Paul Brodsky & Lee Quaintance run QB Partners, a private macro-oriented investment fund based in New York.”

March 2009

Alan Greenspan’s March 11 opinion piece in the Wall Street Journal (“The Fed Didn’t Cause the Housing Bubble”) sought to cast doubt on growing suspicions that the Fed shares substantial blame for the current global crisis. We find Mr. Greenspan’s denials and assertions unreasonable. Let there be no doubt; the Fed is largely responsible for the current economic crisis and, as the Chairman of the Fed leading up to the crisis, Mr. Greenspan was one of its principal architects.

Mr. Greenspan cited two generally accepted “broad and competing explanations for the origins of the crisis” that he then cast as spurious: 1) easy monetary policies, which he summarily dismissed as in-credible and 2) the “far more credible” (and later denied) notion that interest rates stayed low despite Fed rate hikes, which “spawned speculative euphoria”. Mr. Greenspan seemed to try to separate the Fed from blame by asserting the Fed “lost control” of mortgage and longer term rates because of an organically-created “excess savings pool.”

We find the construct for Mr. Greenspan’s plea lacking. As the body responsible for targeting overnight funding rates in a largely finance-based economy, the Fed is (or should be) concerned only with the interest rate or quantity level of overnight funds relative to available returns that investors may capture from borrowing those funds. The absolute levels of the Fed’s target rate or market-based interest rates do not matter.

Consider that the shadow banking system comprised of global leveraged arbitrage investors (on Wall Street and independent of Wall Street) care only about yield spreads, not about yields. A Fed funds target that rises from 1% to 5.25% over two years may not induce a diminution of credit issuance because as long as arbitrageurs may buy credit paper with higher yields than their funding costs, they will continue do so.

Against this more relevant backdrop, Mr. Greenspan’s Fed maintained an extraordinarily easy monetary policy throughout his tenure, even at times when overnight funding rates rose. This easy money policy engendered credit expansion; at first among mostly creditworthy borrowers, then among more marginal borrowers and ultimately among dubious borrowers with virtually no hope of repaying their home mortgage and consumer loans.

Nevertheless, we will respectfully address Mr. Greenspan’s arguments and then seek to substantiate our claim that the Fed is indeed largely responsible for the current crisis.

* * * * *

Regarding low interest rates, Mr. Greenspan argued that from 2002 to 2005 mortgage rates decoupled from their long history of being tightly correlated to short-term benchmark interest rates that the Fed controlled and/or heavily influenced. He noted that the leading indicator of home prices was the mortgage rate and not the fed-funds rate, which the Fed explicitly targets. Any fact-checker can see this is true, but it is an irrelevant data point taken out of context. As we have already implied, the driver of home prices from 2002 to 2005 was easy credit that ultimately influenced mortgage rates lower than pure economic fundamentals would have dictated.

Indeed, the record is clear that the Fed chose an easy money path that created supplemental demand in US

Treasury and mortgage markets. This artificially-induced demand in turn caused mortgage rates to drop to

artificially low levels (i.e., levels not explicitly tied to true home values or borrower credit risk), and to then be relatively insensitive to rising funding rates later on.

A little background is appropriate. The mechanism the Fed deploys to create credit is time-worn and well known among Wall Street bankers. Simply, the Fed provides daily amounts of credit to Wall Street primary dealers through repurchase agreements. (Fed repurchase agreements or “repos” are overnight or short-term credit facilities between the Fed and the largest Wall Street banks in which eligible collateral is swapped in return for Fed credit in the form of US dollars. The borrowers pay an implicit interest rate — or repo rate — for this credit that finances their balance sheets.)

There was (and remains) no limit to the repo lines the Fed and Wall Street may create (other than the amount of eligible assets that may be offered as collateral), meaning the Fed largely controls the amount of US dollar-based credit provided to the markets. In short, through the repo market the Fed controls/supplies funding for the largest Wall Street banks and, secondarily, the shadow banking system (the securitization process and levered buyers of those securities that borrow from Wall Street).

Through Fed repos, Wall Street was able to grow its collective balance sheet dramatically and then use it to

distribute — through the shadow banking system — credit to homeowners and consumers. Wall Street provided vendor financing to leveraged debt investors through their profitable prime brokerage units. Yet, ultimately, the credit came from the Fed. (The Fed and commercial banks “create, distribute and sometimes even extinguish” credit while Wall Street “intermediates and demands” it. Wall Street does not create it but does “market” and “redistributes” it.)

Ironically, Mr. Greenspan seems to be pointing his finger at banks and borrowers for taking the Fed’s credit. (Even more ironic is that, as the Fed Chairman, he was the chief bank regulator and could have stepped in to prevent bank, and ergo, leveraged-investor balance sheet growth by demanding and enforcing more traditionally- stringent lending standards.)

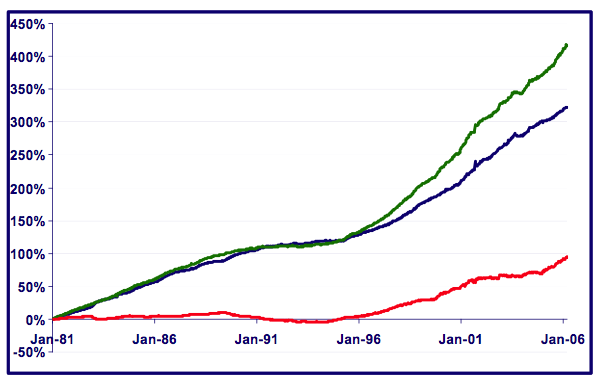

We assert that Mr. Greenspan knew perfectly well what he was doing and, as the graph below indicates, he was quite proficient in meeting his goals. Beginning in 1996, the Fed seemed to have increased the magnitude of its repo program dramatically as indicated by the expanding differential of M3 growth (green line), which includes repurchase agreements, and M2 growth (blue line), a narrower money stock measure, which does not.

We can see from the graph the degree to which the Fed financed Wall Street directly and thus, the shadow banking system, indirectly. Notable is that from 1981 to 1996, the growth rates of M2 and M3 tracked one another quite closely, implying the Fed’s manufacturing of credit would be sustainable (a dollar loaned could be paid back with an existing dollar). However, from 1996 to 2006 — during Mr. Greenspan’s chairmanship — M3 growth consistently pulled away from M2, implying increasing future hardship for debtors with obligations to repay the credit leant to them. The red line at the bottom of the graph represents the difference in growth rates of M2 and M3.

(Curiously, the Fed ceased publishing M3 in March 2006 to save on “administrative costs.” Hmm. Who could blame it? The growth of M3 relative to M2 seems to provide clear evidence of risk-enticing Fed monetary policy.)

From 1996 to 2006, M3 grew from about $4.7 trillion to about $9.6 trillion, an astounding average annual increase of 10.2%. M2, the narrower monetary aggregate that does not include repurchase agreements, rose a more modest 8.2%. This difference was a big deal. In these ten years, M3 growth compounded to a 94% increase over M2 growth. This difference reflects the aggressiveness of Fed-lending to Wall Street, ergo the capital markets, ergo the housing and derivative markets.

We assert that without this Fed-induced financing, the credit, housing and derivative bubbles would not have developed to anywhere near the magnitude they ultimately did. The nexus of these bubbles was a currency bubble initiated and exacerbated by the Greenspan Fed. It appears the Maestro sacrificed the future for the present, which is a sure way to make people on Wall Street, Main Street and in Washington happy…temporarily.

We must ask ourselves why banks and investors would keep buying homeowner and consumer debt even as

interest rates began rising in 2004. The answer is simple: as long as banks could maintain a profitable spread between the rate at which they borrowed overnight from the Fed (the repo rate) and either the rate at which they could lend directly or the rate of return implicit in the fees they generated by effectively re-structuring and distributing their repurchase agreements (and, as long as debt buyers could maintain a positive arbitrage), then the actual level of interest rates – benchmark, mortgage or consumer rates – didn’t matter. It was, as all things financial usually are, the “spread” that mattered.

Wall Street and the shadow banking system were fundamentally engaged in a grand carry trade for which the Fed provided funding. This is the business of finance, which is precisely the business that Wall Street and investors practice. After fourteen years at the helm of the Fed (in 2002) Mr. Greenspan should have known this (or, might we dare say, should not have forgotten this).

* * * * *

By 2007 the entire interest rate pricing structure had been corrupted by: a) the difference in the amounts of credit previously sold and the available funds necessary to retire that credit and, b) generally-accepted benchmarks that erroneously signaled all was well when all was anything-but-well. There seems to have been a bit of deception that made the markets seem healthy when in reality they were not.

To start, we think low inflation expectations subsequent to a time of very high monetary inflation (1996 to 2006) may have made it an inevitability that the bubble would burst. Treasury Inflation-Protected Securities (TIPS) are viewed upon by the fixed-income markets to be a practical, market-based indicator of inflation expectations. While their yields may have accurately reflected — and still reflect — the public’s general perception of low future inflation rates (at least as expressed by CPI-U), they did not in 2007 — and still do not – compensate investors for anything close to recent historical or anticipated monetary inflation rates in our view.

Without getting into too much detail, it is broadly agreed that in pure economic terms inflation is a monetary phenomenon in which changes in the stock of money (and by extension, credit) determine changes in nominal prices for goods, services and assets. Simply, the more dollars outstanding, the less purchasing power each has and the more dollars it takes to purchase an item. In other words, money creation produces nominal price increases and money destruction (a dynamic that has not occurred for any length of time since the Fed was established in 1913) would produce price declines.

This has real-world investment applications. As is evident in the graph, the substantial and consistent creation of asset-supporting credit by the Fed from 1996 to 2006 also created the future need for more dollars to service and pay down that credit. So inflation was (and is) built into the system yet few investors seemed positioned for it. Either the value of credit had to drop or the amount of money in the system had to rise to repay that credit. (This is literally the same dynamic that perpetuates a Ponzi scheme – the need to find or manufacture more money to satisfy existing claims.)

But there is a far more granular reason for the bursting of the currency/credit bubble. Too much credit in the system drove down fixed-income yields across the board (thanks to a wide arbitrage spread separating funding rates from nominal debt yields). When the Fed began allowing the fed funds rate to rise in 2004, it triggered a narrowing arbitrage spread and nominal price losses on the bond side of the arbitrage. This, in turn, triggered redemptions for bond funds like the Bear Stearns mortgage funds.

There was an air pocket underneath. Bonds and their derivatives were being priced at the margin by leveraged arbitrageurs. Smart real money buyers were waiting for positive real yields which, given the aggressive monetary inflation at that time, could only be found at nominal yield levels well in excess of those then available (hey, today’s “safe haven” Treasury buyers, are you listening?). Can Greenspan’s Fed be held accountable for this?

We think so. In 2004 the Fed began to allow a progressively higher fed funds rate to “be targeted” which created the perception of tightening monetary policy. Yet the Fed was NOT TIGHTENING AT ALL. Despite a steadily rising fed funds rate we believe the Fed stood by as market-based funding demand continued to increase substantially. In fact, short-term credit provisions from the Fed continued to grow during this time. Indeed the Fed pursued an easy money policy despite the optics of it “targeting” a higher funds rate. To us, “easy money” means more money and credit, not less.

Orthodox economic supply/demand curve analysis has no difficulty reconciling a progressively higher fed funds rate with simultaneous growth in the quantity of credit clearing in the marketplace. (Don’t demand curves shifting to the right create both higher clearing prices and clearing quantities? And, don’t supply curves shifting to the left create higher clearing prices but lower clearing quantities? We intuit a lot of the former and little to none of the latter during the period in question.)

We argue that Mr. Greenspan would have had to restrict Fed credit far more than he did if he wanted to close the arbitrage spread giving bond investors incentive to keep adding credit to their balance sheets. He should have shifted the funds rate higher and more forcefully. The move in the fed funds rate from 1% to 5.25% from 2004 to 2006 was woefully inadequate and should have been MUCH more aggressive if spurious credit demand were to be discouraged. Put slightly differently, we assert that the ENTIRE fed funds move from 1% to 5.25% was driven by increased credit DEMAND (levered credit buyers had incentive to put as much on their balance sheets at a positive spread between funding costs and bond yields). Mr. Greenspan didn’t seem to get this.

Had the Fed wanted to restrict the clearing quantity of credit, it would have had to target a fed funds rate well in excess of 5.25% and/or acted much quicker than it did. The Fed would have needed to restrict SUPPLY and thus target less growth in overall credit. This, no doubt, would have endeared him to no one (but former Chairman Volcker perhaps?).

More forceful credit restriction would have clearly retarded any growth in demand from the shadow banking

system and the credit bubble would have been stopped in its tracks well before it burst. We don’t believe that Econ-101 supply/demand curve analysis is beyond Mr. Greenspan’s reach as he seems to protest, nor was it so when he was Chairman of the Fed.

* * * * *

In a broader sense, real (inflation-adjusted) losses had already been locked-in by fixed-income investors because prevailing absolute nominal yields were lower than the higher rate of monetary inflation. And as we discussed, the Fed’s monetary inflation between 1996 and 2006 actually produced lower absolute bond yields than would have otherwise prevailed (too much money chasing bonds). Why did this “irrational investment behavior” occur?

It was not irrational-investor behavior though it was irrational investing. We think there were two inter-related issues at hand: 1) investors didn’t mind running a mismatched asset/liability book because they were compensated at shorter intervals and, 2) conventional economic wisdom, that seems to have been fostered and encouraged by policymakers, produces terribly inaccurate economic data that these mismatched investors used to justify their actions. (The two dynamics remain in place today.)

For example, the Consumer Price Index (CPI) and other price baskets generally used as “inflation” indicators had not risen to reflect gross monetary inflation produced by the Fed from 1996 to 2006. This is not proof that money growth does not equal inflation; rather it is proof that the CPI does not accurately reflect the diminution of a dollar’s purchasing power. (If an indicator like the M3 growth rate had been a generally-accepted inflation metric — not perfect but closer than highly subjective price baskets — then there would not have been buyers of credit at negative real yields.)

In this light, it would also not appear to be acceptable Fed regulatory policy to assume that Wall Street banks — competitive publicly traded institutions with quarterly incentives to produce ever-increasing revenues — would somehow not re-distribute that credit to its credit-purchasing clients (that they were vendor-financing). It is also not reasonable to assume that credit buyers — competitive institutional asset managers with daily incentives to produce competitive returns relative to benchmark indexes and their peers, not relative to the creditworthiness of the instruments they were buying or even the real returns they were producing — would somehow not buy that credit priced at yield spreads above diminutive benchmark Treasury yields and funding rates (particularly when many of those asset buyers accessed leverage through Wall Street banks.).

There is more to Mr. Greenspan’s assertions that we find troubling. As he brought up for the second time in as many years:

“As I noted on this page in December 2007, the presumptive cause of the world-wide decline in long-term rates was the tectonic shift in the early 1990s by much of the developing world from heavy emphasis on central planning to increasingly dynamic, export-led market competition. The result was a surge in growth in China and a large number of other emerging market economies that led to an excess of global intended savings relative to intended capital investment. That ex ante excess of savings propelled global long-term interest rates progressively lower between early 2000 and 2005.”

Mr. Greenspan surely knows that there cannot be “an excess pool of savings” because, by definition, the pool of savings equals the pool of investment. (Mr. Bernanke seems guilty of this lapse too, we’re afraid.) However, there is an excess pool of “currency” in today’s world. Again, as the simple laws of supply and demand suggest, an increase in the supply of currency which is not coincident with an increased supply of assets will drive asset prices higher. A prudent central banker acting in the interests of economic stability would have absorbed that excess pool of currency (and would not now dub it as “savings”).

In an honest or “hard” money system, the “tectonic shift” Mr. Greenspan discusses would have led to CPI

deflation as the newly accessible pool of cheap Asian labor would have been deployed in the productive process. This would have implied lower consumer prices and higher interest rates. There would have been better margins helping asset prices on the one hand, and higher interest rates hurting them on the other. The net effect on productive asset prices would thus be ambiguous.

But the economy would have been sustainable and the US dollar would have remained sound. Clearly, Mr.

Greenspan allowed the various measures of the monetary aggregates to inflate and his reputation did not suffer for it during his tenure. The organic forces of price deflation provided him a shield. Why did he do this? To keep asset prices up? To keep US tax receipts up? The effect of his actions hurt dollar-based savers, fixed-wage workers and people living on a fixed-income. All would have been better off if the purchasing power of the dollar were to have been maintained or even, via the “tectonic shift”, enhanced.

And finally, Mr. Greenspan’s reminder that “prior to the crisis, the U.S. economy exhibited an impressive degree of productivity advance” is almost too much to bear. If this were true, where then were the fruits of this productivity advance? Doesn’t an increase in productivity, ceteris paribus, imply lower output prices and thus lower consumer prices? (Is this the “shabby secret” of modern central banks — they are inflation machines that counterbalance natural deflationary pricing forces brought about by private sector competition?) Mr. Greenspan’s record is crystal clear and his knack for obfuscation is not as charming now — or helpful to society — as it appeared it once was.

What's been said:

Discussions found on the web: