2008 has again been a good year for FusionIQ and its research team. Below are some cherry picked excerpts from Fusion’s various research publications:

- ● 10/22/07 Bank Index Review (BKX) – “Many of the BKX components: C, CMA, COF, FITB, RF and WM have extremely low technical scores in our FusionIQ quantitative ranking with scores of 23, 10, 17, 4, 8 and 11 respectively (out of a possible 100). While there may be an attempt short-term to bounce after Friday’s sell-off the technical structure of the index suggests sellers are in control ….”

- ● 2/12/08 American Intl. Group Inc. (AIG) – Technical Sell – “Additionally with a FusionIQ Technical Rank of only 12 (out of a possible 100) forward returns for AIG do not look promising … Analyst sentiment remains overly bullish with 14 BUYS and only 4 Holds …

- ● 08/07/08 KBR Inc. (KBR) – Technical Sell – “ The catalyst for the breakdown in KBR Inc. was the sharp fall in second-quarter profits. KBR shares are ranked a low 44 out of a possible 100 in our FusionIQ quantitative ranking system and with over 90% of its float already in institutional hands there is a lot of potential supply out there … Our technically delivered target is $ 15.00 and the objective point and figure target is $ 7.00. KBR was at $ 23.79 at the printing of this report – today it is – $ 9.93.

Note: In all fairness we had some calls that did not work out such as BUYS on WU @ $ 26.00, LZB @ 10.15. However EVERY recommendation that is published comes with a defined stop loss or drawdown point so even the bad recommendations get wiped out quickly and with minimal damage.

All of these recommendations plus access to our quantitative ranking system (and expanded economic coverage by yours truly) can be attained by subscribing to FusionIQ’s software application ($39.95 per/mo). Reliable, unbiased guidance, intelligent recommendations, and risk management tools.

Please note the a PDF of all of our published research for 2008 is available for new institutional research clients (the results relative to the market have been quite impressive).

Note for compliance reasons, this can only be sent to institutional email addresses. Send your request to Peter Greene by clicking here.

~~~

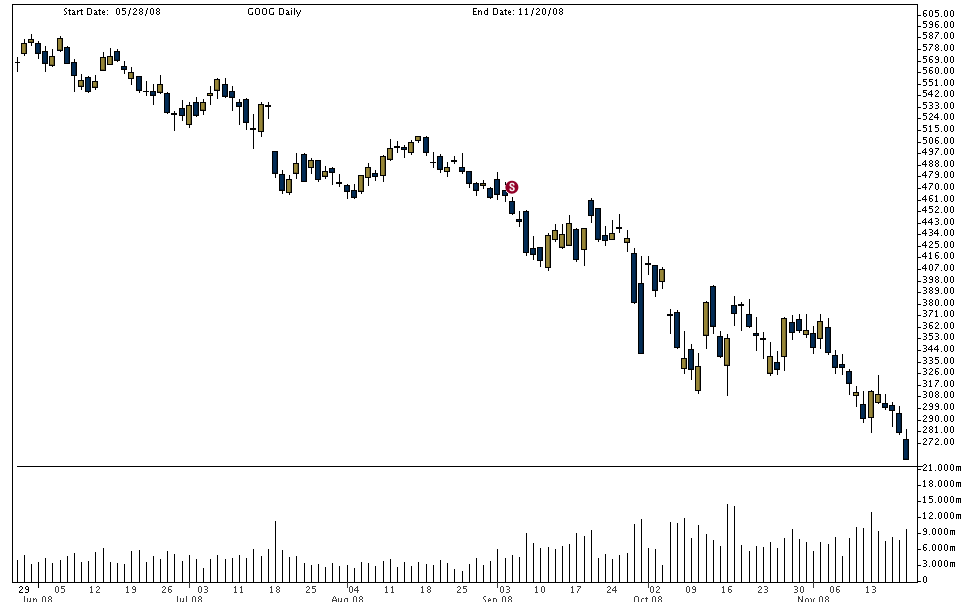

We also will leave you with this picture. Everyone loved Google (GOOG) as an investment however FusionIQ, with its independent, unbiased ranking ability placed a SELL signal on GOOG @ $ 452 its now below $ 275 !! For only $ 39.95 to have a second opinion to help you determine if you should buy sell or hold something is a no brainer !

What's been said:

Discussions found on the web: