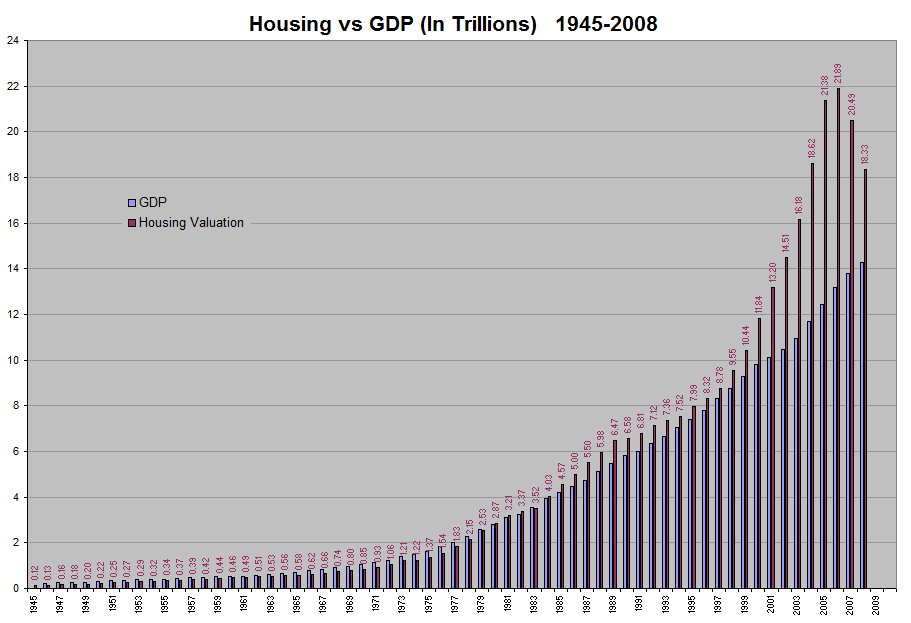

Housing Bubble Bust has this outstanding chart of Housing versus GDP going all the back to 1945.

Note the two began to diverge in 1999 — my experiences then were what we used to call smart money in the late 1990s were taking some stock winnings off of the table and diversifying then into a different asset class – namely, Real Estate.

My observations of this phenomena (at least in NY) was this rotation was less financial wealth planning and more lifestyle upgrade.

>

What's been said:

Discussions found on the web: