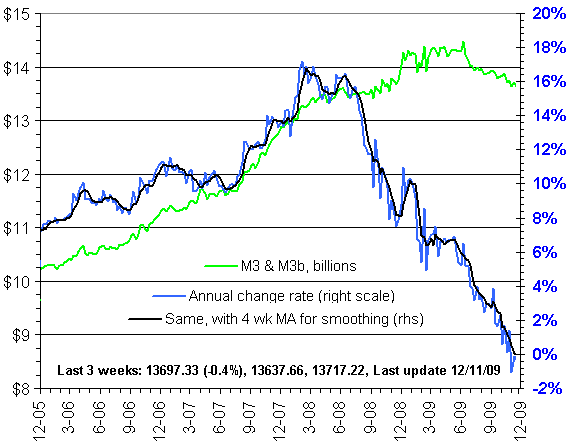

For all the talk about inflation appearing sometime in our not-too-distant future and, according to Milton Friedman, rising prices still being a monetary phenomenon, you sure don’t hear too many people talking about the broadest measure of the money supply – M3.

Reconstructed over at nowandfutures for about the last three years after the Federal Reserve discontinued it, much to the chagrin (or, maybe, delight) of those conspiracy minded individuals who viewed the move as a cover-up on the grandest of scales, it’s hard to see how consumer prices are going to be bid higher anytime soon, given a chart like the one above.

Of course, if banks ever start lending some of their massive reserves, an entirely different dynamic could quickly develop and the recent trend could quickly reverse, but, fortunately, our central bank leaders have assured us that they’re on top of that particular situation.

ooo

Tim Iacono is a retired software engineer who writes the blog “The Mess That Greenspan Made”. He is also the founder of “Iacono Research” , a subscriber-based investment website focusing on natural resources.

What's been said:

Discussions found on the web: