This time of year, many investors are looking at their asset allocation, and stock selection.

This time of year, many investors are looking at their asset allocation, and stock selection.

Perhaps they should be asking themselves, “How dense are my dopamine receptors?”

As it turns out, some people process the brain’s “reward” chemicals differently, depending upon the number of receptors they have,

The BBC reported on a recent study by Professor David Zald

of Vanderbilt University. They noted:

“Scientists say they have found physical evidence of brain differences which may drive “thrill-seekers” to act impulsively or dangerously.

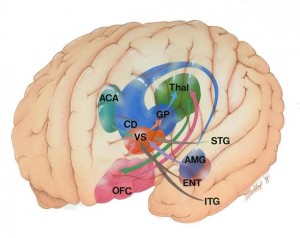

A small study from Vanderbilt University in the US found the biggest “risk-takers” processed a brain “reward” chemical dopamine differently. Scans spotted fewer “receptors” for the chemical on the cells which make it.

The Journal of Neuroscience study could help explain why some are vulnerable to drug abuse and other addictions. . . . Just as in animals, a propensity towards thrill-seeking, spending money freely, and spontaneity, could be linked to lower levels of autoreceptors.

As it turns out, the same cells that produce the dopamine also have a self-regulating system respond to rising levels of the hormone by reducing its production. Preliminary research now suggests that those of us with lower levels of autoreceptors have tendencies towards greater risk taking — spending money freely, thrill-seeking, engaging in spontaneous actions.

What does this mean for investors and traders?

A few things. It goes back to one of our favorite trader admonitions: Know Thyself. All investors should have a good handle on their own personalities, and adjust their strategy and tactics to their own personality, risk tolerances, and natural tendencies.

Rather than make resolutions you won’t keep, try something different this year. Figure out your own brain tendencies — including personality type. Don’t try to become something you are not, and instead, adapt to your own physiology. If you are impulsive, map out an investment strategy that includes handling this part of yourself.

Some people have had success setting up a sequestered, smaller, “thrill” account for trading. Any impulsive trades should be in the fun account, measured in percentages, not dollars. Keep your dopamine-seeking trades here — put and call options, hail marys, shots in the dark — and make sure these trades remain separate from your long term retirement monies.

Your investment returns will thank your brain chemistry for it.

>

Previously:

Apprenticed Investor: Know Thyself

The Street.com, May 03, 2005

http://www.thestreet.com/_tscs/comment/barryritholtz/10221284.html

Sources:

Evidence of ‘risk-taking’ brain

BBC, 31 December 2008

http://news.bbc.co.uk/2/hi/health/7802751.stm

Professor David Zald

Vanderbilt Faculty Home Page

https://sitemason.vanderbilt.edu/site/js36bS

Midbrain Dopamine Receptor Availability Is Inversely Associated with Novelty-Seeking Traits in Humans

David H. Zald, et. al.

The Journal of Neuroscience, December 31, 2008

http://www.jneurosci.org/cgi/content/abstract/28/53/14372

Dopamine Transmission in the Human Striatum during Monetary Reward Tasks

David H. Zald, et. al.

The Journal of Neuroscience, April 28, 2004

http://www.jneurosci.org/cgi/content/full/24/17/4105

What's been said:

Discussions found on the web: