>

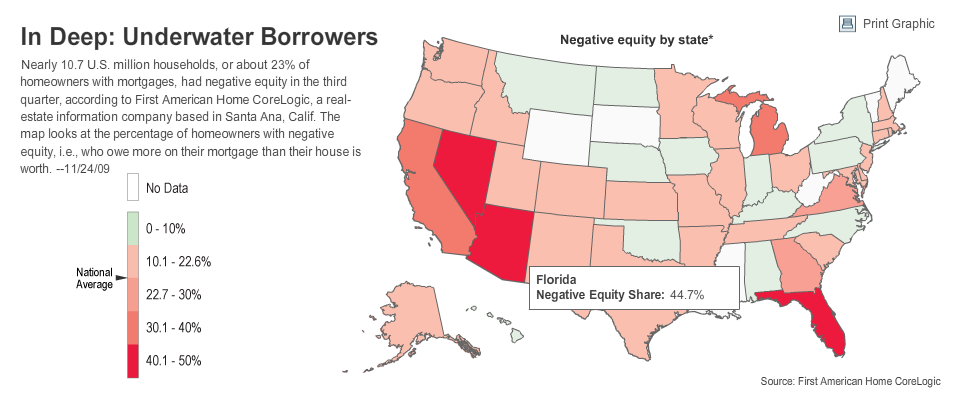

Here’s a stat to wake you up this morning: 23% of all mortgage borrowers in the US are underwater:

“The proportion of U.S. homeowners who owe more on their mortgages than the properties are worth has swelled to about 23%, threatening prospects for a sustained housing recovery.

Nearly 10.7 million households had negative equity in their homes in the third quarter, according to First American CoreLogic, a real-estate information company based in Santa Ana, Calif.

These so-called underwater mortgages pose a roadblock to a housing recovery because the properties are more likely to fall into bank foreclosure and get dumped into an already saturated market. Economists from J.P. Morgan Chase & Co. said Monday they didn’t expect U.S. home prices to hit bottom until early 2011, citing the prospect of oversupply.”

There are 5.3 million U.S. households with mortgages at least 20% higher than the home’s value. And it gets worse, depending upon the vintage of the mortgage.

During the boom, appreciably worse: Of those who took out mortgages at the 2006 peak, more than 40% are under water.

>

Source:

1 in 4 Borrowers Under Water

RUTH SIMON and JAMES R. HAGERTY

WSJ, NOVEMBER 24, 2009

http://online.wsj.com/article/SB125903489722661849.html

What's been said:

Discussions found on the web: