Fascinating front page WSJ article today, titled More Debtors Use Bankruptcy To Keep Homes.

It seems that Chapter 13 filings are gaining in popularity. Why? Because they halt foreclosure proceedings:

“Last month, as the nation’s housing slump continued, consumer

bankruptcy filings increased almost 23% from a year earlier —

representing nearly 69,000 people — according to the American

Bankruptcy Institute, a nonprofit research group whose members include bankruptcy attorneys, judges and lenders. Overall, consumer bankruptcy filings were up 44.76% during the first nine months of this year.In some areas where the real-estate boom was especially heated, the increase in filings has been even sharper — especially for a type of bankruptcy that allows homeowners to halt foreclosures on their homes . . .

In recent months, however, an increasing number of homeowners have filed for bankruptcy under Chapter 13, which staves off foreclosure proceedings while the homeowner works out a plan to pay off mortgage debt and other obligations over time — usually three to five years. To qualify, debtors must have a regular income and must stay current on their new bills. About four in 10 filers today are filing under Chapter 13 — up from three in 10 two years ago. The 2005 change in bankruptcy laws was designed in part to shift more filers to Chapter 13, which forgives less debt than Chapter 7.”

We can expect to see a whole lot more these types of filings in the coming months and years. Why? One word: RESETS.

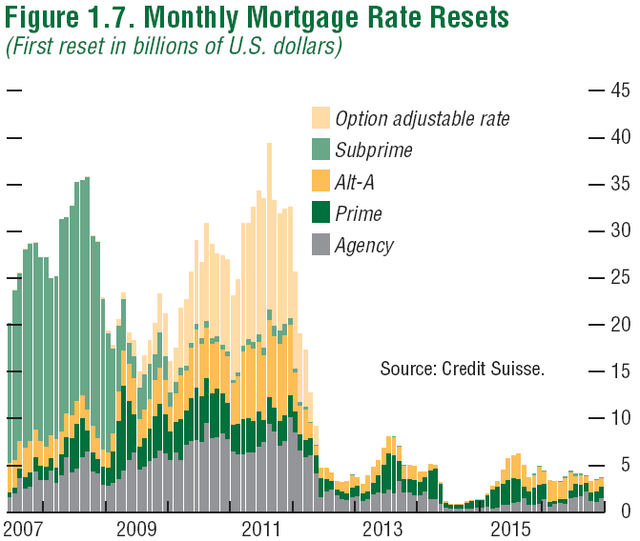

The ongoing APR mortgage reset process isn’t expected to peak until some time in 2008. Following that, we see a new surge in resets, as Option Adjustable Mortgages begin to come up in 2010-11. Note that these are non-subprime mortgages.

Econbrowser called this Monthly Mortgage Resets from Credit Suisse (via the IMF) graphic their Distressing Picture of the Day:

>

>

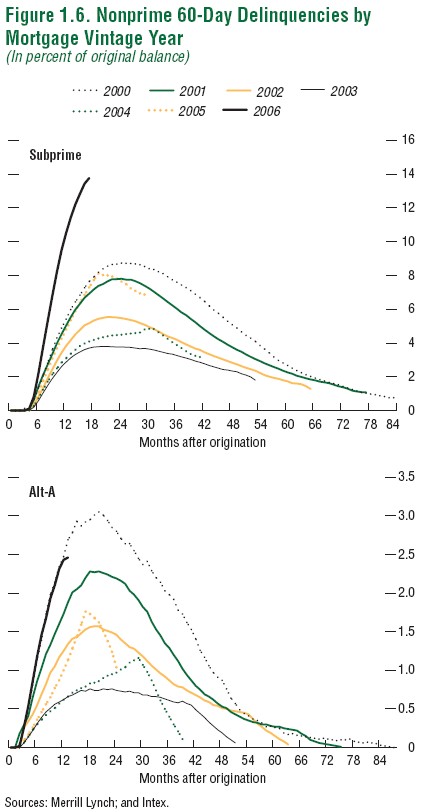

Here is is another intriguing pair of charts, this one from Merrill Lynch (via the IMF):

>

The pair of charts above suggests that as the last cycle progressed, Credit quality

mattered less each subsequent year. Eventually, it seems that mortgage underwriters were giving loans to

just about anyone in order to generate fees, commissions, and re-sellable paper . . .

>

Sources:

More Debtors Use Bankruptcy To Keep Homes

Chapter 13 Filings Gain In Popularity Because They Halt Foreclosures

AMY MERRICK

WSJ, October 23, 2007; Page A1

http://online.wsj.com/article/SB119309633953367729.html

Global Financial Stability Report:

Financial Market Turbulence: Causes, Consequences, and Policies

IMF, September 2007

http://www.imf.org/external/pubs/ft/gfsr/2007/02/index.htm

http://www.imf.org/external/pubs/ft/gfsr/2007/02/pdf/chap1.pdf

Bet the sub-prime lenders wish they could have been as sleazy as the student loan lenders on the recent bankruptcy ‘reform’. . . (Student loan debts became non-dischargeable.)

Barry,

Can’t these bankrupt people use their profits from trading Google, Apple, Intutitive Surgical, RIMM and VMWare to pay off their home?

Anyone else feeling a VERY BAD credit fueled selloff coming?

“Anyone else feeling a VERY BAD credit fueled selloff coming?”

I suspect that we will see some selloff. As to the severity, it would seem to me that there has already been a discount taken for credit problems. Whether its been enough, I don’t know. But unless a lot of market participants have been living in caves, credit problems have to a large measure been priced into the market.

Awesome coverage BR. Muchas Garcias from the west coast

“Note that these are non-subprime mortgages.”

Keep hammering that home. Few seem to realize the problems extend way beyond sub-prime, which the media has overused to the point of nausea.

Well we know its a “Free Market”, right, since everything depends on the FED. What a crock. The Fed will cut by 50 bps next week. They are trying their hardest to keep the bubble from popping. They are looking very closely at the ARM’sd that are about to adjust. The balancing act is dependent on whether or not the foreigners will play along.

Think about it, Hanky says strong dollar policy, but all he has to do is say, “well the Fed is independent and I have no say in interest raid policy”. The whole thing is really annoying, this manipulation. They won’t be happy until all shorts are killed off, and people will only buy stocks. Then they the market can go up everyday like it is suppposed too, right.

“…I have no say in interest raid policy”.

Was that a freudian slip there Bill?

If so, it was a very amusing one.

Option ARM and Alt-A resets in 2010/11 shouldn’t be a problem. It’s looking like we’ll have a zero FFR by then.

Character is what you do when no one is looking….or minding the store…of if you can call it national security and make it illegal for anyone to look.

Thankfully, the current cast of characters in charge is busy safeguarding us by preventing stem cells from marrying and gays from cloning – so we got that going for us.

I think you are right Pool Shark

Fascinating, you can see the so-called wealth effect expand and contract like a lung: 2000, the year of the equity crash is high in delinquencies in both sub-prime and alt-a but the latter is steeper and, since jumbo loans are typical in alt-a, this seems to suggest it was primarily dot-com wealth that was translated into housing before the collapse that is giving up the ghost.

Then the steady decline in defaults from 2001 through 2003 as everyone who can’t hold on is washed out.

The expansion in defaults begins anew in both sub-prime and alt-a in 2004 but is even more abrupt, almost a spasm, until we hit parabolic in 2006 suggesting poor and/or predatory lending practices grew as fast as real-estate fever in all home classes, jumbo and sub-prime alike.

The implication of predation or gross sloppiness on the part of lenders is particularly clear in the incredibly steep and early rise in 2006: When defaults hit a high within 12 months of origination and there is no strong economic and/or market downturn to suggest loss of wealth among borrowers then just about the only thing left is loans that shouldn’t have been made.

Says The Dirty Mac

“As to the severity, it would seem to me that there has already been a discount taken for credit problems.”

Says I:

The financials are right now where the homebuilders were summer 2006. Everyone who was paying attention knew something bad was coming, the prices had come down as much as 50% from the peak. I questioned whether to short the homebuilders and decided the market had priced that in because “it is so obvious”. So instead I shorted secondary businesses (fixtures, lumber, hardware stores). I never made money on that. In the end I came out slightly down after being incredibly down for a while. This time I look at the market and say “it is so obvious and they are already down by 50%”. Well, there is more to come. Too much of the market is driven by idiots and chart analysts to discount things. Idiots lack the ability and chart analysts are always looking backwards. There is plenty more downside. I am up big on my WM short, and doing okay on COF. If I didn’t respect my wife’s fears I would be even more short on the financials.

Forgot to mention, if I had just shorted the homebuilders instead of thinking it was “priced in” I would still be up big. The fundamentals are bad. The future for them is bleak. They still hope they will dodge the bullet. But it isn’t a bullet, it is a bomb. You don’t dodge bombs.

We’ll see philip. My comment was really regarding the broader market.

We’ll see philip. My comment was really regarding the broader market.

Can’t these bankrupt people use their profits from trading Google, Apple, Intutitive Surgical, RIMM and VMWare to pay off their home?

Posted by: Christopher Laudani | Oct 23, 2007 1:54:46 PM

Chris,

I take it that you didn’t make any money in these names. Any reason for that?

Certainly going back 6-12 months, these stocks were relatively cheap, so you can’t use the “crazy momo” excuse that people who miss major moves always lean on. Many traders have been long these names for months. Why did you miss it….work on that to refine your strategy. If you are in the performance game then you can not afford to miss these kind if moves.

Chapter 13 used to be a disaster for the lender, for it used to stop interest accruing on the Chapter 13 bankrupt’s debts. All the lender was entitled by rule to get back was cash equal to the unpaid balance of the loan principal at the time of filing the bankruptcy petition. If still true, for mortgage or credit card debt, and a lot of borrowers exercise their Congressional right for the Bankruptcy Courts to rewrite their loans to ‘loans that bear no interest ever or at all’ loans, the financial system has a lot more to deal with. A lender will not only lose receipt of future interest from the borrower, but will have to bear the cost of the money lent, interest paid depositors. So, from a positive spread of interest on mortgage less interest on deposits, the spread goes negative by the amount of interest on deposits, from +1% to =5% (for example, assuming mortgage interest is 6% and deposit interest is 5%) Big Picture might find it worthwhile to check this out with his favorite legal eagle.

…Chapter 13 Bankruptcy lets some people keep their homes, but in ‘non-recourse mortgage’ states like California — borrowers can simply walk away from their mortgages with no personal liability or bankruptcy stigma.

Of course, the bank/lender gets the house… but they eat the difference on the mortgage money lent and the current market value of that house.

1) The increased “popularity” of Chap. 13 may simply be a result of an increase of filers not meeting the “means test” now required for a Chap. 7 filing.

2) Borrowers can “…simply walk away from their mortgages with no personal liability or bankruptcy stigma…” in non-recourse states? Not quite. Laws vary in non-recourse states, but generally the bar to a lender collecting a deficiency is limited to first mortgages for purchase. Even then, there will be a substantial blow to the borrower’s credit rating and the possibility of a large bill for the phantom taxable gain.

The loan modification scam (rearranging the deck chairs on the Titanic?) at Countrywide, and the SIV Superfund are both trying t but time for a housing recovery. Looking at some web traffic charts says that is not going to happen. I have them posted at my site.

For Alt A this cycle is apaprently no worse than the 2000 cycle.

“Note that these are non-subprime mortgages.”

I wonder if there can be any evidence reported on the positive effects of “non-subprime” exotic mortgages. Could it be that any of the “cash out, interest-only” mortgages were actually used to restructure debt, re-invest cheaply, improve cash flow, or start a profitable business? This is a bit anecdotal but I know of several individuals who did all of the above.

The media likes negative news. It lives on death — not on life.

I will not take a “bearish” or “bullish” posture but I believe there is over-reporting on both sides and the “right side” does not get much exposure. One could draw a parallel from financial media “noise” to political media “noise.”

Cheers…

Jim Grinney, senior vice president and chief investment officer for Northern Trust Bank of Florida:

NBR TRANSCRIPT

.

moom: The same thing could have been said last year about subprime. If you assume that Alt-A is running a year behind subprime…

These charts also suggest that we are in a recession.

;)

max

http://www.nycmortgage.us

For people facing the risk of foreclosure, start with making absolutely sure you are a sub-prime borrower. The public needs to be aware that almost two thirds of all sub-prime loans are categorized improperly. Look at your overall package and see that you fall into this group. If your FICO score is 620 or above, there is a chance that you are a “prime” borrower (depending on that score, you might be an ALT-A borrower which still is conventional financing, but slightly higher rate).

If you still find yourself in that “sub-prime” category, you then have to see what you loan-to-value is. If you are at 80% or less, don’t give up. There are a number of sub-prime lenders still available. The overall market has shrunk for the time being, that is all. Sure, the guidelines have also tightened. Watch, the market will loosen up again anyway in its cyclical fashion. Look online for active sub-prime lenders. Try Countrywide, Long Beach, First Franklin just to name a few.

Richard Maize

The question is, if the loan amount is much more than the value of the home, and debtor wants to keep the home, i.e. refinance, can this be done through Chapter 13?