Torsten Sløk, Ph.D., Deutsche Bank Research:

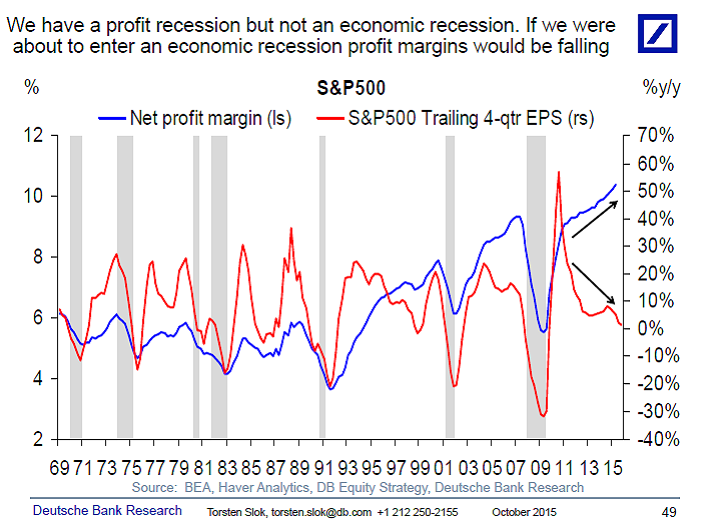

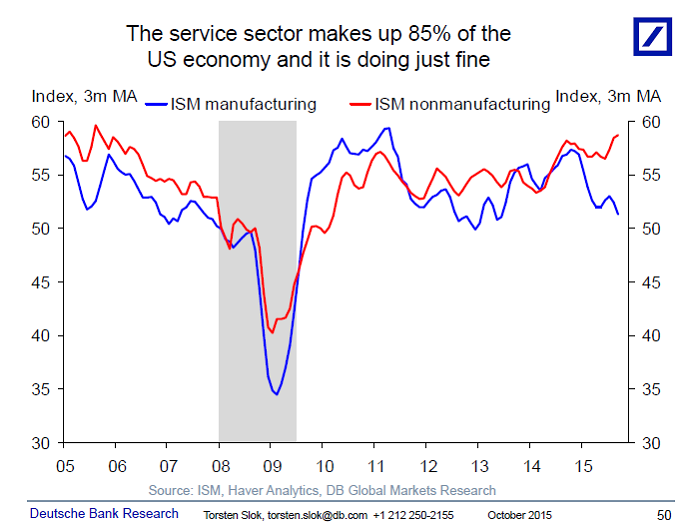

We are experiencing a profit recession without an economic recession. This is not surprising given that the problems are very concentrated in the energy sector. Lower energy prices is bad for earnings in the energy sector and some of the industrial and materials sectors but good for the bottom line in all other sectors. In fact, the first chart below shows that despite oil prices having fallen for the past 15 months overall S&P500 profit margins are still trending higher as the profit losses in the energy sector are more than offset by increasing margins elsewhere, in particular in tech, healthcare, and consumer discretionary. Lower energy prices and a higher dollar are hurting certain parts of corporate America at the moment but with the China shock fading and the dollar and energy prices stabilizing it is becoming clearer that we are not about to enter an economic recession because the service sector – which makes up 85% of the US economy – is doing just fine, see the second chart below. Or put differently, to generate an economic recession we need a much more broad-based slowdown across companies and that is not what we are seeing and hearing in the anecdotes during this earnings season, including from Wal-Mart yesterday, which was a Wal-Mart specific story and not a consumer slowdown story (see also our WMT analyst Paul Trussel’s note on this).

That may be so, though my lizard brain looks at those two charts and sees patterns. Those patterns I see make me think there is a divergence from normally loosely correlated data. Brain concludes somethings wrong; something is going to make those lines move generally in tandem again.

My lizard brain see a similar divergence of lines on the period of 2004-7. What does it mean? – where will it all end? – tell us big lizard god!!!!

Do you mean the divergence between profits and margins, or the divergence between service and manufacturing? In the case of profits and margins, you are correct — they will eventually correlate. But no one has a clue as to whether that will be by profits rising or by margins falling.

But in the second chart, the only way that manufacturing to again correlate with the services sector will be if manufacturing is rejuvenated by cheap robots and process automation … the same way that the agricultural sector was rejuvenated from the shift away from an agrarian economy by the modern machinery-driven corporate (and family) megafarms. We’re still not in an agrarian economy any longer, but the agrarian sector is just as profitable as it once was, but employs a tiny fraction of the people. The same will happen to manufacturing.

It doesn’t always happen that way— the horse-drawn carriage industry still exists, but more as a cottage industry than as a productive component of the economy. Services may end up going the way of the carriage industry, as human-form robots become cheaper, smarter and more reliable than humans, replacing them in the services sector (possibly even the oldest profession, but not for A Very Long Time).

I eagerly await some serious research into what kind of society will be stable in a world where human workers are superfluous. Thus far, the only historical scheme for redistributing the profits of a society to its members that would work in a worker less system is socialism. Surely, someone can devise a better scheme, but I just don’t see anyone working on that problem. Possibly, our societies have not (yet) become unstable enough to convince the thinkers to begin work on that problem.

Excluding energy gives you a better look