I saw an interesting poll on a web site called The Globalist run by my friend Stephan Richter. He and I share a delight in telling the truth — or at least what we see as truth — in public in Washington. Since 95% of what is spoken in Washington is sponsored by some corporate interest, expressing actual honest opinions is a radical concept.

Here are the poll questions:

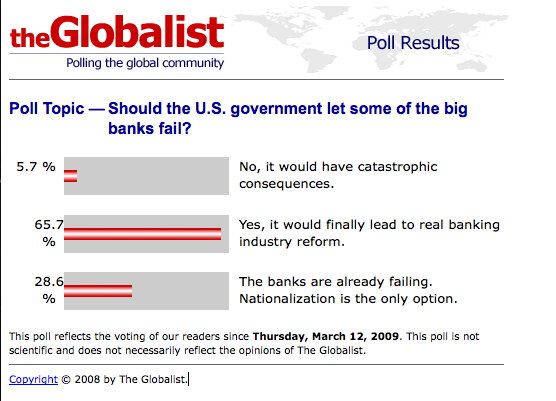

Should the U.S. government let some of the big banks fail?

| No, it would have catastrophic consequences. | |

| Yes, it would finally lead to real banking industry reform. | |

| The banks are already failing. Nationalization is the only option. | |

The thing which caught my interest was 2/3 of the respondents favor allowing the large banks to fail and be broken up, this to advance the concept of reform.

Chart via Globalist

Almost a third of the respondents said that the banks were already failing and should just be seized and broken up.

What is interesting about this poll to me is that The Globalist is a pretty broad, non-financial portal with a definite international following. Not a hotbed of Republican, conservative politics. But there does seem to be a broad and broadening public disgust with the problems on Wall Street.

Of note, something interesting happened at the Financial Services Hearing this week that very few people picked up on, but that is actually somewhat newsworthy. During the hearing on mark to market accounting standards Robert Herz of FASB (Financial Accounting Standards Board) said that about two weeks before insolvent institutions go under, they come to him and ask for accounting rules changes. The exchange is at about minute 4:45.

So guess we should be tracking Bob as a bank fail indicator? When Rog Cohen calls with a patient on life support and Bob gets on the conference call, we know the time is nigh?

On Wednesday, Bloomberg News wrote a piece about lawmakers (Brad Sherman) thinking of giving bad bank bondholders a haircut based on the GMAC model whereby bondholders were given a 40% haircut. That would help improve capital ratios, and make them smaller. Both desirable outcomes, the financial clog could clear and confidence could be restored.

But, on Thursday, Bloomberg News reported other lawmakers were talking about legislating an end to FV accounting, to allow banks to continue the lie. Paul Kanjorski is the nutbag on the Hill spear-heading this lame-brained effort. The goal is to let banks decide what marks to give their assets. Presumably, these marks would be marked-to-model, that is whatever fictitious fantasy model they wish to create. The financial system would not clear and confidence would remain in the shitter.

The FASB chair Robert Herz is being pressured by lawmakers to change the FV rules, according to the chatter. Barney Frank is doing some of the arm-twisting, a role he does with only modest skill. SEC Chairman Mary Schapiro appears to be against eliminating mark-to-market, but she is not forceful on this point.

>

Sources:

Banks’ Bondholders May Be Next to Share Bailout Pain

David Mildenberg and Bryan Keogh

Bloomberg, March 11 2009

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aKqHkkFlnvfM

Lawmakers Tell FASB to Change Fair-Value ‘Quickly’

Ian Katz and Jesse Westbrook

Bloomberg, March 12 2009

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=a6RX9zOA4Td4

Alan Grayson Questions AIG Math

You Tube, March 13, 2009

What's been said:

Discussions found on the web: