Despite most of the economics profession declaring the recession over — I think they are premature — I got into an interesting debate with Mish last night over the state of the economy.

I have been calling this the “Great Recession,” and suggested the worst of it is over, and we are now in a not-so-great, ordinary recession. Mish believes we are in something far worse: A Depression (See Depression Debate – Is this a Depression?)

In an email exchange, Mish expanded his thinking:

“I believe we are in a depression.

Prior to the “Great Depression” the word recession did not even exist. I do not know where the dividing line is, I just know we are over it.

If that sounds strange, note the NBER does not have a formal definition for recession. Some people get together and decide when it started and when it ended, based on many factors of unknown and probably varying weight. Recessions are not based on two quarters of negative growth as many people think.

To say we are in a depression one needs to look at a lot of factors and I certainly mentioned them. Note that we can have “a depression” even if it does not match “the great depression”.

There are just too many parallels to things that happened in the 30’s in regards to housing, credit, the stock market, jobs, treasury yields, etc etc etc that “recessions” since then did not have.

Treasury yields and consumer spending might easily be deciding factors. The Fed’s reaction is another difference. This is certainly not like the stagflations in the 70’s and 80’s at all. And it differs from the 2001 recession in that consumers threw in the towel.

So it’s not just a case of being more severe, there are numerous parallels in play that do not match prior recessions.”

I have a few minor quibbles with some of his comments, but for the most part, we essentially agree that 1) This was a very severe economic downturn; 2) Some things are very parallel to 1929-39 era.

Our disagreements? Well, the NBER includes a definition of a recession every time they formally announce one. Here is the December 2008 Business Cycle Dating Committee statement:

“A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators. A recession begins when the economy reaches a peak of activity and ends when the economy reaches its trough. Between trough and peak, the economy is in an expansion.”

On the other hand, I know of no widely recognized definition of what a Depression is.

Let’s look beyond that. While we can find some obvious parallels between the Great Depression and the Great Recession, there are also some enormous differences. Looking at the current contraction versus the 1930s, we note several very significant factors that distinguish the two eras: The safety net of unemployment insurance, FDIC bank deposit guarantees, Medicaid, food stamps, Social Security, etc. that exist today. The USA safety net may not be ideal, but it is far better than what existed during the 1930s. That alone has made this contraction quantitatively different in terms of Human misery than the 1930s.

OK, this recession is far less miserable than the 1930s. What of the economic data, the specifics from that era?

Consider:

• From its 1929 peak to the ultimate low in 1932, the Dow Jones Industrial Average fell 89% versus 43% for the 2008 collapse — literally, the Depression was 2X worse;

• In the 1920s and ’30s, Mortgages were interest only, 3 (or 5) year financings, with a balloon payment at the end. No balloon payment, or rollover of credit, you lost the house.

• Credit disappeared after the crash — and defaults skyrocketed. Foreclosures may be high today at a rate of 1 per 81 homes with a mortgage, but they are nowhere near the 1 in 4 homes with a mortgage that defaulted or could not roll over their loans;

• I haven’t come across reliable data as to how much home sales dropped and prices fell, but with a 25% foreclosure rate and credit nonexistent, it is probable that, like the stock market, it was far worse than the current housing collapse;

• Manufacturing output took production in the 1930s back to the lowest levels since 1901, almost a third of a century earlier;

• Consider the steel industry: Production dropped 75% drop from its pre-crash peak (1929), cascading from more than 63 million net tons of ingot iron in 1929 to barely 15 million tons produced in 1932.

• Bethlehem Steel, which had been at 90% capacity in ’29, was operating at 13% of capacity by 1932. Other than securitizing mortgages, underwriting derivatives and/or credit default swaps, can you name any major company or industry that saw this sort of collapse today?

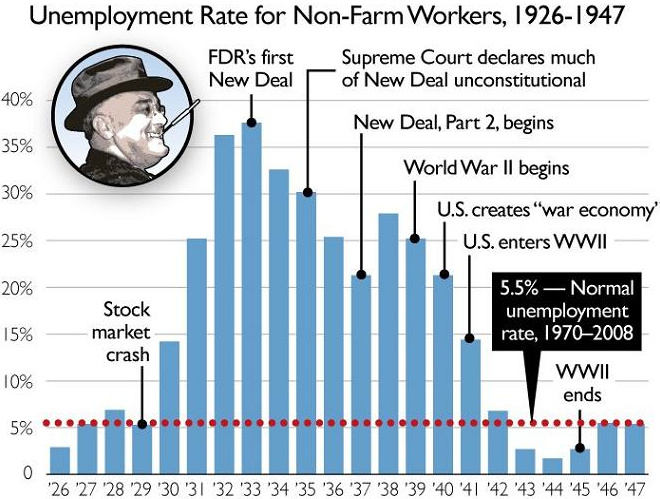

• Any measure of unemployment — U3 at ~10% or U6 ~17% — is far below the 1930’s one in four adult males unable to fund work. (See chart below)

• Producer prices (PPI index) didn’t fall single digits — it utterly collapsed in the 1930s, far worse than today.

During the Great Depression, the U.S. economy simply collapsed into shambles. Lenders faced heavy investment losses, communities were unable to collect property taxes, the construction industry was all but frozen. Unemployment rates ran over 25 percent. Industrial capacity plummeted. Municipalities were badly in need of funds. The automobile industry ground to a full halt. During the worst of the Depression, one in five homes was in danger of

foreclosure.

Even the worst of the complex difficulties of the 2008–2009 credit crunch and housing recession were mere sun showers compared to the financial hurricane of the Depression era: Banks have f ailed, but the FDIC’s guarantees have prevented widespread panic. Unemployment has risen, but f ar below the worst levels of the 1930s. And the two million or so foreclosures over recent years are f ar less, on a percentage basis, than the nearly 20 percent foreclosure rate in the 1930s.

In short, while the broad economy circa early 2009 is ugly, it remains far healthier than during the Great Depression — by just about every measure, and in many cases, by orders of magnitudes.

Have a look at this chart. It shows not just underemployment (full time workers who could only find part time jobs) but shows that at the peak, over 35% of workers were unemployed.

>

What's been said:

Discussions found on the web: