One of the oddities of the current rally is that Futures before the open seem to have little correlation with closing prices.

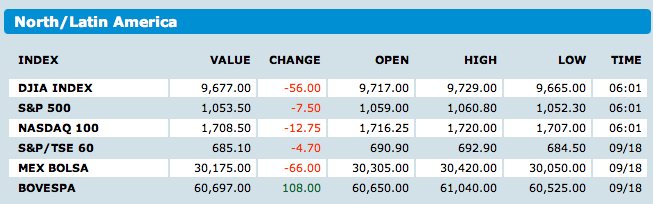

Today, we see futes are pretty ugly. Yet its hard to guess where we will close.

Bill King likes to point out that after a Quad Expiration like we had on Friday, the option pressure dissipates. That suggests the market will have a more difficult time making up the opening gap down.

What's been said:

Discussions found on the web: