted sum of the probability that the economy already is in recession and the probability that a recession will begin within a year. The former probability is estimated as a function of the term slope of interest rates, stock prices, payroll employment, personal income, and industrial production. The latter is estimated as a function of the term slope, stock prices, credit spreads, bank lending conditions, oil prices, and the unemployment rate.

Currently this model, updated through May’s data, estimates that the probability of another recession month occurring within the coming year is zero.

What's been said:

Discussions found on the web: