Home prices dropped 15% from the same period one year ago; Despite the price drop, sales fell 4.6%. How anyone can try to spin this as a positive is beyond my mathematical comprehension.

Even the NAR reported that “overall sales activity remains relatively soft,” as existing-home sales increased in February (month over month).

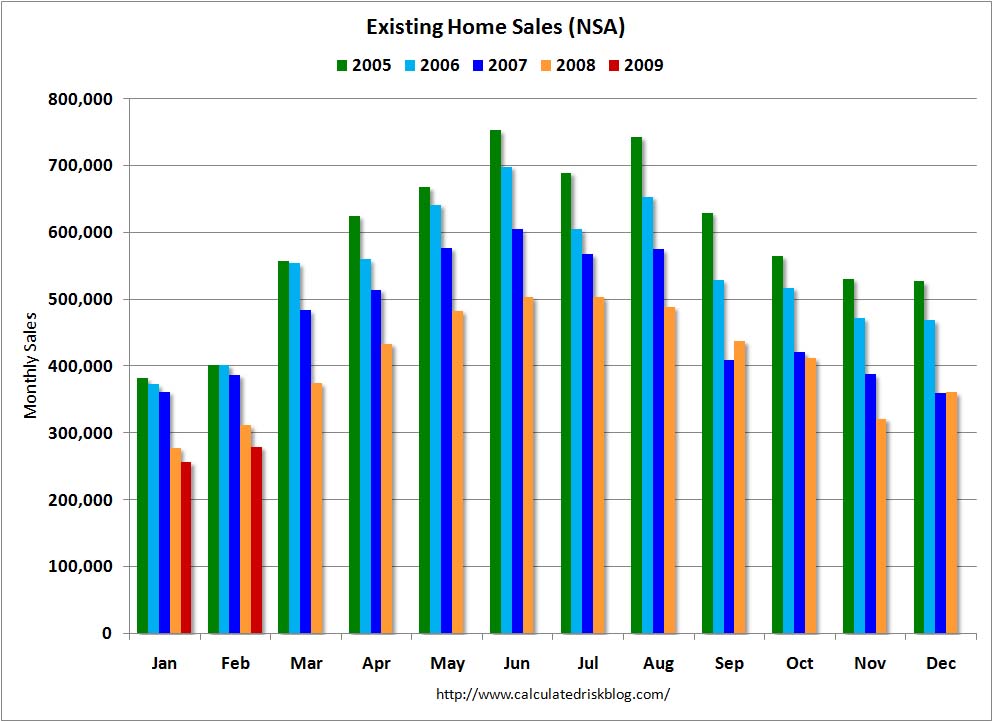

This was another weak housing report. Do not be fooled by the monthly gains, as we have been saying for 4 years now, as they are meaningless (see chart at bottom):

-Single-family home sales rose 4.4% to a seasonally adjusted annual rate of 4.23 million in February. They fell 4.6% from the 4.95 million-unit level of February 2008;

-Distressed properties accounted for 45% of all sales;

-Home foreclosures were up 30% in February from a year earlier;

-The national median existing-home price for all housing types was $165,400 in February, down 15.5 percent from a year ago.

-The median existing single-family home price was $164,600 in February, down 15% from a year ago

-Total housing inventory at the end of February rose 5.2% to 3.80 million existing homes available for sale, a 9.7-month supply at the current sales pace.

-The absolute number of homes for sale rose to 3.8 million from 3.6 million

-The West continued to see the biggest drops in prices due to foreclosures.

While there was a healthy increase in sales from January, a look at the non-seasonal data might be instructive: As expected, the gins are primarily seasonal in nature, with January the worst sales month of the year, and February the start of modest seasonal improvements.

>

Existing Home Sales, Non-Seasonally Adjusted

chart via Calculated Risk

>

Sources:

Existing-Home Sales Rise In February

NAR, March 23, 2009

http://www.realtor.org/press_room/news_releases/2009/03/february_existing_home_sales

What's been said:

Discussions found on the web: