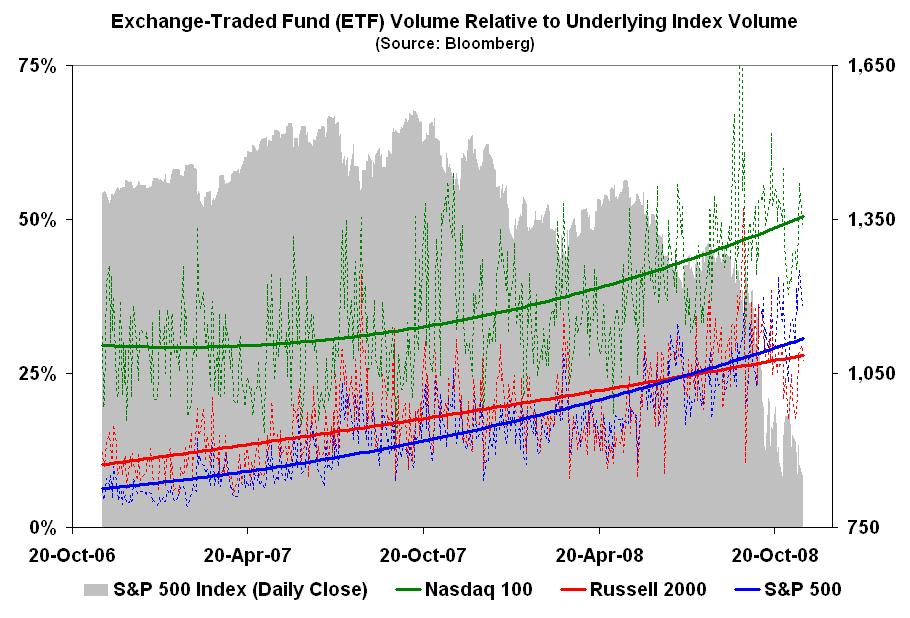

As the market has sold off since January, exchange-traded fund volumes have outpaced those of the underlying indexes, suggesting that ETFs are increasingly becoming the hedging and speculative mechanisms of choice in the U.S. equity market.

Since the year began, volume in the PowerShares QQQ (QQQQ) ETF relative to the Nasdaq-100 index has jumped from around 35% to more than 50%; in the iShares Russell 2000 ETF (IWM) relative to the index, from around 20% to 30%; and in the SPDR Trust Series 1 (SPY) relative to the S&P 500 index, from around 17% to 27%.

>

What's been said:

Discussions found on the web: