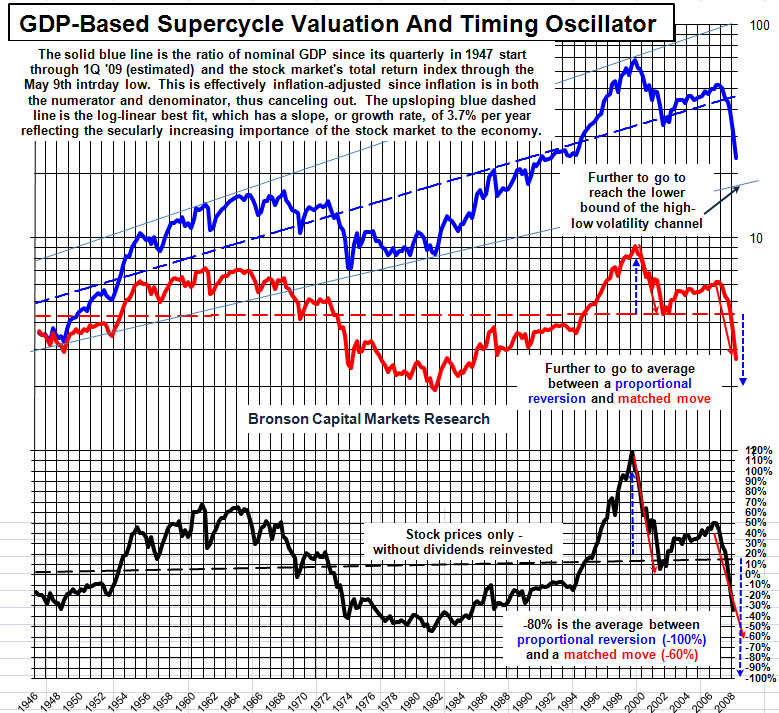

Bob Bronson (BRONSON CAPITAL MARKETS RESEARCH) looks at GDP and Valuation:

We prefer the following construct of the stock market vs. GDP. Note that it does not require any multi-year averaging, like the methodology illustrated in the chart at the bottom does, and as required for corporate earnings in Supercycle market P/E valuation metrics. And our metric better identifies the actual peaks and troughs in the stock market, unlike the other metric which is fuzzy. But they both tell the same story: we are getting closer to the stock market bottom, but there still is way to go.

Using GDP, which Buffet has said is his favorite stock market secular valuation metric, also further explains why our index below, as well as our Supercycle market P/E ratio have upward secular trends. This is because the stock market has historically-increasing importance to individuals and families/households, and thus for the whole U.S. economy.

What's been said:

Discussions found on the web: