I find that most of the day-to-day market action is simply noise. The moves up and down are for myriad reasons, but hardly what is ascribed to them.

Take for instance the recent bounce on “better than expected” confidence numbers. Markets took off on the number earlier this week, rallying 200 points. Why?

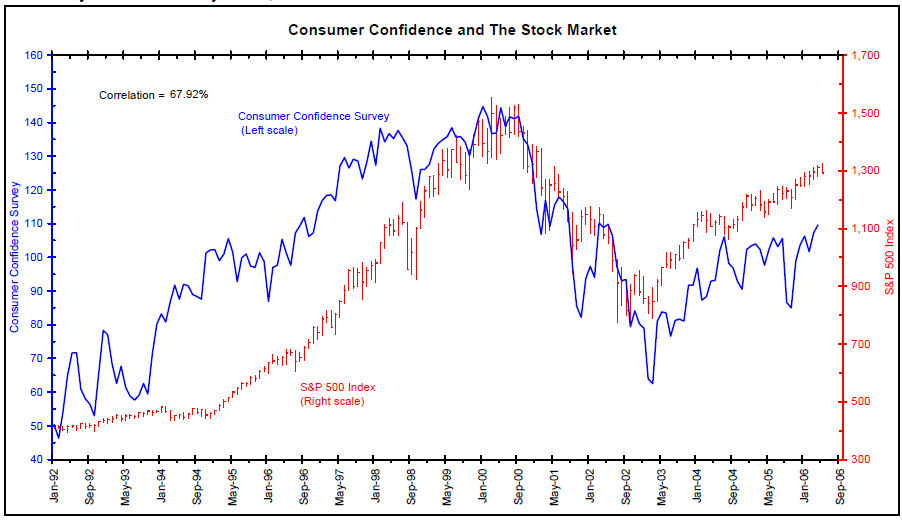

History teaches us that Confidence does not forecast future economic activity; rather, it is closely correlated to recent stock market gains or losses. Markets go up, and people feel better; markets go down and people feel worse.

One of the ironic things about the data is how conclusive it is that sentiment is a contrarian indicator. Mark Hulbert looked at consumer confidence data (via the Conference Board’s index) to its beginning — 1977. He then looked at how markets did over the ensuing periods. His conclusion?

“The biggest monthly jumps in the consumer confidence index were, on average, followed by sub-par returns. Conversely, big drops in the index were typically followed by above-average returns.

The starkest patterns in the data, however, were between monthly changes in the consumer confidence index and how the stock market had performed in prior months. When the stock market is going up, their confidence rises too — and vice versa. So, given the stock market’s impressive rally over the last couple of months, it was entirely to be expected that consumer confidence would rise smartly.

In other words, focusing on consumer confidence tells us more about how the stock market has performed in recent weeks than it does about the future.”

That makes perfect sense to me.

Howard Simons of Bianco Research pointed out sentiment tracks past — and not future — activity. He notes the absurdity of believing future activity follows sentiment changes:

“For this to be otherwise, we would need to believe consumer sentiment and expectations were truly leading indicators and completely independent variables, with the reductio ad absurdum being the U.S. economy was based in large measure on mood swings.“

>

Consumer Confidence and S&P500

Chart via Bianco Research, May 2006

>

Even more amusing: Consider the big Homebuilder‘s bounce on Tuesday — they were one of the strongest performers that day. But if you looked at the part of the sentiment survey about houses, it was the most negative aspect of the survey: The outlook for home purchases over the next 6 months fell — not surprising, given the recent activity in the housing market — falling sales and prices.

Since that’s the case, why did the Homebuilders rally?

>

Sources:

Consumer confidence is a contrarian indicator

Mark Hulbert

MarketWatch, May 27, 2009

http://www.marketwatch.com/story/a-contrarian-take-on-the-consumer-confidence-data

Sentiment Is Not An Independent Variable

Howard L. Simons

Bianco Research, May 27, 2009

http://www.arborresearch.com/biancoresearch-files/SubscriberArea/commentaryarchive/pdffiles/com20v35.pdf

What's been said:

Discussions found on the web: