According to a survey of business economists, the recession in the U.S. “will probably end in the third quarter.”

Of course, these are the same folks who said there would not be a recession. Given their track record and ill informed opinions, we can safely ignore the noise that passes for their analysis. In its place, lets use a variety of readily available metrics that will provide a more objective measure.

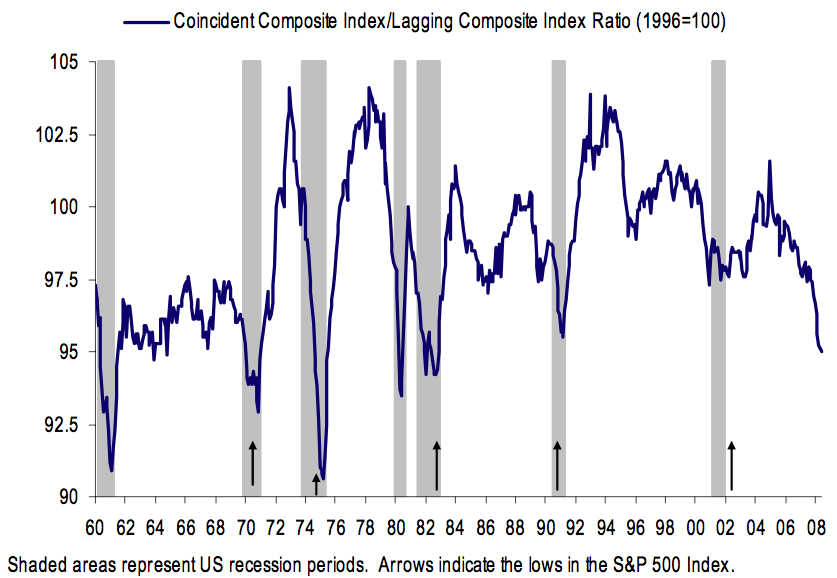

Let’s look at the Conference Board’s Leading Economic Indicators, the ECRI LEIs, and the Ratio of Coincident to Lagging Indicators. They imply sometime in the first half of 2010.

1) Conference Board’s Leading Economic Indicators: Historically, when we see the LEIs jump a full point (to 99 in April), that is a positive sign for the end of a recession. David Rosenberg, now Chief Economist & Strategist at Glusking Sheff, notes that going back to 1960, “the only times we have seen increases of this magnitude in recessions were at the very tail end of the downturns.” However, he warns that “even if the LEI has bottomed, it typically takes another six months for the recession to come to an end and that lag time has been known to be as long as 10 months.” Given the severity of this downturn relative to prior recessions, we are likely to be on the longer end of the range.

2) ECRI LEIs: The Economic Cycle Research Institute (ECRI) leading index has risen to -11.5% — that has been a significant point in past recessions. On average, it takes five months from the time this index hit -11.5% til we reach the end point of a recession. Again, the average can be misleading, and the range is what matters. In the past, the minimum was one month and the maximum was 12 months. Again, givent he depth of this recession, and then credit destruction it has had, expect the longer end of the range.

3) Ratio of Coincident to Lagging Indicators: The coincident-to-lagging ratio almost always bottoms at the lows in the S&P 500, usually within a 2 month range. Look at levels around 93 (range of 90.9 to 94.2).

The chart below is from Summer 2008; I will update it later today . . .

>

Coincident-to-lagging indicator in recession terrain

Chart via Haver Analytics, Merrill Lynch

>

Sources:

U.S. Recession May End Next Quarter, Business Economists Say

Shobhana Chandra

Bloomberg, May 27 2009

http://www.bloomberg.com/apps/news?pid=20601087&sid=a62f_EptgAT0&

What's been said:

Discussions found on the web: