“The Securities and Exchange Commission should be very interested in any financial company that secretly decides a financial product is a loser and then goes out and actively markets that product or very similar products to unsuspecting customers without disclosing its true opinion. This is fraud and should be prosecuted.”

-Laurence Kotlikoff, a Boston University economics professor

>

McClatchy has a huge and sobering piece of investigation into Goldman Sachs.

The product of a five-month investigation, it is a damning indictment of how Wall Street is riddled with conflicts of interest. Even after GS concluded the housing bubble would burst, it continued to sell billions of dollars in shaky securities tied to subprime mortgages to pension funds, insurance companies and other investors — while simultaneously betting these same instruments would collapse:

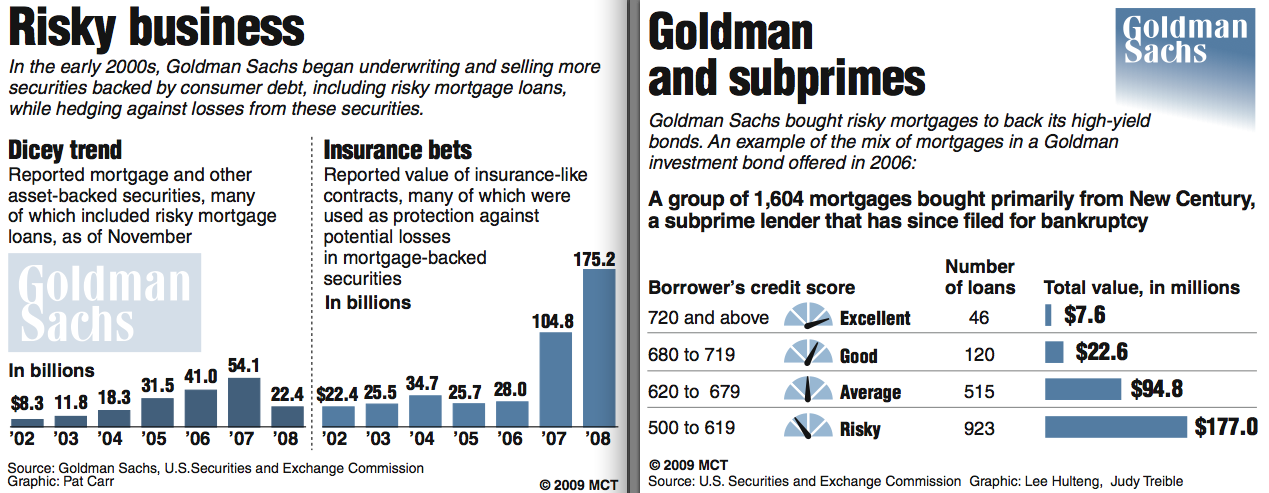

“In 2006 and 2007, Goldman Sachs Group peddled more than $40 billion in securities backed by at least 200,000 risky home mortgages, but never told the buyers it was secretly betting that a sharp drop in U.S. housing prices would send the value of those securities plummeting.

Goldman’s sales and its clandestine wagers, completed at the brink of the housing market meltdown, enabled the nation’s premier investment bank to pass most of its potential losses to others before a flood of mortgage defaults staggered the U.S. and global economies.

Only later did investors discover that what Goldman had promoted as triple-A rated investments were closer to junk.”

That much is well known; Where McClatchy’s inquiry focused investigation into Goldman Sachs was how the firm:

• Bought and converted into high-yield bonds tens of thousands of mortgages from subprime lenders that became the subjects of FBI investigations into whether they’d misled borrowers or exaggerated applicants’ incomes to justify making hefty loans.

• Used offshore tax havens to shuffle its mortgage-backed securities to institutions worldwide, including European and Asian banks, often in secret deals run through the Cayman Islands, a British territory in the Caribbean that companies use to bypass U.S. disclosure requirements.

• Has dispatched lawyers across the country to repossess homes from bankrupt or financially struggling individuals, many of whom lacked sufficient credit or income but got subprime mortgages anyway because Wall Street made it easy for them to qualify.

• Was buoyed last fall by key federal bailout decisions, at least two of which involved then-Treasury Secretary Henry Paulson, a former Goldman chief executive whose staff at Treasury included several other Goldman alumni.

Its detailed investigation, well worth pouring over.

As to professor Kotlikoff’s assertion at the top of the page: Goldman’s defense would likely be “Of course we did not know the future. One division sold this product, another division made a bet against the sector. But it was a gamble, one that hardly anyone else (Aside form John Paulson) took. After the fact, it may look like prescient, but an investment opinion is not the same as knowing the future. That is, of course, impossible.”

Case dismissed . . .

>

>

This is a multi-part series; I’ll update this as more stories come out:

- Sunday: High-yield promises, secret contrary bets

- Monday: Take borrowers to court, then take their homes

- Tuesday: Big losses, little recourse for overseas investors

- Wednesday: Blue-chip prestige flirts with subprime disaster

>

Hat tip Bill King

Source:

How Goldman secretly bet on the U.S. housing crash

Greg Gordon

McClatchy Newspapers, November 1, 2009

http://www.mcclatchydc.com/227/story/77791.html

http://www.mcclatchydc.com/goldman/

What's been said:

Discussions found on the web: