One of the primary reasons I am not a big believer in the green shoots thesis is due to the fragile financial condition of the Consumer.

Despite spending less time at the mall, throttling back consumption, and increasing their savings rate, the US consumer still finds themselves with too much debt and too little savings. Even worse (at least for the economy), they lack the income or the equity to fund their previous lifestyles.

In my opinion, consumer spending remains an unhealthy ~68% of the economy. While this is down from a peak of ~71%, it is way up from the 63% of the 1950s. The difference over that period has been the massive increase in revolving credit and accessible secure lending (2nd mortgages, HELOCs, etc.).

“Despite recent frugality, consumers have barely dented their debt load. The Federal Reserve will offer a fresh peek at that mountain on Thursday, when it releases its “flow of funds” data for the first quarter.

By the end of 2008, households were on the hook for $13.8 trillion in debt — nearly matching the $14.3 trillion output of the entire U.S. economy, not adjusted for inflation, that year.

Households are shedding debt; they’re just not doing it very quickly. They owed roughly 130% of disposable income at the end of 2008, down only slightly from a record 133% in the first quarter of 2008.”

I am not sure that really puts this into the proper context of indebtedness. Let’s go to David Rosenberg‘s recent charts on the same subject:

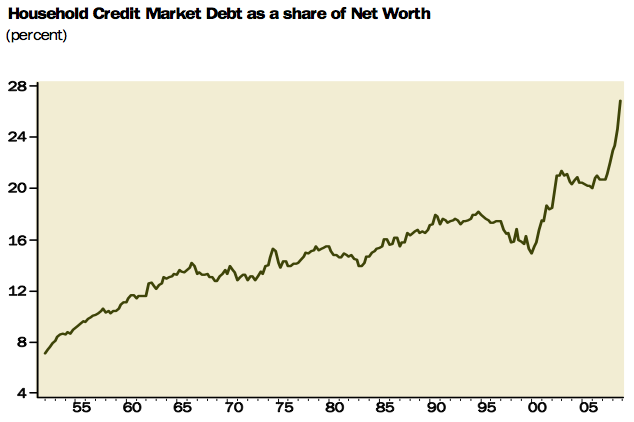

>

HOUSEHOLD DEBT-TO-NET WORTH AT AN ALL TIME HIGH

Source: Haver Analytics, Gluskin Sheff

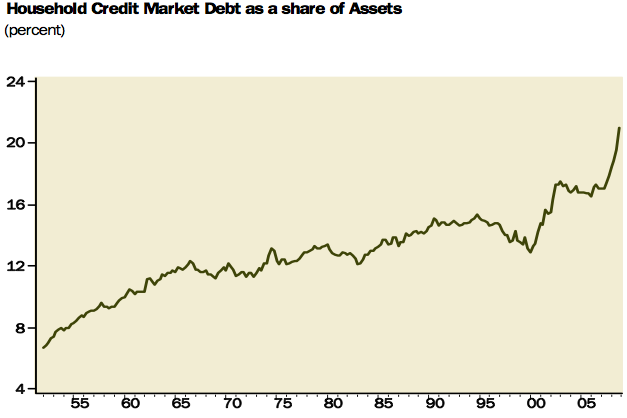

>

HOUSEHOLD DEBT-TO-ASSETS RATIO

Source: Haver Analytics, Gluskin Sheff

>

Other than the scales, these two charts look identical.

The bottom line remains: Two thirds of the economy is dependent upon consumer spending, Oil is now ~$70 a barrel (gasoline coming up on $3), and the consumer’s ability to borrow, tap equity, or otherwise live a profligate, unfunded lifestyle has been radically crimped.

>

Source:

G19 Consumer Credit

Federal Reserve, June 5, 2009

http://www.federalreserve.gov/releases/g19/Current/

(will be moved here eventually)

http://www.federalreserve.gov/releases/g19/20090605/

On Borrowed Time: Consumer-Led Recovery

MARK GONGLOFF

WSJ, June 9, 2009

http://online.wsj.com/article/SB124449816432295655.html

What's been said:

Discussions found on the web: