>

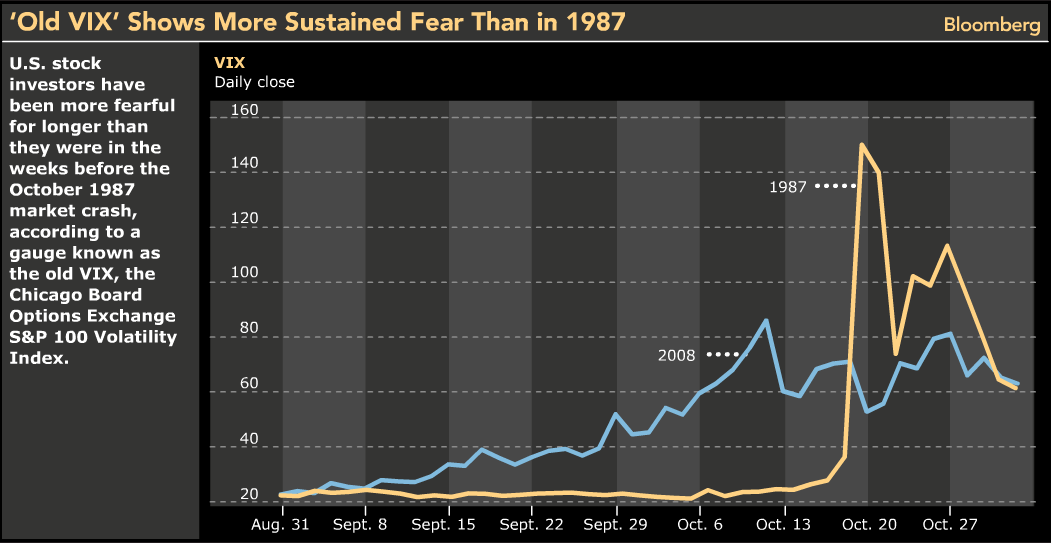

In all of the end of month mayhem last week, you may have missed the above Bloomberg chart-of-the-day on Friday. It showed something that was rather fascinating: Option traders have been at a more elevated level of fear for a longer period of time than during the 1987 crash.

The comparison is one between short and sharp (1987) versus high and protracted (2008). Its between a brief peak and a prolonged elevation.

Here’s the Ubiq-cerpt:™

“U.S. stock investors have been more fearful for longer than they were in the weeks before the October 1987 market crash, according to a gauge known as the old VIX.

The CHART OF THE DAY shows the closing values for this indicator, the Chicago Board Options Exchange S&P 100 Volatility Index, in the past two months (the white line) and the same period 21 years ago (the red line).

This year, the old VIX climbed from the start of September through Oct. 11, when it surpassed 100 in intraday trading for the first time since the month of the crash. Back in 1987, the index stayed below 30 until the Friday before stocks tumbled.

The indicator is derived from prices of options on the S&P 100, as its name suggests. The current version, introduced five years ago, uses S&P 500 options and includes more contracts in the calculations. Their readings tend to be similar. The VIX closed yesterday at 62.90.”

Good stuff . . .

>

Source:

‘Old VIX’ Shows More Sustained Fear Than in 1987: Chart of Day

David Wilson

Bloomberg, October 31 2008

http://www.bloomberg.com/apps/news?pid=20601109&sid=ays2N58cIcUo&

What's been said:

Discussions found on the web: