A few additional thoughts on Housing:

1) The hottest markets are where foreclosures have driven prices down 50% or greater;

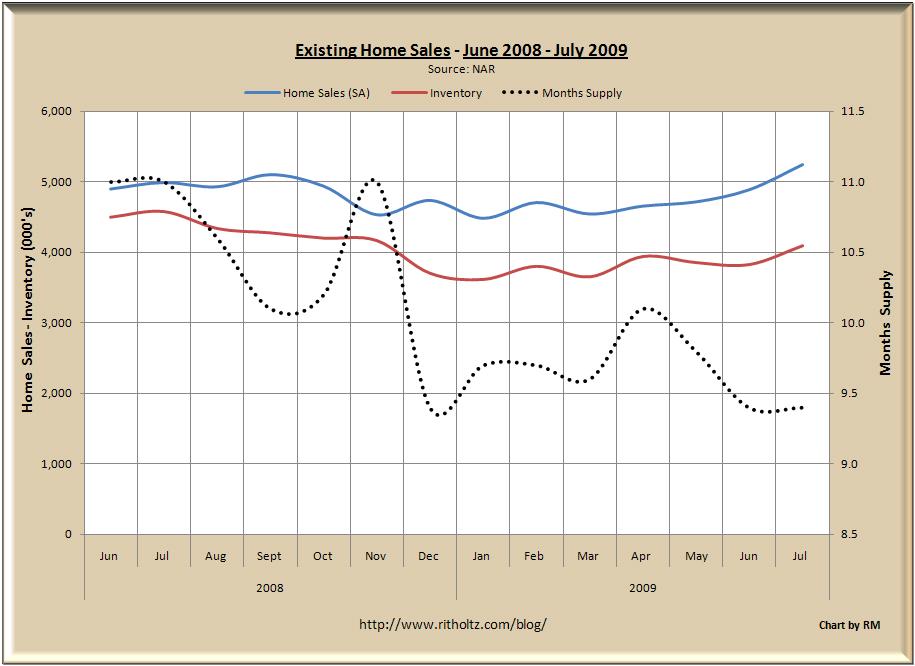

2) Inventory remains significantly elevated — its closer to 10 months than historic averages of 5-6 months;

3) Mortgage rates are at unusually low levels — despite this, sales remain generally soft;

4) Prices remain elevated by historic norms;

5) Big increase on the low end — Starter homes and Condos — are moving units; The middle and larger (jumbo mortgages) are a vast wasteland; But for the 16k increase in condo sales in the NorthEast, monthly sales would have been negative;

6) Indeed, on a NON-seasonally adjusted basis, [but for that 16k condo bump] National existing home sales were up a mere 12k units year over year.

7) Lots of “shadow” inventory is waiting to come on the market once prices improve; These were specs, vacation property, etc that got caught when the market collapsed — they are renting them out or they are vacant.

Finally, have this last look at the details of sales and inventory over the past 13 months:

>

What's been said:

Discussions found on the web: