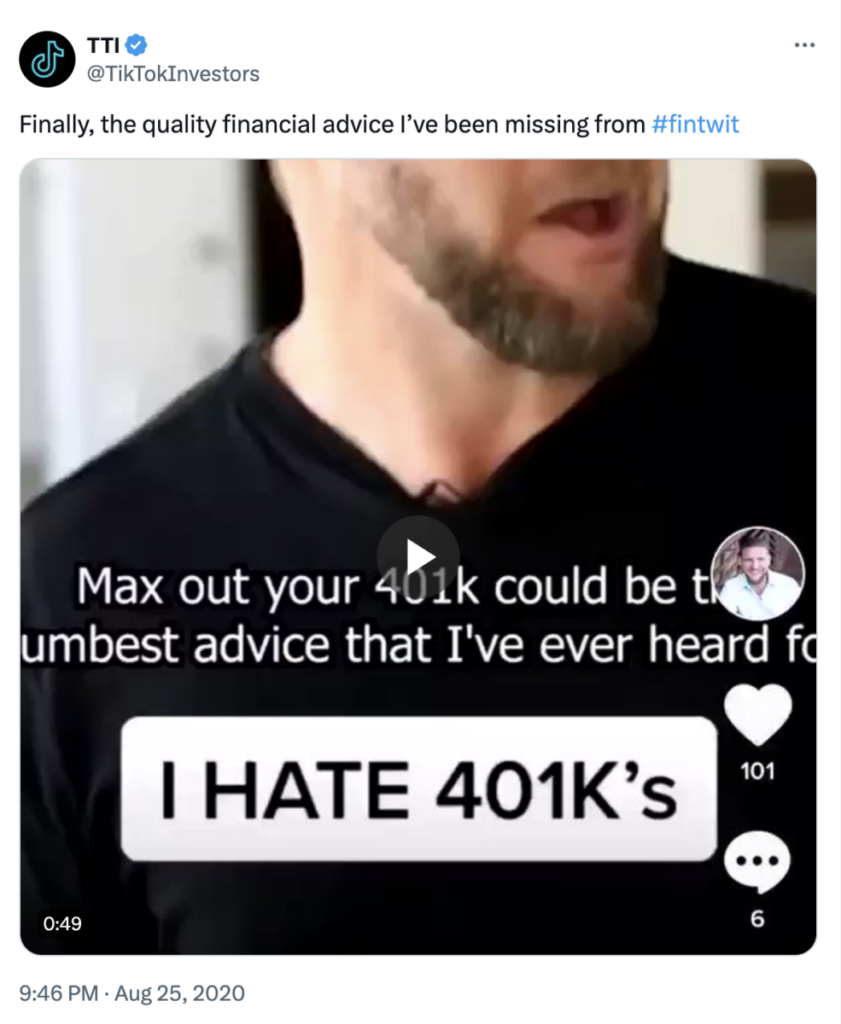

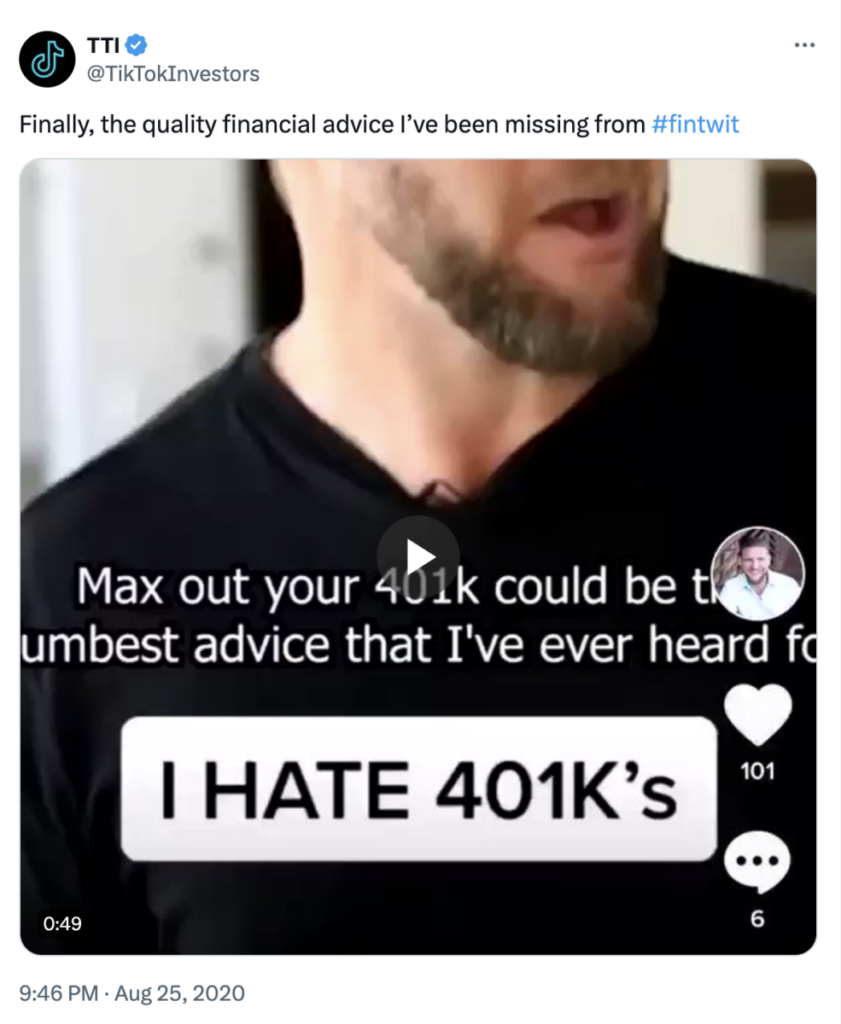

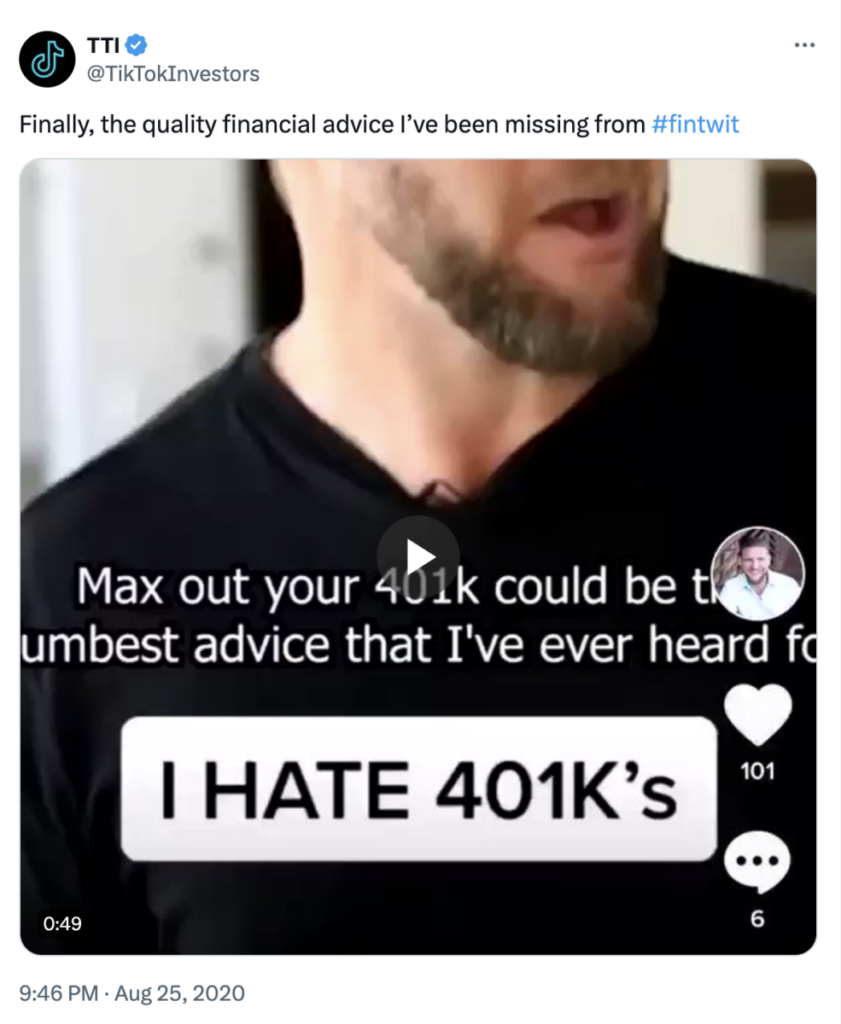

Nestled in between lip-sync dancers and fashion influencers, financial fraud lurks on TikTok. At least one person1 has noticed the...

Nestled in between lip-sync dancers and fashion influencers, financial fraud lurks on TikTok. At least one person1 has noticed the...

Read More

It’s taken me months to organize all of my research for my next book project; it’s a lot of stuff, some dating back to...

It’s taken me months to organize all of my research for my next book project; it’s a lot of stuff, some dating back to...

Read More

The transcript from this week’s, MiB: Ed Yardeni on the Roaring 20s, is below. You can stream and download our full...

Read More

This week, we speak with Dr. Ed Yardeni, President of Yardeni Research, a provider of global investment strategies and...

Read More

The transcript from this week’s, MiB: Ashish Shah, CIO, Public Investing, Goldman Sachs Asset Management, is...

Read More

This week, we speak with Ashish Shah, Chief Investment Officer, Public Investing, Goldman Sachs Asset...

Read More

The transcript from this week’s, MiB: Samara Cohen, CIO, Blackrock ETF & Index Investments, is below. You can...

Read More

This week, we speak with Samara Cohen, senior managing director at BlackRock, and chief investment officer of the...

Read More

Confused about where we are today? A favorite exercise is to go back to first principles to consider how we got to where we...

Confused about where we are today? A favorite exercise is to go back to first principles to consider how we got to where we...

Read More

At the Money: Staying the Course (April 10, 2024) Markets go up and down as news breaks, companies miss earnings estimates,...

Read More

Nestled in between lip-sync dancers and fashion influencers, financial fraud lurks on TikTok. At least one person1 has noticed the...

Nestled in between lip-sync dancers and fashion influencers, financial fraud lurks on TikTok. At least one person1 has noticed the...

Nestled in between lip-sync dancers and fashion influencers, financial fraud lurks on TikTok. At least one person1 has noticed the...

Nestled in between lip-sync dancers and fashion influencers, financial fraud lurks on TikTok. At least one person1 has noticed the...