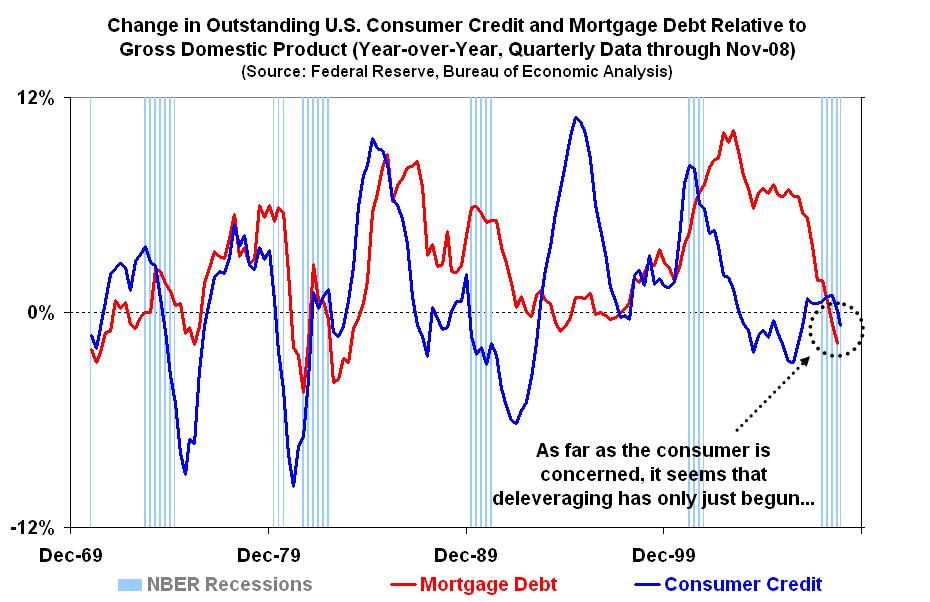

Yesterday, the Federal Reserve reported that outstanding consumer credit for November fell a worse-than-expected $7.9 billion, lending support to the notion that the consumer is deleveraging.

However, based on the accompanying graph of year-over-year changes in consumer credit and mortgage debt relative to GDP, it seems like deleveraging has hardly begun.

>

What's been said:

Discussions found on the web: