Two weeks ago, I noted that the Great Recession was over, but we still had to deal with the ongoing “ordinary” recession.

Today’s data confirms that view.

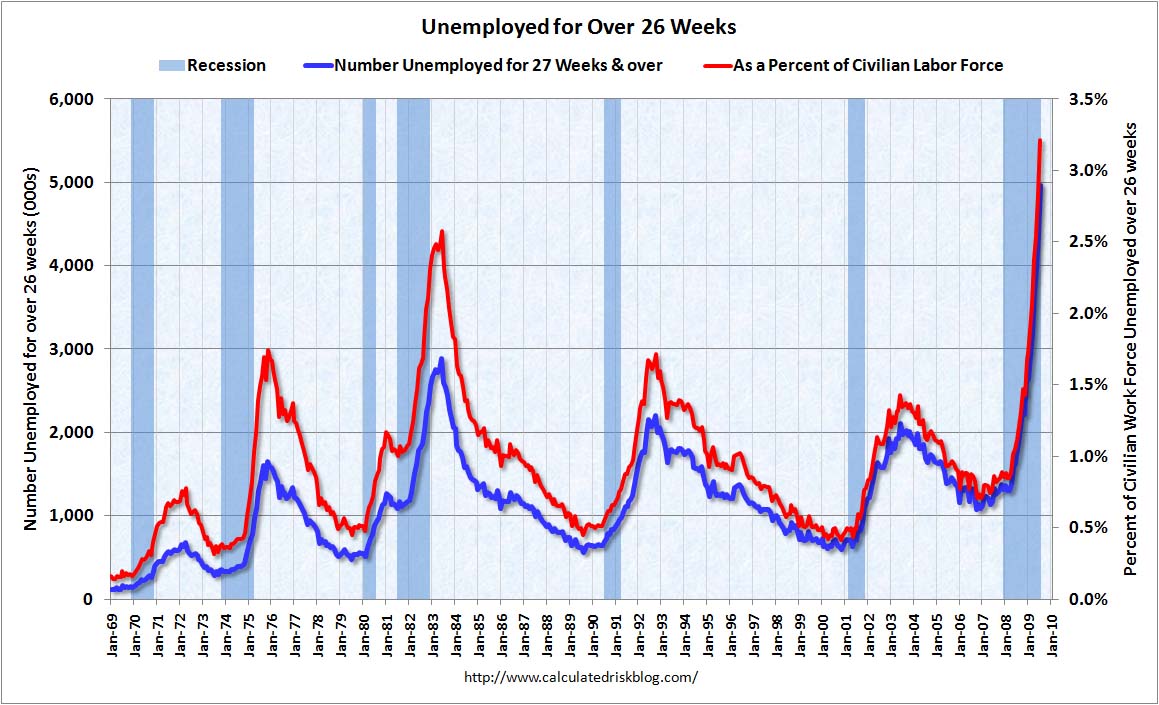

Initial Claims were much weaker than the green shoots crowd expected; Continuing Claims are falling as exhaustees drop off the rolls of Unemployment Insurance (see chart below). And the 90% of the labor pool that does have jobs have seen no gains in income for over a decade now. In Real Inflation adjusted terms, these consumers are worse off — much worse off the lower you go down the pay scale — then they were 10 years ago.

No job, no Unemployment insurance, no money — what might that do to spending?

Take a wild guess.

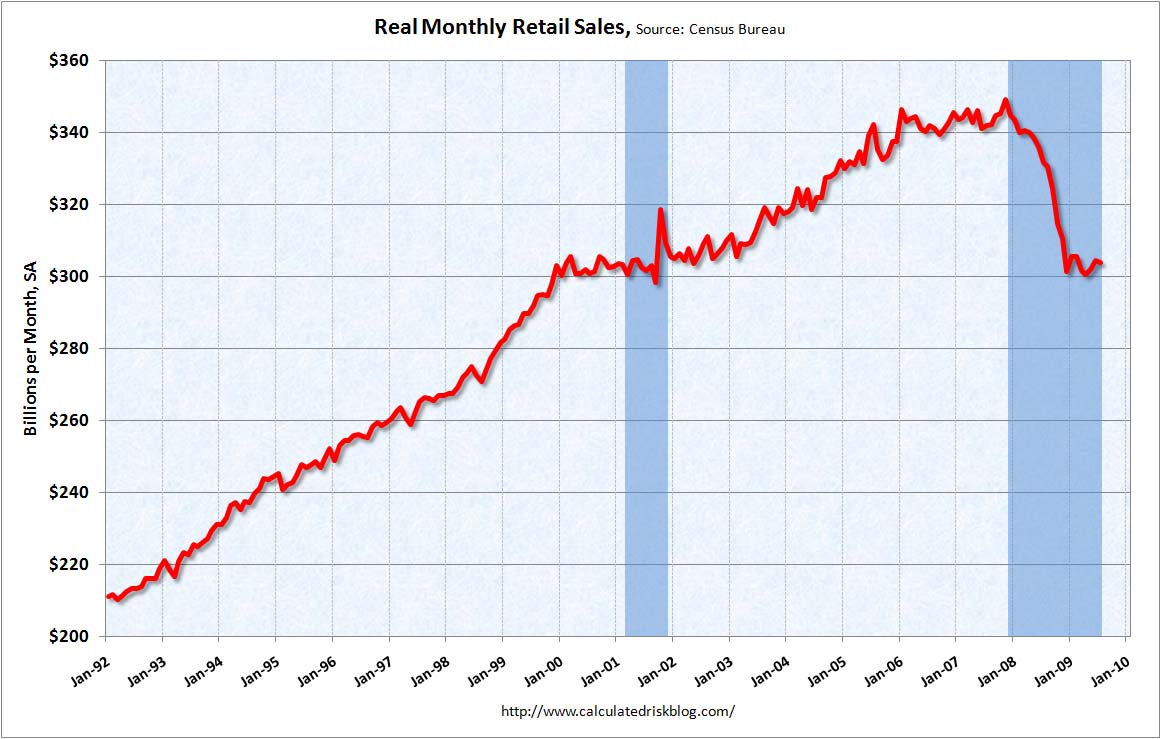

Despite the government “Cash for Clunkers” billion dollar giveaway, Retail Sales still fell. Consensus was expected to be 0.8%, and instead we saw a negative 0.1%. Ex-Autos it Retail Sales fell 0.6%. (see chart below)

Consumers continue to save versus spend. As a group, they are shell shocked from the twin asset collapses (Housing and Equity). Keep in mind that typical middle class family has much more of their net worth tied up in their home than in their stock portfolios/401ks.

Those folks looking for a fast 2001 snapback in Retail Sales are going to be sorely disappointed.

>

Long Term Unemployed Continues to Rise

click for larger chart

chart courtesy of Calculated Risk

Retail Sales Remain Punk

click for larger chart

chart courtesy of Calculated Risk

>

Previously:

The Great Recession is Over! Long Live the Ordinary Recession… (July 31st, 2009) http://www.ritholtz.com/blog/2009/07/great-recession-over-long-live-ordinary-recession/

Sources:

ADVANCE MONTHLY SALES FOR RETAIL AND FOOD SERVICES July 2009

The U.S. Census Bureau, August 13, 2009

http://www.census.gov/retail/marts/www/marts_current.pdf

UNEMPLOYMENT INSURANCE WEEKLY CLAIMS REPORT

EMPLOYMENT AND TRAINING ADMINISTRATION

U.S. Department of Labor, August 13, 2009

http://www.workforcesecurity.doleta.gov/press/2009/081309.asp

What's been said:

Discussions found on the web: