>

Is Bernanke purposely aiding & abetting the usual market manipulation that occurs during expiration

week? In July, Ben poured $80.2B into the system, mostly by monetizing MBS, during expiration week, igniting a huge rally. The Fed balance sheet contracted for most of June and July before Ben’s gambit.

For the week ended Wednesday, Ben increased the Fed balance sheet $46.157B. Ben monetized

$66.646B MBS this time.

Retailers report worse than expected sales. LEI, Jobless Claims, both Initial & Continuing Claims, are

worse than expected. But the Philly Fed, which is opinion not fact, is better than expected. So traders buy stocks…The last time the Philly Fed was positive was Sept 2008 – just before the collapse.

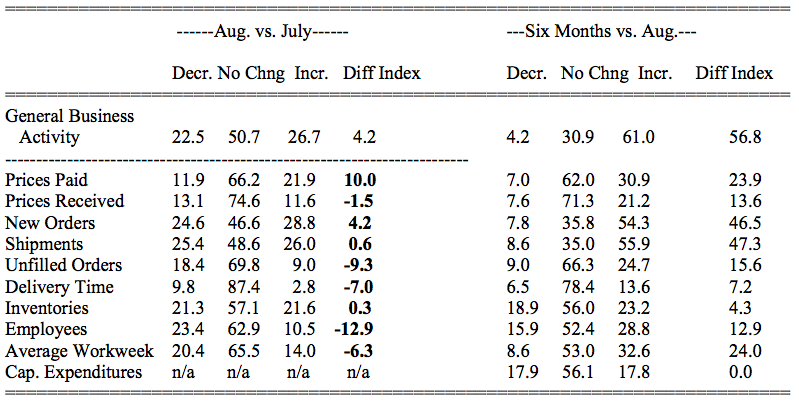

Only two non-price components increased: New Orders (4.2) & Shipments (0.2). The most important, the most telling components are employees, which declined 12.9 and workweek, which declined 6.3. BTW, if prices paid increased 10 and price received declined 1.5, your profits are being squeezed!

Why is the Philly Fed Index reading at 4.2 the same reading as New Orders (4.2) and all the negative readings (Unfilled Orders -9.3, Delivery Time -7.0, Employees -12.9 and Workweek -6.3) somehow are negated by a 0.6 increase in Shipments and a 0.3 increase in inventories?

The Philly Fed: Indexes for general activity, new orders, and shipments all registered slightly positive

readings this month. Although firms reported continued declines in employment and work hours this

month, losses were not as widespread. Most of the survey’s broad indicators of future activity continued to suggest that the region’s manufacturing executives expect business activity to increase over the next six months.

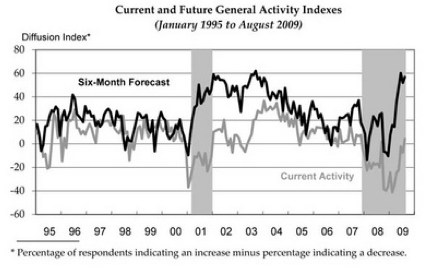

Furthermore, the Philly Fed Survey shows future expectations [6-month forecast] are soaring – just like consumer confidence did several months ago! Consumers are rescinding those expectations now…Please note that the six-month forecast jumped in both mid-2007 and mid-2008. How’d that work out?… How does the Philly Fed account for firms that can’t be surveyed because they have disappeared?

So once again we are given ‘statistical evidence’ of recovery but jobs, the key determinant of income, remain weak or deteriorate. And politicians are surprised at the populace’s anger!?!?

When either Initial or Continuing Jobless Claims fall, the usual suspects stridently proclaim recovery. When Claims increase or the previous week is revised lower, which occurred again, they are mum.

What's been said:

Discussions found on the web: