Here is the latest minor consumer insult: owing more on your vehicle then its worth. Its not the same as being underwater on a house — you can always drive the car until it falls apart, so its market value is irrelevant.

Here is the latest minor consumer insult: owing more on your vehicle then its worth. Its not the same as being underwater on a house — you can always drive the car until it falls apart, so its market value is irrelevant.

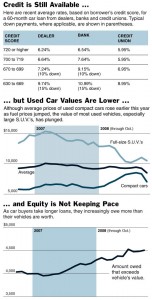

“For consumers, the credit crunch may have a silver lining.

“Dealerships are desperate to sell cars,” said William Ryan, who follows the auto finance industry for Portales Partners, an independent research firm in Manhattan. “The reality is, you are probably going to get a pretty good deal if you can afford it. There is a lot of heavy discounting going on.”

On average, automakers are doling out incentives worth more than $2,675, up 23 percent from a year ago, according to the auto information site Edmunds.com (which lists rebates on its site). Some dealers are discounting S.U.V.’s by more than $10,000.

Automakers have reported falling sales numbers for months, with the annualized sales rate for October the worst in 25 years, according to data compiled by a trade journal, Ward’s Automotive Reports. Automakers are on pace to sell fewer than 11 million vehicles in 2008, about a third fewer than the annual average of the last decade. Although 2009 models are in showrooms, last year’s vehicles remain on dealership lots, and unusually high inventory-financing costs are giving dealers more reason to clear out the surplus by offering sweet deals.

“It’s a buyer’s market right now,” said Adam J. Renie, sales manager at Gray Auto, an independent used-car dealership in Greenfield, Ind. “Anybody who is an able buyer, you are making sure they end up in your vehicle.”

I suspect you may see even more incentives next year . . . but don’t dawdle too long.

>

Source:

Strategies for Car Shopping in a Time of Tighter Credit

ERIC DASH

NYT, November 20, 2008

http://www.nytimes.com/2008/11/23/automobiles/23LEND.html

What's been said:

Discussions found on the web: