Since everything I know about Goldman Sachs was learned either by reading articles from Matt Taibbi at Rolling Stone or by listening to him talk about the company on Comedy Central or YouTube, I’m probably missing something here, because, surely, this can’t be right.

Surely, the investment bank’s latest image-rebuilding effort can’t be this transparent.

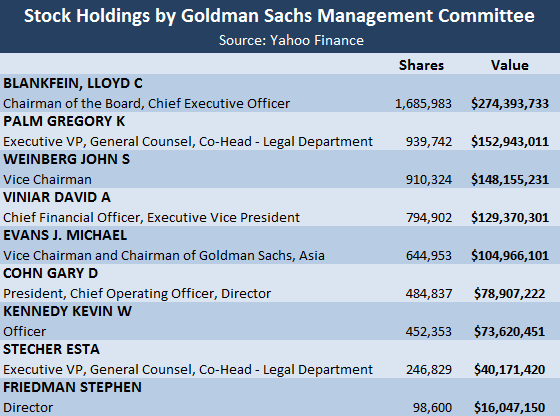

Something has probably escaped my grasp here because, to me, it doesn’t appear as though issuing stock that can’t be sold for five years to their management committee instead of paying cash bonuses will have a material effect on the executives’ finances (that was the point, right?) since they already own millions of shares that can, presumably, be sold in a pinch if they need to buy something really nice this holiday season.

As a point of reference, though he declined a bonus last year, Blankfein received an all-time record $53.4 million bonus in 2007.

The company’s decision was intended to quiet some of the popular dissent about Wall Street prospering while Main Street is still struggling and, like some of the other image-repair work they’ve done this year, it may not have the desired effect, though you can easily understand how the phrase “not paying cash bonuses” must have sounded irresistible when the idea was first floated amongst the executive staff.

Of course, since the shares vest over a five year period and the expense won’t be recorded until that time, this move will have the added impact of making Goldman’s reported 2009 profits look even more outlandish than before.

What is it they say? Goldman always wins?

ooo

Tim Iacono is a retired software engineer and writes the financial blog “The Mess That Greenspan Made” which chronicles the many and varied after-effects of the Greenspan term at the Federal Reserve. Tim is also the founder of the investment website “Iacono Research” that provides weekly updates to subscribers on the economy, natural resources, and financial markets.

What's been said:

Discussions found on the web: