Yesterday, I wrote: “David Leonhardt’s NYT columns are oftentimes insightful and illuminating. Unfortunately, today’s column is not one of those times . . .” I promised readers (and David) an explanation. Consider this it.

First off, I interpreted Leonhardt’s column as really two distinct issues — one psychological, one statistical. He got the first one right, but muffed the second.

The psychological concepts of recency effect and salience were dead on. Gasoline is the only consumer product that has 6 foot tall prices on street corners and highways. We see gas prices more readily than we do many other items. So the visibility — Salience — is very high. Additionally, drivers tank up every week or more. You cannot help but see and feel the prices more acutely than other items.

The same is true for food prices. You see supermarket prices more readily than many other items, shop for them more regularly. When a restaurant menu has to use stickers to update new menu prices — they change too rapidly too print new menus each time — you notice it.

The Psychology of inflation is a genuine factor in how people feel. On these issues, the column correctly described the angst behind frequent purchases.

Perhaps it is a matter of emphasis, but I thought the column’s tone and content failed to adequately address other realities of price changes in the US.

Let’s look at these explicitly. Consider the following realities:

– Education, Health Care, Housing, Insurance, Property Taxes are not as visible as food or energy. However, they have all risen tremendously in price;

– David mentions that Prices were flat in the 1980 — but that

followed a huge spike in the preceding decade, the inflationary

1970s. That points to the impact of the Fed more than anything else. In the 1970s — and the early 2000s — the Fed dropped rates, allowing more inflation than is comfortable.

– Prices do not necessarily rise smoothly; they seem to sawtooth, rise abruptly, stay the same for a period, rise abruptly again. When

this huge run in commodities ends — as all bull markets eventually do — would it surprise you to see

prices flat for 2 decades?– Even with the recent pullback in Housing, prices remain

significantly elevated; By many traditional metrics (i.e., median incomes to median home prices) Houses are cheaper than

they were in 2005/06, but much more expensive than prior years.– Owner’s Equivalent Rent (OER) — the BLS method of accounting for

housing expenses — is flawed, but not quite in the way the column

suggested. First off, it fails to account for increases in utility

costs, property tax increases, and rising maintenance expenses.

Additionally, while OER understated inflation when housing prices were

rising — due to the falling rental market — it may not be overstating them on

the way down. Why? The excess inventory of homes for sales have become rental units, and in many

markets is depressing rental prices. (UPDATE: See Tim Duy: Misunderstanding the CPI for more on this).– Core Absurdity: The idea of eliminating “Volatility” by ignoring prices in food and energy is ridiculous. If one wants to smooth the data or pull out price fluctuations, you should use a moving average. For example, as Oil ran from $20 to $120, the concentration on the Core didn’t reduce volatility, it instead eliminated a huge source of Inflation.

– The same is true for the doubling and tripling of food prices over recent years.

– Speaking of food, the BLS concept of Substitution is more nonsense. When Steak goes up in price, and consumers choose chop meat instead, that does not mean there was no inflation — it means you have been price out of steak. (No mention of that in the column)

– Also omitted: Hedonics — quality adjustments — which have claimed that falling prices are deflationary. See our prior discussion: Technology Adoption Lifecycle as to why they are not (go to #3).

– If hedonic quality improvement is anti-inflationary, what about corresponding drops in quality? The low, low price retailers sell cheap clothing, but subjectively speaking, the quality has been decreasing rapidly. Where’s the Hedonic adjustment for that?

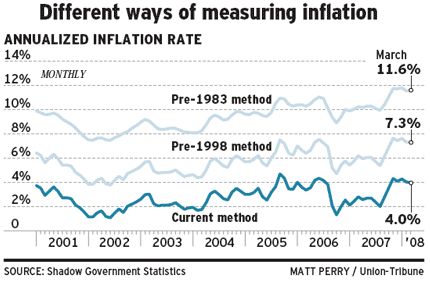

– Sometimes, skepticism is deserved. Each of the major BLS changes in CPI

data have resulted in a significant shift downwards in price reporting:Courtesy of San Diego Union Tribune

>

Lastly, as to the conspiracy theories, I have my own take on it: The government doesn’t respect you enough to lie. They actually put out all of the official statistics reach month for anyone with the time and interest to plow through them. All of these data runs, adjustments, changes to CPI, historical data — its all online, waiting for you to review it, and be mollified or outraged.

Most people don’t bother . . .

>

Sources:

Seeing Inflation Only in the Prices That Go Up

DAVID LEONHARDT

NYT, May 7, 2008

http://www.nytimes.com/2008/05/07/business/07leonhardt.html

The Fed’s inflation gauge isn’t realistic, critics say

Dean Calbreath

San Diego UNION-TRIBUNE, April 17, 2008 http://www.signonsandiego.com/news/business/20080417-9999-1n17inflate.html

Previously:

GDP, Inflation & Recession

http://bigpicture.typepad.com/comments/2008/04/gdp-inflation-r.html

Is the Fed Causing a Global Food Crisis?

http://bigpicture.typepad.com/comments/2008/04/is-the-fed-caus.html

Inflating Our Way Into Recession

http://bigpicture.typepad.com/comments/2008/02/inflating-our-w.html

“The government doesn’t respect you enough to lie.”

But it fears us enough to obfuscate.

when will the aarp make this an issue?

Watch that OER component — now that it is printing higher on the other side of the housing bubble, it is probably on a political hitlist for an “adjustment”.

The CPI is a measure of the average price level. Unless you just happen to be the average consumer, your personal CPI will be different, and possibly very different, from the headline numbers. But Leonhardt uses a specific consumer – a first time homebuyer – to justify his claim that using rents, not prices, to measure housing costs understated inflation during the housing bubble. Let’s take a different consumer. Me, for example.

My mortgage payment has not changed in 5 years. Assuming I stay in my current house, my mortgage payment will not change for the next 25 years. All else equal, CPI was overstating inflation during the bubble according to my personal experience, and, unless rents fall or I move, will continue to overstate inflation.

Inflation may appear overstated to the first time homeowner, but what about the renter? If rents go up even while housing prices go down, how is inflation overstated from their point of view? Again, one cannot use a specific consumer to claim the CPI will be overstating inflation. Either Leonhardt doesn’t really understand inflation, or he is deliberately mischaracterizing inflation to dismiss incoming data as flawed.

Moreover, by dismissing as a “(l)ong story” the issue of why the BLS uses rents, not house prices, to measure housing costs, Leonhardt is missing an opportunity to explain the justification for the use of owner’s equivalent rent (OER).

Alternatively, he just doesn’t want to explain OER because the explanation undermines his criticism of the CPI.

The government does have an interest in underestimating inflation. Cost of living adjustments on social security/medicare payments, Interest payments on TIPS, and payroll increases for government employees are all idexed to inflation data.

Don’t forget that the CPI is seasonally adjusted as well. So, for example, even though we have seen a large rise (+7%) in gasoline prices in April they have actually been less than normal seasonality (normally +8%).

However, they are up from a larger base and are inflicting more pain on the margin to consumers.

Barry,

Thanks for the inflation graph with the various methods (pre-83, 98 and current) I have been wondering what inflation figures would be over the past several years based on each model. I guess my intuition was right that inflation feels more like the 70-80’s than what is being reported.

Todd

As a general rule, the average politician treats the average American as a child and as a rule government press releases can be viewed as nothing more than baby talk.

Barry, you are right. As with all things, don’t listen to the salesman, read the fine print.

Certainly agree that the “core rate of inflation” is flawed both conceptually and as a method — smoothing should be a moving average (I use that on unadjusted CPI as a benchmark in investing) — but I always understood OER to be an attempt to tease out the shelter cost (ongoing consumption) from the asset cost (investment) of a house so my objections to the method are probably less strenuous than the problem I have with what appears to be a continuing assumption underling the formal concept of inflation generally, at least as I understand it: That assets don’t get consumed.

Times change and what people depend upon to acquire daily bread changes too.

I get the impression that no one understands how bad this situation could get or knows what to do about it. The country is going to have a USSR style collapse. We cannot continue to with a finance based economy that encourages massive credit growth and leveraging. Its a dysfunctional system. The country desperately needs wage growth that doesnt require huge amounts of debt to achieve. We’ve been papering over our problems with credit for twenty years and it went to extremes in the last five.

Anyone know how our methodology differs from that of Europe or Asia/

Have you looked at the Fed Free Reserves number lately?

RW – “That assets don’t get consumed”

The concept of inflation doesn’t assume this at all. The concept is to measure the dollar cost of the asset at zero maturity (ie consumption). My can of tuna for lunch was an asset (inventory) to the store I bought it from, but today it matures into lunch. Before the store, it was an asset to wholesalers, canners, and fishermen. CPI isn’t meant to value the tuna asset anytime prior to zero maturity.

The problem is with how the concept is used. CPI may accurately measure the price I paid the store for the tuna, but surely if the value of the tuna asset is increasing at the store level, it’s likely to mature into lunch at a higher value sometime in the future.

In my view, CPI does a reasonably good job in valuing zero maturity asset values. The problem is that asset values with non-zero maturities aren’t measured systematically and whatever predictive value this info may have is lost.

My 2cents.

The pre 1983 method overstated inflation as explained by Herman Kahn in his 1982 book “The Coming Boom’.

The adjustments in the 90’s were purely political. They were mainly used to ‘solve’ the looming Social security ‘problem’.

The pre 1998 numbers are as close to the real mark as you can get on a generalized basis. Everyone’s consumption patterns vary.

Inflation is also somewhat generational. My Dad’s income is spent primarily on food, fuel and utilities. A 2.7% increase in his S.S. payment for 2008 should be viewed as a disgrace.

Then again, what’s to be expected from a corrupt system.

The missing hedonoic that makes me bat sh$t craze is Software.

The BLS jumps all over itself to hedonically adjust for quality improvements in computers (2x the memory etc.) but do they EVER adjust the other way? No.

And it would be so easy too. They could use lines of code or computer equipement necessary to run the new code. You would quickly see that nearly all of the improvements in the hardware is sucked up in requirements of the software, so the price of the overall computer should not be falling.

So instead of double digit declines, we’d get a more flat line out of a massive sector of the economy. and presto you’d have inflation around 6-8%

Here is another angle/article from the

Ft. Worth Star Telegram that talks about inflation/the psychology of americans.

(I read it in Print on Sunday)

It was in the automotive section!!!!!

There are several other articles by the author that are interesting.

http://www.star-telegram.com/ed_wallace/story/628283.html

And yet they lie all the time about much more serious matters (war, medicines, crime and punishment).

They “respect us enough to lie” there? but not on the economy?

The reality is the neo-cons et. al. have a nasty, retrograde agenda that requires lying to push through.

“…as to the conspiracy theories, I have my own take on it: The government doesn’t respect you enough to lie. … its all online, waiting for you to review it, ….. Most people don’t bother”

I would add that the party which is out of power has nothing to gain by questioning the official numbers. The Dems blame the greedy oil companies, the evil speculators, and the “failed Bush policies”, but they perceive no advantage in questioning the official inflation numbers.

Barry:

Rents are increasing faster now than during the bubble. At this point, the excess/emplty homes are not becoming rentals. Why? One needs %25 down to buy a rental. I don’t think that the article linked to that point supports it. In fact, it states that rents will continue to increase as the buble deflates.

Barry,

I saw you on the Hard Assets video clip today. I hear you on the secular bull trend in commodities, but they don’t follow a business cycle?

The email link on the BP homepage does not seem to be working, but if you can give me an email address, I would like to send you a chart to post of copper from ’60-’82, the last great secular bull in commodities. Cyclical price corrections were still violent.

I have been speaking at resource conferences over the past year and will be at the Hard Assets NY conference next week. Everyone is crazy for commodities right now. But I can’t help but see resource investors lately as a bit like the rabid people in Will Smith’s “I am Legend.” Not sure many of them are anticipating the possibility of a 30% “correction” still within a secular uptrend. D

Paul Jones and Marcus Aurelius accurately perceive our situation. That said, most people here are painfully aware of the fact that we have to run like hell to stand still.

I continue to believe and insist that this is really a moral issue. As long as your private outlook is that life is dog eat dog, king of the mountain, etc., our country and indeed the world will continue on the malthusian carousel. We can only hope that screw your buddy behaviour is recognized as not being cost effective in the long run. Otherwise life expectancy will be inversly proportional to exposure to fellow humans.

Rising costs hit laptop makers

Retail prices for laptop computers are set to rise as contract manufacturers move to raise prices for the first time in the face of soaring raw material and assembly costs.

Quanta, Compal and Wistron, the world’s three largest notebook contract manufacturers by output, are in talks with their customers – branded computer vendors such as Hewlett-Packard, Dell and Acer – on how to share the burden of rocketing prices for key materials. Labour costs in China, where the manufacturers have their main production bases, are also rising.

“We will be raising prices for the first time,” said Ray Chen, chief executive of Compal, which expects to account for 25 per cent of the global market this year.

“In the past, we [the contract manufacturers] were always forced to absorb upward price pressures. But 95 per cent of the industry is controlled by Taiwanese manufacturers, and the prices for key materials such as copper and plastic resin and the cost of labour in China have been rising so much that it doesn’t make sense for us to continue lowering prices.”

Analysts said higher costs would probably be passed on to consumers very soon.

Quanta, Compal, Wistron and their smaller peers design and assemble most notebook computers, which the leading PC companies sell under their own brands.

Over the past decade, the Taiwanese contract manufacturers have seen their profits squeezed following consolidation among the branded vendors.

The Taiwanese manufacturers have called for price rises following past surges in cost, but never managed to get their customers to agree.

Now, however, several of the branded PC companies have agreed to share part of the burden, recognising that the entire supply chain is clamouring for price rises, according to executives at the notebook manufacturers.

“This time, the industry can make a case because makers of components such as batteries, panels or memory chips, which in some cases the branded vendors source directly themselves, are sending the same message,” said Chris Wei, an analyst at the Institute for Information Industry, in Taipei.

The main pressures are from soaring prices of cobalt and nickel, used in rechargeable batteries, as well as new labour laws and tax rules in China which have driven manufacturing costs up.

Agreed that core inflation in these times is meaningless. But… looking at the shadow inflation chart, inflation has been 10 percent (or so) a year on average for the last seven years, instead of 2 or 3 percent. Which means that prices have gone up (excuse my bad math) seven times seven = 50 percent more than I thought. Which means on my inflation-adjusted paycheck I am able to buy 33 percent less than seven years ago. My standard of living has dropped by a third since 2001? Sorry, no, it hasn’t, not even close. I just don’t buy these shadow statistics.

Barry and Tim,

The CPI explicitly includes many of the factors you are both arguing about. Look at the NYTimes infoporn you posted a few days ago more closely. There is a rent section (probably for renters) and an owner’s equivalent rent for homeowners. Renters are 5.8% of the CPI, homeowners are 23.9%. Rent increased 3.6% last year, but OER increased 2.6% (not sure why the discrepancy exists here).

So Tim, the renters are accounted for separately than homeowners, and theoretically rent can go up (or down) while owner’s equivalent rent did the opposite.

Utilities such as electricity and gas are explicitly accounted for separately under housing. So are furniture, moving, tools, and a bunch of other little items. Check out the infoporn! So Barry, these items are included as small portions of total housing cost, but they are explicitly modeled.

The path to accuracy in CPI calculation is to balance the gains or losses to the wealthy oligarchy that result from either under- or overestimates of inflation.

Currently they mostly benefit from understating inflation.

Some methods to shift the incentives :

– set a new estate tax level subject to high taxation rates , and CPI-adjust that level annually.

– similarly , allow long-term capital gains to be adjusted for inflation.

– rework the AMT , with income limits CPI-adjusted annually.

I don’t expect such changes to occur , of course , but we’d get more accurate CPI data if they did.

Bernanke has repeatedly stated that the Fed’s “target” or “comfort zone” for inflation is 1-2 percent per year. It would be interesting to know what the target is using pre-1983 measurement methods.

How embarrassing would it be for the fed to say it is targeting 5-6 percent inflation?

I dont think we had >9-10% inflation rate since 2001.

just making a guesstimate, i would say inflation in things we need(food, energy etc) has been almost 10-15% in the past 2 years.

The psychology of inflation is not established until there is a common expectation of wage increases – that is, until people expect that price increases should not matter to them. This is not now present in the US. What we are seeing is one of – or a combination of – two things: price bubbles in limited areas based on monopoly pricing power and perceived shortages and a basic shift in the basket of things that people in the US are, and will be, able to buy with their money. It may well be a permanent shift where oil and oil-derived products move up a notch at the expense of other things.

It might be time to stop calling this ‘inflation’ and try to come up with a more accurate understanding of what is happening.

Substitution…despite spending some time at the BLS web site, it’s not clear to me exactly how far substitution extends. I’m pretty sure they’re *not* assuming the substitution of chicken for steak when steak prices go up…but will they substitute hamburger for strip steak, or only t-bone for strip?

Someone could do a great service by describing the CPI methodology in depth, in a manner better organized than the BLS site for those who don’t live in the details of the statistics on a day-to-day basis.

Hedonics and Substution are two items that get my goat. Yes, computers are faster, but the software is up to the task of bogging them down. And if you take Substitution to the limit, we can all live in cardboard boxes, travel on roller skates, and eat moss and lichen.

From what I’ve gleaned, the Hedonic factors as applied to televisions (and other electronic goods) will eventually get them priced at zero (or some ridiculously small amount). Then the game is up.

You have no idea what your are talking about.

Leonhardt’s article did a pretty good job on the CPI, with a few mistakes. Your post is littered with errors.

Substitutions: The BLS changed the CPI by switching from a Laspeyres formula to a geometric mean formula when computing the CPI. Laspeyres assumes people always buy the same amount on everything. For example, it assumes that a person always buys 2lbs of steak for every 1lb chopped beef. Obviously this is inaccurrate if the price of steak goes up and people switch to buying 2lbs chopped 1 lb steak. The geometric means assumes people always spend the same relative porportion of money. For example, it might assume that people spend 50% of their income on steak and 50% on chopped beef. If the price of steak goes up, then they will still spend 50% on steak, they just won’t buy as much. Geometric isn’t perfect, but it beats Laspeyres. The best is to measure how much people buy of chopped beef relative to steak each month. This is more or less what the PCE deflator does.

OER – The BLS does include utilities and maintence, just not real estate values itself (I’m not sure about property tax). Since you obviously don’t know anything about what the BLS prices, go here http://data.bls.gov/PDQ/outside.jsp?survey=cu to get some idea.

Hedonic adjustment – You argue that always push the index down, but they should also push it up when there is decreasing quality. Guess what, hedonic adjustment does push the index up sometimes! The BLS released an overview (see below) of the impact of hedonic adjustments and showed that sometimes it has pushed the index down (TVs and computers) and sometimes up (apparel, audio equipment, and VCRs). Overall, it looks like hedonic adjustment doesn’t have much of an impact, and sometimes pushes inflation higher.

Maybe you should look into this a bit more.

http://www.bls.gov/opub/mlr/2006/05/art2full.pdf

Conspiracy theory – the primary impetus for adjusting the CPI was to lessen the annual social security inflation adjustments and keep the system solvent for a longer period of time, which btw actually worked. The adjustments were not a result of a coordinated action, but rather well timed statements, primarily by Greenspan, questioning the accuracy of the CPI without “hedonics”, etc.

While I feel Greenspan is unfairly attacked for lowering interest rates in 01 & 02, I do believe he is the main reason why the bureaucrats blinked in 1988. Whether the result has been overall beneficial or detrimental, anyone’s guess (or opinion). It does conflict with my midwestern values however in that “the end should never justify the means”.

«Laspeyres assumes people always buy the same amount on everything. For example, it assumes that a person always buys 2lbs of steak for every 1lb chopped beef. Obviously this is inaccurrate if the price of steak goes up and people switch to buying 2lbs chopped 1 lb steak.»

But this is precisely why the geometric mean trick is dishonest — because it weights less the items that grow in price.

The CPI is supposed to measure price given a *constant standard of living*, that is constant weights, not a *constant budget* with variable weights.

That is, inflation is how much it costs across the years to buy a certain standard of living defined as a basket of goods/services. The purpose of the CPI is to inflation-proof the standard of living of workers and pensioners so as to reduce the workplace conflict due to attempts to get inflation-proofing raises via industrial action (what a quaint old euphemism).

The reason why the government and their sponsors in the Business Roundtable and their corrupt friends in the economics community have been playing tricks with the definition is that workers and pensioners don’t have any leverage to initiate industrial action for inflation proofing raises or for raises of any sort, so why give them automatic protection of their standard of living?

Yet another case of “F*ck them, we are fully vested!” ideology.

Inflation is the growth of the money supply in with respect to the growth in productive capacity of the underlying economy. That’s not at all related to prices. All these stupid price indexes are a complete farce.

If you want to measure inflation keep track of the monetary indexes.

If you want to keep track of prices use Quicken.

You only need the government data for money supply. Prices are between you and your suppliers.