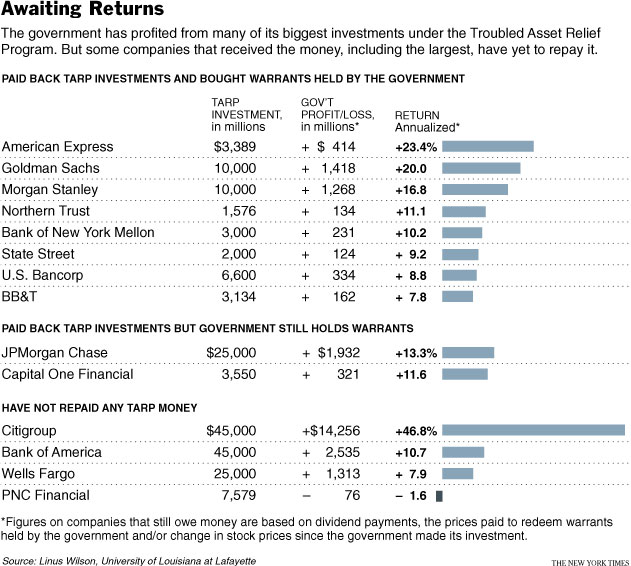

“The government has taken profits of about $1.4 billion on its investment in Goldman Sachs, $1.3 billion on Morgan Stanley and $414 million on American Express. The five other banks that repaid the government — Northern Trust, Bank of New York Mellon, State Street, U.S. Bancorp and BB&T — each brought in $100 million to $334 million in profit.”

–New York Times

>

My definition of an investment profit is simple: You take the money you have invested, and if adds up to more that what you began with, well, then, you have a profit.

Let’s say on the other hand, you own 20+30 positions; 5 of them are higher than where you purchased them, and all the rest deeply in the red. Net net, your portfolio is down immensely. Most rational investors would hardly call that investment a “profit.”

Looking just at early TARP repayments means that we are ignoring a) the rest of the TARP; and b) the majority of other expenses, guarantees, loans capital injections, and outright spending that has taken place.

Perhaps the rookies are manning the terminals, with the senior people away on vacation. That would explain the inexplicably clueless headline over at the NYT this morning: As Big Banks Repay Bailout Money, U.S. Sees a Profit.

Excerpt:

“Nearly a year after the federal rescue of the nation’s biggest banks, taxpayers have begun seeing profits from the hundreds of billions of dollars in aid that many critics thought might never be seen again.

The profits, collected from eight of the biggest banks that have fully repaid their obligations to the government, come to about $4 billion, or the equivalent of about 15 percent annually, according to calculations compiled for The New York Times.”

Now, by any traditional measure of profits, you include all of the costs incurred against the total revenue, to determine if there is a net gain (or loss). This simple mathematical analysis of what a profit is — Are we up or down? — seems to have eluded the headline writers.

At least the author makes mention of how tenuous the usage of that word is the article’s body:

“These early returns are by no means a full accounting of the huge financial rescue undertaken by the federal government last year to stabilize teetering banks and other companies.

The government still faces potentially huge long-term losses from its bailouts of the insurance giant American International Group, the mortgage finance companies Fannie Mae and Freddie Mac, and the automakers General Motors and Chrysler. The Treasury Department could also take a hit from its guarantees on billions of dollars of toxic mortgages.”

What this is more appropriately described as is a return of capital; to call this a profit is to ignore trillions of dollars in taxpayer monies that have been spent, lent, guaranteed, drawn against and otherwise consumed in what will likely be the greatest transfer of wealth in the planet’s history.

>

click for larger graphic

>

Source:

As Big Banks Repay Bailout Money, U.S. Sees a Profit

ZACHERY KOUWE

NYT August 30, 2009

http://www.nytimes.com/2009/08/31/business/economy/31taxpayer.html

See also:

Is TARP Profitable?

Daniel Gross

Slate, Aug. 28, 2009

http://www.slate.com/id/2226517/

What's been said:

Discussions found on the web: