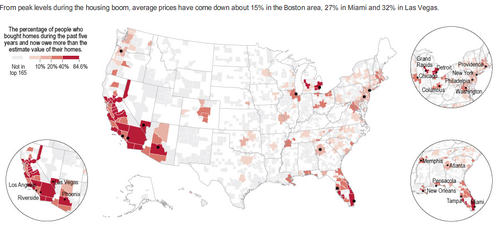

graphic via WSJ Interactive

>

Fascinating WSJ article about “underwater” homeowners:

“The relentless slide in home prices has left nearly one in six U.S. homeowners owing more on a mortgage than the home is worth, raising the possibility of a rise in defaults — the very misfortune that touched off the credit crisis last year.

The result of homeowners being “under water” is more pressure on an economy that is already in a downturn. No longer having equity in their homes makes people feel less rich and thus less inclined to shop at the mall.

And having more homeowners under water is likely to mean more eventual foreclosures, because it is hard for borrowers in financial trouble to refinance or sell their homes and pay off their mortgage if their debt exceeds the home’s value. A foreclosed home, in turn, tends to lower the value of other homes in its neighborhood.

About 75.5 million U.S. households own the homes they live in. After a housing slump that has pushed values down 30% in some areas, roughly 12 million households, or 16%, owe more than their homes are worth, according to Moody’s Economy.com.

The comparable figures were roughly 4% under water in 2006 and 6% last year . . . Among people who bought within the past five years, it’s worse: 29% are under water on their mortgages, according to an estimate by real-estate Web site Zillow.com.”

To me, this data suggests that we should be doing triage on home ownership and mortgages: Identify those people who can afford their homes with a reworked mortgage, and facilitate new financing (think 1930s type HOLC loan work outs).

For those people clearly in over their heads with no hope of reasonably affording their homes, develop a plan to allow them to move forward as quickly as possible.

Its important that the Fed/Treasury stop focusing on prices. If entry level homes remain elevated and unaffordable, the sales move up cycle won’t happen. What is missing in the current housing crisis are that buying chain: entry level buyers purchase a “starter home (i.e., 2 bedroom 1 bath, 1/4 acre), from people who buy a larger house to accommodate a growing family (3 bedroom, 2 bath, more yard) from people who up to an even bigger home (4-5 bedrooms, 3 baths, 1 acre), etc.

If the entry level homes are not affordable, the entire chain of transactions won’t occur. This is why it is a huge mistake to focus on prices — they should be allowed to mean revert back to price levels on their own. The Fed and US should instead be working on making mortgage loans available to those who qualify, and reworking those that can feasibly prevent foreclosure in a reasonable manner (i.e., where they won’t default again or walk away in 6 months).

~~~

Pending Home Sales Index out today at 10:00am . . .

>

Previously:

The Ongoing Impact of the Housing Sector

Barry Ritholtz

Investor Insight, Aug 27 2007, 11:50 AM

http://www.investorsinsight.com/blogs/john_mauldins_outside_the_box/archive/2007/08/27/the-ongoing-impact-of-the-housing-sector.aspx

Real Estate and the Post-Crash Economy

Barry Ritholtz

Thoughts from the Frontline,December 29, 2006

http://www.2000wave.com/article.asp?id=mwo122906

>

Source:

Housing Pain Gauge: Nearly 1 in 6 Owners ‘Under Water’

JAMES R. HAGERTY and RUTH SIMON

WSJ, OCTOBER 8, 2008

http://online.wsj.com/article/SB122341352084512611.html

What's been said:

Discussions found on the web: