This continues to become ever more interesting . . .

“Lehman Brothers Holdings Inc.’s main lender and clearing agent, JPMorgan Chase & Co., caused the liquidity crisis that led to Lehman’s collapse, creditors said.

JPMorgan had more than $17 billion of Lehman’s cash and securities three days before the investment bank filed the biggest bankruptcy in history on Sept. 15, the creditors committee said in a filing Oct. 2 in bankruptcy court in Manhattan. Denying Lehman access to the assets on Sept. 12, the bank “froze” Lehman’s account, the creditors claimed.

JPMorgan, the biggest U.S. bank by deposits, financed Lehman’s brokerage operations with daily advances, while money market funds and other short-term lenders provided overnight loans, according to bankruptcy court documents. When JPMorgan shut Lehman off from funds, Lehman “suffered an immediate liquidity crisis that could have been averted by any number of events, none of which transpired,” according to the filing.

The creditors asked the judge in charge of the case to let them interview a witness and request relevant documents from JPMorgan and to pursue possible legal claims. U.S. Bankruptcy Judge James M. Peck is scheduled to hold a hearing Oct. 16 on that request, the creditors said.”

The Times of London added:

“Lehman’s collapse is fast emerging as the single biggest event of the credit

crunch, sparking a number of unexpected effects. The unravelling of the firm’s prime brokerage operations has already forced a

number of hedge funds out of business.”

Stay tuned — this charge may have legs . . .

>

UPDATE: October 5, 2008 10:38am

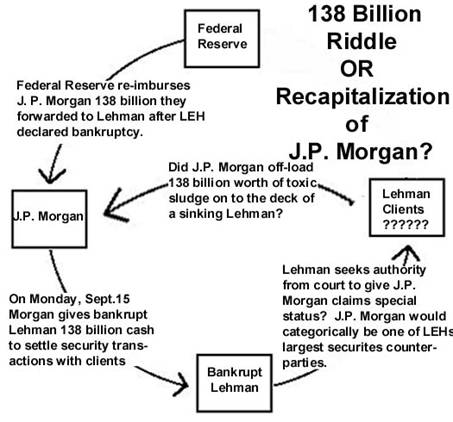

Ron Kirby notes: “I wrote about a very strange occurrence – the reporting of J.P. Morgan “transferring” 138 billion dollars to Lehman, after Lehman had already filed for Chapter 11 bankruptcy early last Monday morning…It is highly likely [or a certainty on my planet] that J.P. Morgan was INSOLVENT and was “BAILED OUT” last Monday, September 15, to the tune of 138 billion dollars. This would explain why the Fed and Treasury dictated that Lehman fail – to disguise or otherwise obfuscate the recapitalization of or illicit transfer of 138 billion to A MUCH SICKER, TEETERING ENTITY, J.P. Morgan Chase.”

>

Sources:

Lehman Cash Crunch Caused by Lender JPMorgan, Creditors Say

Linda Sandler and Jeff St.Onge

Bloomberg, Oct. 4 2008

http://www.bloomberg.com/apps/news?pid=20601109&sid=aOBEg1wAitck&

JP Morgan ‘brought down’ Lehman Brothers

Iain Dey and Danny Fortson

The Sunday Times, October 5, 2008

http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article4882281.ece

What's been said:

Discussions found on the web: