@TBPInvictus

(Pun intended in the title)

There are myriad factors that typically go into determining the success or failure of any legislative policy. It will be no different with regard to the minimum wage.

Let’s turn (again) to Seattle, currently Ground Zero for the minimum wage debate, where the minimum wage was recently kicked up on a gradual journey to an ultimate $15/hour (it is $11 per hour as of April 1, 2015, and it eventually will phase in to $15 per hour for all employers by 2022).

By way of quick recap, many are focused on the restaurant industry, as it is known to employ a fairly high number of minimum wage employees relative to other industries.

Very importantly, there will be a long term study of the effects of Seattle’s recent legislation. Details of that study can be found here. It will hopefully, over time, answer many of the questions about the effects of the new law.

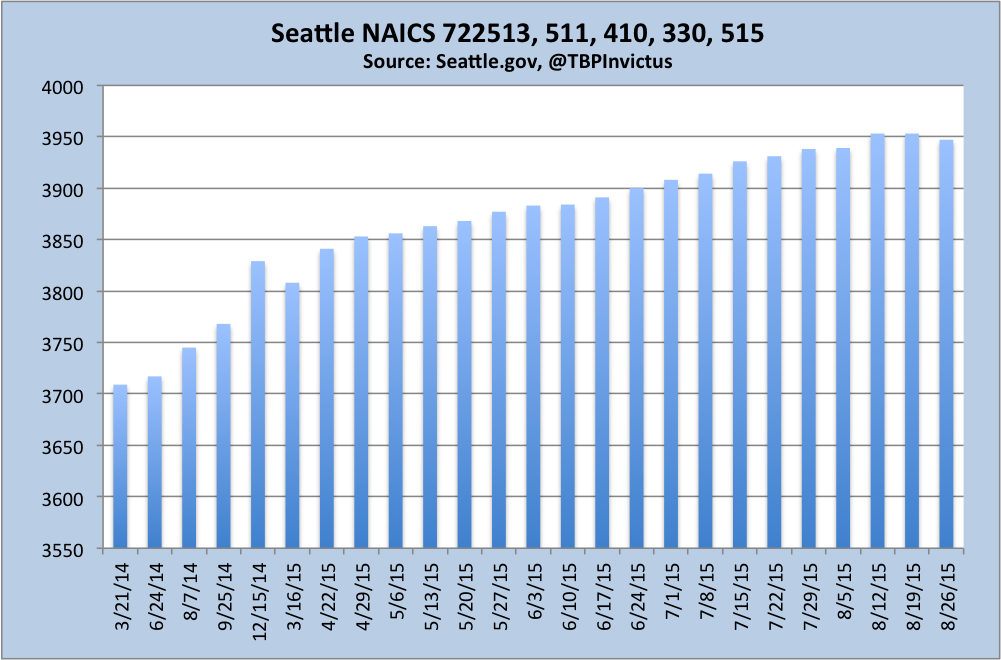

As the issue has been heating up, I have been keeping weekly tabs on the number of restaurant permits in issue for the city, covering five distinct NAICS codes. Below are the codes, listed in descending order of count. This count is for the city proper, not the Metropolitan Division (MD) or Metropolitan Statistical Area (MSA). This is simply a permit count; I’m implying nothing about employment.

722513 Limited-Service Restaurants

722511 Full-Service Restaurants

722410 Drinking Places (Alcoholic Beverages)

722330 Mobile Food Services

722515 Snack and Nonalcoholic Beverage Bars

Below is a recent graph of the overall count, which was first tallied by Evan Soltas here.

Based on the chart, there’s been no discernible impact on permits – they have grown steadily dating back to the first date Evan captured in March 2014, and currently sit at 3,947 (as of August 26).

As I’ve previously mentioned, one of my Seattle contacts advises that rising rents – the area is booming – will likely play more of a factor in a restaurant slowdown than higher wages. This will, hopefully, also be part of the information we glean from the aforementioned study.

Among the many factors that might also eventually be sussed out is this – food services saturation. How many restaurants can an area accommodate? Certainly there has to be a limit on the sheer number of restaurants any given geography can sustain.

Thankfully, Bloomberg has done some work in this regard. Importantly, note that Bloomberg looked at MSA’s, much broader areas in many cases than individual cities (as I’ve repeatedly pointed out). However, that said, the information is still instructive. (While some folks very subtly conflated the city of Seattle with its much broader MSA, that’s a game I’m not going to play.)

Some caveats:

- Again, these are MSAs and not individual cities or “places.”

- While I suspect it matters very little if at all, the data were last updated in March 2014. I doubt much has changed.

- Bloomberg looked at only two NAICS categories – Full-service and Limited-service (aka “fast food”) – and not the broader array I’ve been looking at.

What we see:

- As of March 2014, the Seattle-Tacoma-Bellevue MSA was already #2 in the country behind San Francisco-Oakland-Fremont.

- A re-sort on the “fast food” column actually puts the Seattle-Tacoma-Bellevue MSA at #1 with 11.63 establishments per 10,000 population.

On Twitter, we see this observation:

@TBPInvictus@paulconstant@GoldyHA@workingwa@KillerMartinis With 1 establishment for every 170 people in Seattle market looks saturated.

— Charles WL Hill (@charles_chill) August 21, 2015

The math there seems more or less spot on: ~670,000 population/3,953 establishments = 169 people per establishment. Not sure yet how that compares to other cities (not Metropolitan Statistical Areas or Metropolitan Divisions), though I intend to try to find out, but it intuitively feels a bit crowded, at least to me.

In any event, the notion that a recently increased minimum wage in [fill in the geography] is already having an adverse impact in said geography is nonsense, as I’ve chronicled time and again (and again, again, again, again, again, again, again, again, and again).

This will be a marathon, not a sprint. That said, another factor in the equation must be the sheer number of establishments any given area can accommodate; it cannot be unlimited.

The overarching point here is this: Towns/villages/cities/states/the US all go through business and economic cycles. Rents rise and fall. People immigrate and emigrate. There are surpluses and shortages of goods, services, and labor that influence pricing. It’s all a very complex choreography, and it’s rare indeed that we get a good, clean experiment. And so it will be in Seattle, which is why the aforementioned study will be so important. In the meantime, we can stay abreast of what data we get and determine what we can, all with the knowledge that the best and most thorough data come with painfully long lags. But such is life.

The people who predicted that the stimulus package would destroy our governments ability to borrow were proven wrong. The people who predicted that ObamaCare would destroy our healthcare system were proven wrong. The people who predicted that increasing the minimum wage in Seattle would destroy its fast food places will eventually also be proven wrong.

Their response is the predictable of “wait longer and our predictions will be proven true” (and no matter how many decades you wait it is never long enough). Admitting that their predictions were wrong would be to admit that their narratives were wrong – and that would be to much for their fragile little egos.

But does raising the minimum raise REALLY help lower income people? Or does everything around them (rent, food, services) become more expensive as others try to scalp the extra $$ now in circulation?

And if prices rise in reaction to widespread general increases in income, wouldn’t most everyone else (not covered by the minimum wage increase) also try to raise THEIR prices, attempting to maintain economic income parity, thus relegating the newly upgraded minimum wage workers back to the same bottom of the economic pyramid they were at before? I say yes.

Additionally, as prices increase in areas where the minimum wage has been increased significantly to numbers like $15/hr, what of the pensioners who live on fixed incomes? Certainly they should also get a corresponding boost in their monthly stipend, no?

Every action has consequences, sometimes unanticipated and often unintended.

Your solution is to do nothing?

Fail

Hmmm. So I gather that you want to do something even if you have no idea if the something you want to do will work or even makes economic sense?

You should run for political office. You will make a great politician! [lol]

Things like rent do not respond to “I think (s)he can afford to pay more”. Rent and other prices are determined by supply and demand. The underpaid workers will still need just one place to live and 3 meals per day so the effects on demand is moderate, not huge. Furthermore, increased demand is always followed by increased supply (as long as it is profitable to increase supply). Therefore, it is not likely that the increased demand from low income people being paid more will change prices. What it will do is grow the economy by a moderate increase in demand (and production).

Theory always sounds nice but real practice is often different. I will have to disagree on all your points. It will be interesting to see how this all works out, but I think it will take some years to do so.

As to “Furthermore, increased demand is always followed by increased supply (as long as it is profitable to increase supply)“, ’tain’t so here in northern California. There is constant demand far in excess of supply but due to land use restrictions, earthquakes, environmental policy and so on, relatively few new apartments are being built for the demand.

Last apartment rental figures I saw were one bedrooms in my county averaging about $2200/month (many are more), up almost $1000/month from about 4 years ago. In San Francisco itself the cost is more like $3k-4k. That’s PER MONTH! The average house price in my county south of SF is a cool $1.6 million and in many cases, you won’t get a very remarkable house for that price.

Why so high? Because there is plenty of excess money circulating here from all the tech activity, which buttresses my argument above.

Those getting the high pay may well be able to afford these prices, but many not working for tech companies, cannot.

I really like seeing data on this topic. Businesses exist to make situations like this, and people work. As long as the playing field is level it will all work out.

What I am seeing in the restaurant industry more and more is that a 20% gratuity is automatically added to the check. The owner uses these funds to run the restaurant, wages healthcare etc.

Left out of this discussion is the fact Seattle unemployment is running 3.0 to 3.7. I guess it would be negative but for the new minimum wage law. ;-> https://www.google.com/publicdata/explore?ds=z1ebjpgk2654c1_&met_y=unemployment_rate&idim=city:CT5363000000000:CT4159000000000&fdim_y=seasonality:U&hl=en&dl=en

Meanwhile unemployment in Seattle is 3%.

1:169 = ~59 per 10,000 (to compare to MSA numbers). Does not seem likely. Maybe numbers need checked.