Paul Kedrosky directs us to a recent study by Moody’s (of all folks) that looks at that precise question: When will collapsed U.S. real estate prices regain their prior peaks?

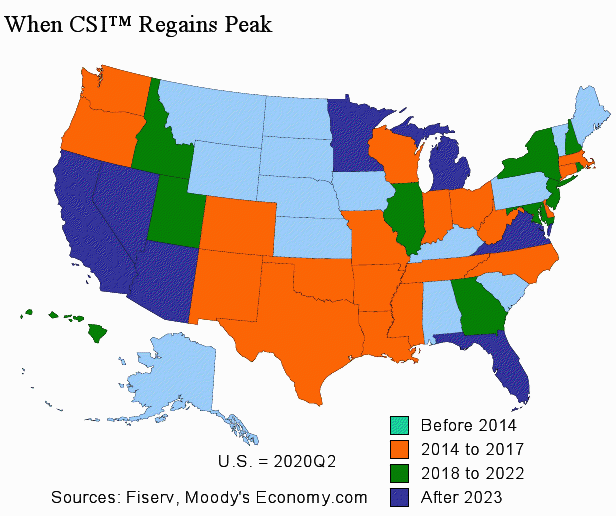

The map below suggests 2020 as the year nationwide — and while on the pessimistic side, that might not be too far off. Note the wide regional disparities.

>

>

Paul cites other data (not on the map) that according to Moody’s, California, Arizona and Florida won’t fully recover until (brace yourselves) early 2030:

Hard-hit states such as Florida and California will only regain their pre-bust peak in the early 2030s, well after the nation does. New York will also be a laggard, although its overall decline in prices will be less severe. The main constraint on New York’s outlook is Wall Street. In general, the length of the downturn and the length of recovery in a region will depend on the degree of aggressive lending or overinvestment in housing that occurred during the boom. On the recovery side, states with weaker job growth will also take longer to return to peak.

Moody’s may not be the best analysts of this data, given their past track record. Regardless, I would take the other side of that bet . . .

What's been said:

Discussions found on the web: