A friend reminded me about this section of the book. This is an excerpt from early draft of Bailout Nation: How Greed and Easy Money Corrupted Wall Street and Shook the World Economy. Given the bankruptcy filing today, it is totally suitable. (The final version is thematically similar, but different in actual content).

A friend reminded me about this section of the book. This is an excerpt from early draft of Bailout Nation: How Greed and Easy Money Corrupted Wall Street and Shook the World Economy. Given the bankruptcy filing today, it is totally suitable. (The final version is thematically similar, but different in actual content).

~~~

The current no strings attached bailout demands of the Big 3 stands in stark contrast to the 1980 Chrysler deal. Regardless, the subsequent decades post-bailout reveals the deal wasn’t particularly good for either the industry or the firm’s employees.

In the 1950s, Barron’s described the Detroit automakers as the big two and a half – with Chrysler, the perennial sales laggard, as the half. When the embargo hit, Chrysler suffered the most of the Big Three.

By the mid-seventies, the company was hemorrhaging cash. Chrysler lost $52 million in 1974, and a record $259.5 million in 1975. As smaller, less expensive and more fuel-efficient from Japan and Europe gained increasing market share in 1970s, Chrysler found itself in an ever-deepening hole. It looked like they might have to declare bankruptcy.

As soon as the energy crisis ended, it was back to business as usual. 1976 a hugely profitable year: the company’s net income was $422.6 million. 1977 was profitable, but less so: $163.2 million net income. By late 1978, they were running in the red again, losing $204.6 million. The fall of the Shah of Iran and a new US Oil embargo sent prices higher once again. By 1979, Chrysler was looking at its first billion dollar annual loss.

Management decided to was time to visit their Uncle Sam.

The Chrysler bailout was everything Lockheed was – its predecessor in the bailout timeline by 9 years – and more. It was bigger and more expensive. Lockheed had loan guarantees worth $250 million dollars; Chrysler’s were for six times that amount,. The rationale for the rescue of Lockheed, the country’s biggest defense firm, was national defense. With Chrysler, it was the economy, and saving 200,000 jobs in the U.S.

But the big difference between the two was that the Chrysler recue package was much more complex. The terms of the Chrysler loan guarantees required an additional $2 billion in commitments or concessions from: “its own owners, stockholders, administrators, employees, dealers, suppliers, foreign and domestic financial institutions, and by State and local governments. ”

The Chrysler bailout of 1980 was not quite a pre-packaged bankruptcy reorganization. It left the company with the same management team, the same union contracts, the same pension obligations, and the same health care coverage; all the bailout did was buy the company a few more years. Indeed, the pre-bailout industry looked almost identical to the post-bailout industry. None of the Detroit automakers, Chrysler included, received any long-term benefits from the bailout.

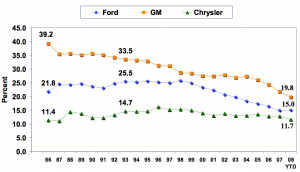

Chrysler survived, but a slow necrosis gradually handed over the dominance of the US automobile market to the Japanese, Koreans, and Germans. In 1980, Detroit had a ~75% market share of autos sold in the US. For the first time ever in May 2008, that number slipper under 50%, and its now down to ~48%.

You read that right, the majority of automobiles sold in the USA are no longer vehicles made by US companies.

The UAW’s membership suffered even more than Detroit’s market share. It peaked in 1979, a year before the bailout, when the Union had over 1.5 million dues paying members. 25 years, UAW membership had fallen by two thirds — down a million to to 538,448 (2006).

And, year-over-year totals are still falling. From 2006 to 2007 (the most recent full year of data ) the union saw its membership decrease yet another 14% –down another 73,538.

~~~

Had Chrysler been allowed to fall into bankruptcy, it’s not too difficult to imagine a vulture investor obtaining all of the aforementioned assets, and putting them to good use. Just picture a refurbished Chrysler Corporation – newly recapitalized, minus the onerous labor contracts, pension obligations, and healthcare overhead. Its new owner would have been free to pursue new manufacturing methods, new automobile designs, even new markets – with all the advantages Chrysler itself had, but without the defunct company’s baggage.

A post bankruptcy Chrysler would have been as leaner, meaner and more cost-efficient, and maybe even more fuel-efficient machine than the rest of Detroit. Surely, they would have been willing to take chances on some new designs that broke free of the stodgy boring cars put out by Detroit in the 1970s and 1980s.

Not only would Chrysler have been much more competitive in the US and world markets, their mere existence would have forced GM and Ford to streamline their own processes improve their vehicles in terms of attractiveness, mechanical reliability, and fuel efficiency.

~~~

Down Below 50% “Detroit 3”U.S. Market Share 1986 –June 2008

(Sales of Detroit 3 N. American “owned”production)

Source: Center for Automotive Research

What's been said:

Discussions found on the web: