My boychik Doug Kass has a good quote in Jack Healey’s NYT column today:

This month, after the stock market staged one of its biggest rallies since the Depression, optimists like Douglas A. Kass, a prominent hedge fund manager, buzzed that the worst was over. Finally, after a 401(k)-busting, 7,722-point plunge in the Dow Jones industrial average, the stock market seemed to be escaping bear territory, the bulls argued . . .

At the beginning of 2008, Mr. Kass, known as a short-seller, saw more trouble coming and bet against the stock market. But now, he says he thinks stocks have hit a definitive bottom, and he said he was buying.

“I’ve been a bear for three years,” said Mr. Kass, general partner of Seabreeze Partners Management in Palm Beach, Fla. “This is a big change for me.” Mr. Kass said the March lows would not just represent the lowest points of the year, but “possibly a generational low.”

Last week, he wrote a note, “Why the Bears Are Wrong,” that tallied a host of hopeful conditions in the economy and the financial system. He saw potential in the Obama administration’s plan to buy $500 billion to $1 trillion in troubled assets from banks using a blend of public and private money. If it works, the move could take the strain off the banks’ struggling balance sheets and loosen credit markets, Mr. Kass said.

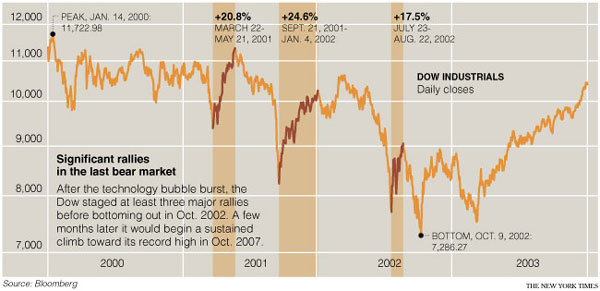

Nice looking chart:

>

2000-03 Bear Market Rallies

>

Source:

A Pitched Battle for Turf Between the Bears and the Bulls

JACK HEALY

NYT, March 30, 2009

http://www.nytimes.com/2009/03/31/business/31market.html

What's been said:

Discussions found on the web: