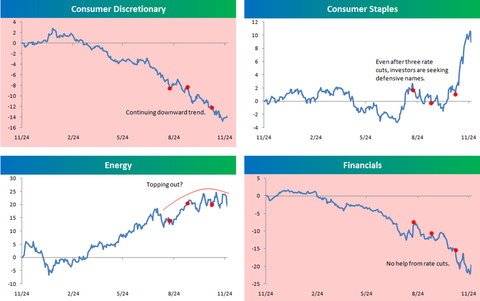

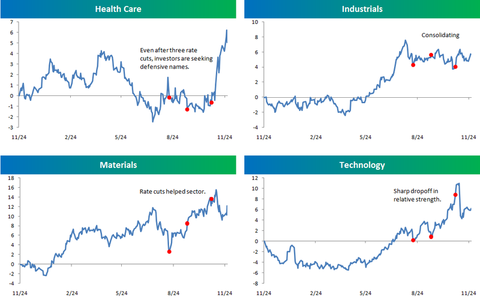

Great set of charts from the Bespoke boys showing what the relative strength of various sectors have been since the Fed began cutting rates.

The winners have been Health Care, Utilities and Consumer Staples: Defensive stocks that will do well in a slowdown.

The losers? Consumer Discretionary, Financials, Telecom — the sectors that are particularly vulnerable to an economic slow.

What’s surprising is that the Fed cuts did not seem to have the desired effect — at least not yet — on the Sectors they were intended to help . . .

I think energy has outperformed–and materials has done well also.

That is why they will cut and cut and cut until the consumer is broken with the dollar and the finacial sector becomes healthy.

The Fed cuts NEVER have that effect and they always explain it away by saying the effects are long-term and will not be seen for months… yet they always panic and act as though the immediate short-term crisis is their responsibility to solve.

They should decide one way or another, they are looking pretty schizo.

Looks like a standard Recession trade, with some weak dollar in the mix.

The weak dollar trades in there are probably the most Credible Re: Fed cuts. Materials, and Energy.

My 101 business Cycle books say “Buy Consumer non-cyclical, Utilities and health Care in a recession”

But…. We should see some reversals in some of the beaten down sectors.(Financials, and Telco)… I’m a little dubious of some of these, since we may see some Enron esque action in the financials… And tel co, seems to be a lotto game still.

I wish they had taken it back to the past 5 rate cut cycles, that would have been interesting, and more …. Actionable.

But it’s interesting chart porn…

What?!

No mention of PM’s???!!!

Since the rate cuts, PM’s have kicked a$$!

(Gold up 23.3% since rate cuts began on August 17th.)