>

Coming in Monday’s missive – Is this a new bull market? If so, or not, what is the

evidence? Stay tuned. Same Bat-time, same Bat-channel.

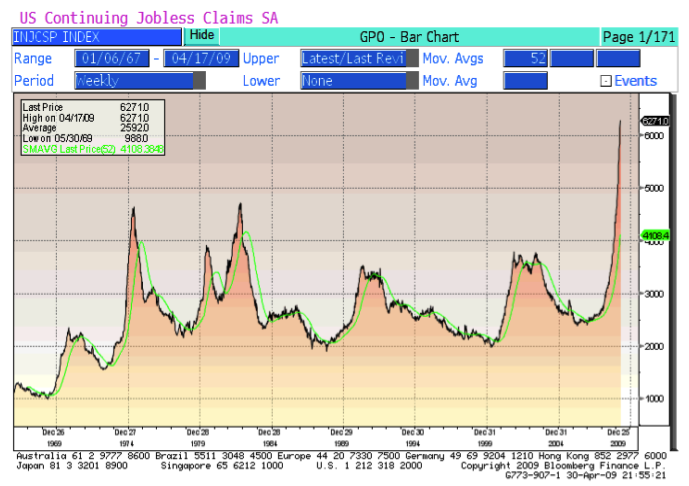

Is the recession ending? Looking at Continuing Jobless Claims, which hit a new record this week, (data series commenced in 1967) there is no sign of stabilization. In the recessions of the 70s and early 80s, unemployment was a lagging indicator. 1981-82 is called a double-dip recession, so that is a difficult comparison. But those recessions ended quickly after the Fed started cutting rates.

By the ‘90s and the mini-recession of 2001, monetary largesse had been so abused that the pop from easing did not appear as quickly. The chart below shows that in the previous two recessions, Continuing Jobless Claims trended sideways for several months before economic recovery commenced.

In the current environment, monetary policy has been in a record easing mode for over one year. It is reasonable to expect Continuing Jobless Claims to level off and trend sideways before recovery begins.

Until there is meaningful restructuring of the US economy, similar to what occurred under Reagan, the main economic stimulus will continue to be easy money and resultant asset bubbles. But as some of us realize, asset bubbles are ephemeral stimulants, like steroids or heroin, and produce worse problems later.