If only the games were a bit more entertaining!

Well, the U.S.-England game over the weekend was pretty darn exciting, thankfully. I have to eat crow for calling out Steven Gerrard in Friday’s Second Note since he scored a crucial goal for England, and also for predicting a 3-0 victory for the U.S. That said, a 1-1 result was totally satisfactory! Now, hopefully both teams will take care of business against Algeria and Slovenia (knock on wood).

In any event, most of the focus went to the TV on Friday and we saw just 7.6 billion shares change hands – the lowest total since April 6th, before the market started to wobble on euro zone fears. A late push saw the S&P 500 break out of a tight range and close at 1091, +0.4% on the day. The Russell 2000, which I’ve been watching a bit more closely lately because I’m fixated on breadth, used support at its 200-day moving average (633) to close 1.4% higher. The transports (+1.1% for the Dow Transports) and tech stocks (Nasdaq Composite +1.1%) outperformed while the defensive sectors that had held up better earlier in the week (food retailers, tobacco, precious metals stocks) lagged with a mixed-to-negative performance.

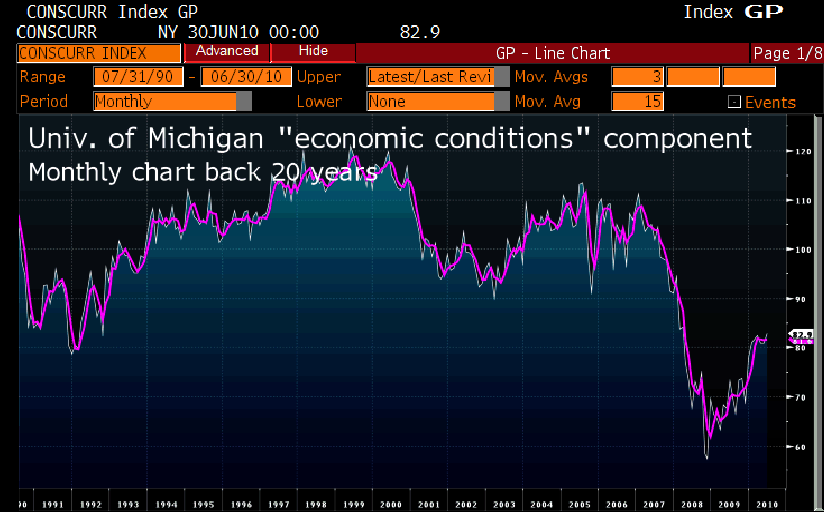

Since the opening game of the WC didn’t start until 10 a.m. EST, traders were still paying attention at 9:55 a.m. when the University of Michigan’s consumer confidence survey was released. It showed a pop to 75.5 in June from May’s 73.6, with the Street looking for a more subdued 74.5. The key “outlook” component rose to 70.7, the best result since September 2009. However, as the below graphs show, both the outlook and conditions components appear to have stalled out. The Census Bureau’s retail sales report for May provided the only other meaningful headline of the day, but the miss (-1.2% m/m versus consensus 0.2% m/m) failed to reverse the market’s fledgling bullish momentum.

>

University of Michigan Economic Outlook

>

University of Michigan Economic Conditions

Source: Bloomberg