See, I say one nice thing about Housing, and I am immediately proven wrong.(heh)

Tim Iacono of The Mess That Greenspan Made points out that although the data showed the first monthly increase in three years, we should be wary of reading too much into the data this time of the year.

Why? Seasonal Adjustments wreak havoc with Case Shiller’s Index:

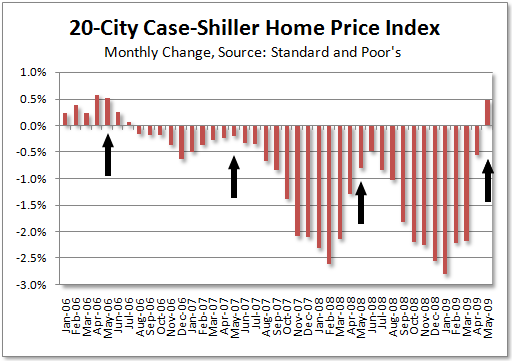

From April to May, the 20-city index rose 0.5 percent while the 10-city index rose 0.4 percent, however, you can see in the chart below that there is a strong seasonal component to the data, monthly price changes improving around this time of the year regularly – look for more of the same in next month’s report.

Bill at CR notes that “Seasonally adjusted, prices fell in 12 of the 20 Case Shiller cities.”

As always, the chart is revealing:

>

Seasonal Adjustments

Source: The Mess That Greenspan Made

>

See also: Case-Shiller House Price Seasonal Adjustment and Comparison to Stress Tests

What's been said:

Discussions found on the web: