Last week, Zero Hedge published Nielsen ratings on CNBC.

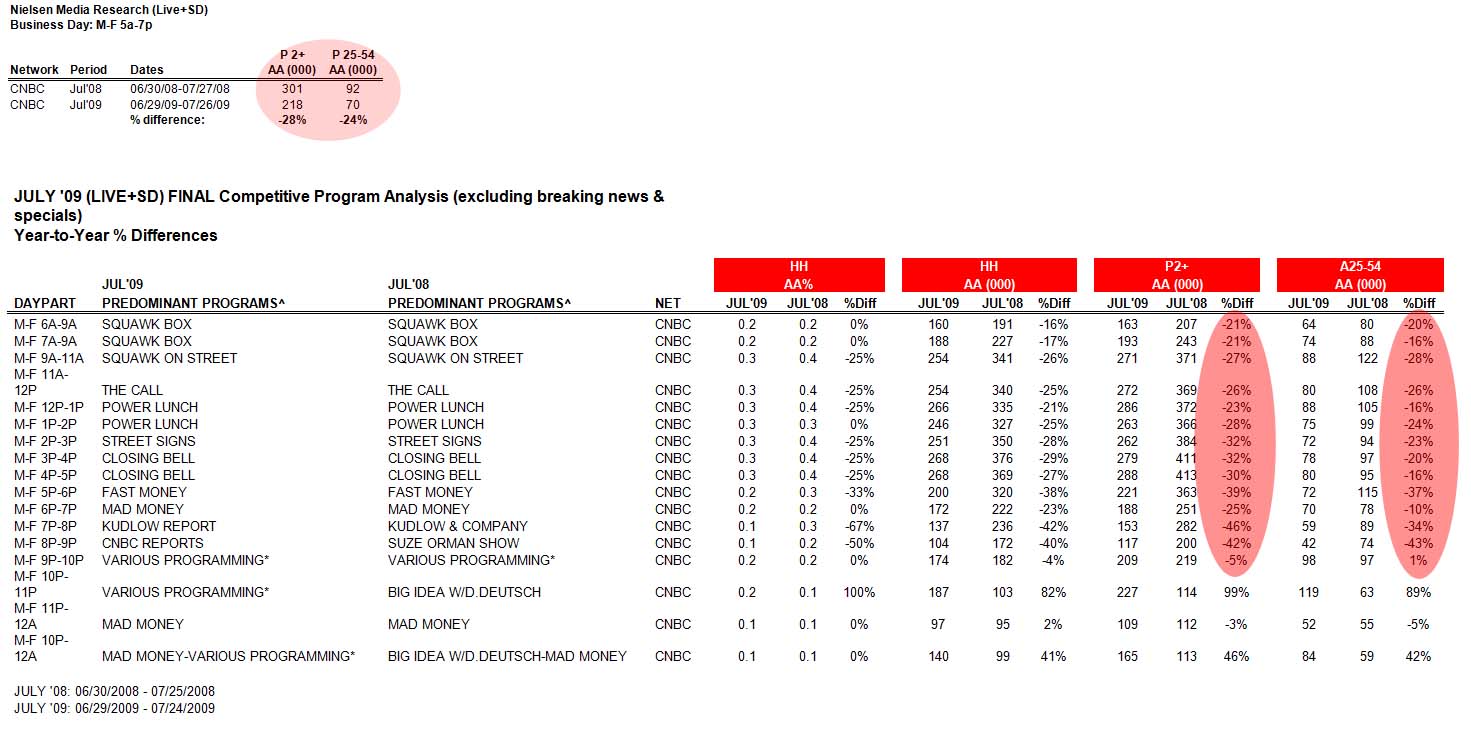

The ratings were, in a word, abysmal. Across the cable network, viewership was down 28% year over year, with some shows down as much as 46%.

In my opinion, these ratings are more or less meaningless. They are not proof of bias or bad programming choices or other assertions. CNBC is a media venue that has surprisingly little control over its own fate. While network executives can occasionally make things better or worse via programming and staffing choices, the tidal wave of forces that ultimately determine the bulk of viewers is in reality far beyond their control.

Think Weather Channel or ESPN rather than NBC or HBO.

To better understand this, let’s look at the history of CNBC. This reveals the cable channel to have run through several distinct eras — 4 historical phases. It is apparent that various externalities — the economy, markets, volatility and major events — have determined the majority of changes in viewership and ratings — and not personalities or shows.

1) Phase one: Pre-history 1990-94: The channel we know today as CNBC was formed when its parent company, NBC Universal, acquired the Financial News Network in 1991. FNN was *merged into what was then known as “Consumer News and Business Channel.”

In its early days, FNN was mostly watched by professionals. While some civilians occasionally wandered onto the channel, it was primarily a staple of trading desks, brokerage firms, and professionals who wanted to a fast update of economic news, government data and breaking M&A stories. Viewer ship was modest, but had very good demographics — high income, high education, etc.

2) Phase two: Roaring Bull Market: 1995-2000: The channel grew as the 1990s bull market accelerated, especially in the second half of the decade. IPOs, mergers and thing technology related received significant coverage. Rating continued to climb along with the market.

The late 1990s were the days of wine and roses for the channel. As stocks became like sports teams rooted on by mom and pop. More members of the non professional investing public became regular viewers. During the irrational exuberance era, CNBC was everywhere. Gyms, bars, restaurants, any public place you went into that had a TV — even sports bars! — had the ticker strewn channel running in the background.

CNBC cut a **deal with Dow Jones. Analysts like Mary Meeker, Jack Grubman and Henry Blodget had become rock stars. Perma-bulls such as Abby Joseph Cohen and Joe Battapaglia dominated the airwaves and were frequent guests. Some critics lamented the relentless cheerleading — Bill Fleckenstein dubbed the channel “Bubble Vision” — as ratings rose with the bull market.***

3) Phase three: Bear Market/Nasdaq: 2001-05: Alas, he that lives by the sword dies by the sword. The 78% peak to trough collapse in the Nasdaq saw ratings tumble nearly as much — by some accounts, they fell nearly two thirds. Merrill Lynch banned the channel from its offices.

Viewers left in droves. Tech Stocks were no longer fodder for cocktail party conversations; Replaced with Commodities and of course Real Estate. CNBC’s loss was HGTV’s gain — Home & Garden channel’s ratings rallied with housing market.

4) Phase four: Crisis & Collapse: 2008-09: Starting with the fall of Bear Stearn’s in March 2008, CNBC viewership spiked. By August, you could smell the leading edge of the coming shitstorm in the air. When all Hell broke loose in September, the channel saw record ratings. These continued as the market gyrated and a new company seemed to collapse every weekend. Fannie Mae and Freddie Mac, Lehman, AIG, Citigroup, BofA, Merrill, etc.

Note that the homebuilders and banking stocks peaked out much earlier. I have yet to run a correlation study on ratings as these sectors became their secular collapse. One would imagine it might be interesting to see if the rising market offset those.

That is an abbreviated version of CNBC’s history, grossly oversimplified. The forces that aligned to drive market and economy are significant secular changes. They impacted viewership dramatically.

Slate (and Newsweek’s) Dan Gross wondered if the channel’s recent tilt to the right might be out of sync with the nation’s recent rejection of Republican rule, but I doubt it. Market performance and volatility are the usual drivers of ratings. And extraordinary events such as scandals, corporate collapses and unusual government bailouts were the cream in their coffee this time around.

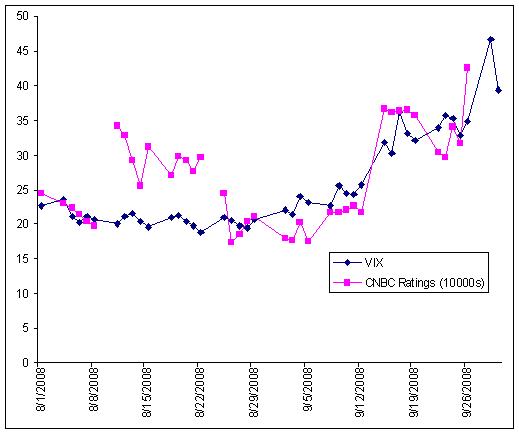

Indeed, those two factors seem to be the keys: Under ordinary bull and bear markets, CNBC ratings are likely to rise and fall with the stock market. That was the conclusion of phases two and three above. However, when we encounter periods of extraordinary events, CNBC ratings are correlated to Volatility.

If you think of CNBC as a single purpose channel — like ESPN or the Weather Channel — this makes sense. During playoffs and other big sporting events, ESPN traffic (including its website) rises. Wild weather sends more people over to the Weather Channel than usual to see the latest update.

Imagine a very unusual weather season, with a different hurricane making landfall and causing billions in destruction every week. That would sure wonders for the Weather Channel’s ratings.

Now consider the same scenario, only instead of naming these hurricanes Andrew or Hugo or Camille or Katrina, we called them Bear Stearns and Fannie Mae and Lehman Brothers and AIG and Citigroup. If you were the designated franchise that covered these firms, what might this storm do for your viewership?

Exactly . . .

~~~

No discussion of CNBC ratings would be complete without mentioning the feud between Jon Stewart and Jim Cramer. There are some claims that the regular evisceration of CNBC by The Daily Show’s Jon Stewart is what did in the network, but I doubt it. While publishing insiders have told me they damaged Jim Cramer’s book sales, I doubt it had much to do with the network.

The beginning of the end of our 4th phase was the March 9th lows. While the economy is not yet out of the woods, the panic portion of the crisis seems to be over. That is likely not good for retaining those marginal viewers who tuned in just to see what the latest crisis update was.

So while network execs can move pieces around the board, play with formats and anchors, they seem to be making some differences around the margins. They can attract viewers and fight against Bloomberg TV and Fox Business, but the giant forces, the huge stories beyond everyone’s control are what generates monster ratings. Just so long as they retain the status as “designated go to franchise” for business news. Beyond that, rating changes seem to be incremental.

What’s true for equities also seems to apply to television stations: Everyone is a genius in a bull market.

>

Source: The Last Psychiatrist

>

click for ginormous table

Source: Zero Hedge

>

Previously:

How to Fix Financial Television (June 8th, 2009)

http://www.ritholtz.com/blog/2009/06/how-to-fix-financial-television/

Daily Show vs CNBC (March 5th, 2009)

http://www.ritholtz.com/blog/2009/03/daily-show-vs-cnbc/

Anti-Climax: Cramer vs. Stewart (March 13th, 2009)

http://www.ritholtz.com/blog/2009/03/anti-climax-cramer-vs-stewart/

The Power of “The Daily Show” (April 23rd, 2009)

http://www.ritholtz.com/blog/2009/04/the-power-of-tds/

Sources:

CNBC feels your pain…… And your anxiety, and your greed, and your outrage, and your optimism. And by tapping into your emotions about the market, the channel is cashing in

Jessi Hempel

Fortune, APRIL 3, 2008:

http://money.cnn.com/2008/03/31/news/companies/cnbc_pain.fortune/?postversion=2008033112

Why You’ve Stopped Watching CNBC

Explaining the ratings decline at the financial-news network

Daniel Gross

Slate Aug. 4, 2009

http://www.slate.com/id/2224257/

CNBC Ratings Seem Correlated To Future Market Volatility

SEPTEMBER 30, 2008

http://thelastpsychiatrist.com/2008/09/cnbc_ratings_correlated_to_mar.html

Why did CNBC slump in July?

Jonathan Berr

Media World: Aug 4th 2009 at 5:00PM

http://www.dailyfinance.com/2009/08/04/media-world-why-did-cnbc-slump-in-july/

Additional Readings:

CNBC on a road bound for revamps: Net takes care of business

MICHAEL LEARMONTH

Feb. 7, 2005

http://www.variety.com/article/VR1117917550.html?categoryid=1237&cs=1

Wald Boosts Business at CNBC

Former Today executive producer offers “industrial-strength personal finance”

Joel Topcik

Broadcasting & Cable, 9/17/2006

http://www.broadcastingcable.com/article/105811-Wald_Boosts_Business_at_CNBC.php

The Revolution Will Be Televised (on CNBC)

CHARLES FISHMAN

Fasts Company, Dec 19, 2007

http://www.fastcompany.com/magazine/35/cnbc.html

An Open Letter to CNBC

Wistar Holt

Safe Haven, July 30, 2004

http://www.safehaven.com/showarticle.cfm?id=1808&pv=1

_______________

* CNBC (“Consumer News and Business Channel”) parent company acquired the Financial News Network in 1991. FNN grew throughout the 1990s, as the bull market quickened.

•• 1997, CNBC formed a strategic alliance with Dow Jones

*** Wikipedia notes: During the late 1990s and early 2000s, CNBC’s ratings were increasing sharply along with the stock market, often beating those of CNN during market hours. In 2000, daytime viewership of the network peaked at 343,000, around the time the Nasdaq Composite crossed 5000. However, when the dot-com bubble began to burst later that year, CNBC’s viewing figures declined in tandem. The network’s ratings steadily fell quarter after quarter, year after year, until bottoming in Q1 2005, with an average viewership of 134,000 during the day. From the bottom, the network, along with the markets, rebounded significantly—average daytime viewership (6 am to 6 pm) reached a 7-year high of 310,000 viewers in the first quarter of 2008.

What's been said:

Discussions found on the web: