>

We opined that the May Employment Report would be better than expected due to BLS B/D and other chicanery, and because it was necessary to fabricate a good report. We also said any rally on a ‘good’ NFP would be ephemeral because most people were set up for a better than expected report.

Part of the stock decline on Friday is due to that fact that enough people recognized that the report was hokey. There will be no job growth as long as the workweek in still contracting. In fact, businesses will not expand employment until well after the workweek moves significantly higher…Declining job cuts are a precursor of job growth but it does not guarantee job growth. Job losses cannot equal job growth.

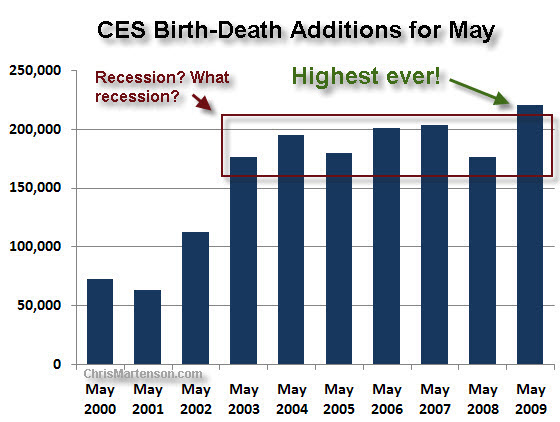

The BLS implausibly created 220k Net Birth/Death jobs, an increase of 44k from last year…The U6 jumped 0.6 to 16.4%..The civilian participation rate was about unchanged at 65.9%; the Employment-population ration at 59.7% continued to ebb…Manufacturing employment declined 156k…The workweek declined 0.1 hours…Earnings are unchanged…Education & healthcare jobs increased 44k.

Chris Martensen, in May Employment Report Not Believable, notes that the BLS added the most ever B/D jobs in May 2009, which is incredulous in the current environment. Yet most of the Street and financial media trumpet the report without performing any due diligence.

>

Source: Chris Martensen

>

Since January the absurd Birth/Death Model has created more jobs than in comparable 2008. This is incredulous! It appears that Team Obama is determined to be even more duplicitous with government economic statistics than prior administrations. Desperate times demand desperate measures.

After stocks declined sharply on Friday morning, Labor Secretary Solis said the rumor that the NFP data is an ‘error’ is false…It’s more a case of nonsense and duplicity – of faulty methodology that overstates job growth for political and other reasons.

If the economy is improving as many suggest the employment report indicates, why would commodities fall sharply on the better than expected NFP? Because the dollar surged. This validates the notion that the commodity rally had little to do with green shoots and everything to do with dollar debasement.

Associated Press: Temp work helps mask joblessness among Americans All told, nearly 25 million Americans were either unemployed, underemployed or had given up looking for a job in April.

The ranks of involuntary part-timers has increased by 4.9 million in the past year, according to a May study by the Federal Reserve Bank of Cleveland. Many economists now predict unemployment won’t peak until 2010. And since employers generally increase the hours of existing workers before hiring new ones, workers could be looking for full-time jobs for some time.

John Williams: May Jobs Loss Was About 538,000 Net of Biases versus 345,000 Official Decline – Birth-Death Model Upside Bias Increased by 27% – Annual Payroll Decline Deepened to 4.0% – SGS-Alternate Unemployment at 20.5%

The jobs report also reflected upward revisions to March and April reporting, but such were due largely to the gimmicked recasting of seasonal factors each month on top of slightly improved unadjusted data. The concurrent seasonal factor bias (CSFB) narrowed the reported jobs contraction by about 89,000, while the revamped birth-death model likely narrowed the contraction by at least another 104,000 (60,000 usual adjusted average plus 44,000 in new biases)….

There has been a shift in reporting patterns to show upside prior-period revisions in the establishment (payroll) survey, including upside changes to March reporting, which had been revised lower in April’s reporting (successive revisions for a given month usually continue in the same direction). This suggests that the BLS may have shifted internal reporting assumptions, with the effect of generating less-negative numbers. Assumptions include, for example, the handling of companies that fail to report payrolls in the current month (are they out of business or just late in handling paperwork?). There certainly has been a shift to the upside in terms of birth-death model assumptions…

John is making a point that most pundits miss. The BLS cannot sample firms that have closed or are in liquidation. So the BLS won’t show as many job losses until it reconfigures its sampling model.

This underscores a major fallacy in the ‘second derivative rally’ hype and hope. When companies disappear, they can no longer report job losses. The usual suspects then spin this as good news and a sign of economic recovery. But those companies will not report job gains either.

This is why most new bull market starts rather cautiously. Though data is showing a second derivative improvement, it does not guarantee job growth and economic growth. But these days, due to decades of inculcated bullishness, many people eagerly jumped to bullish conclusions without looking.

What's been said:

Discussions found on the web: