This has got to be one of those “Bizarro World” days for Fed chief Ben Bernanke, what with the Time Magazine “Person of the Year” award, word of growing distrust among the general population, and, just in the last hour or so, a major twist in his Senate confirmation process where Senator Jeff Merkley (D-OR) said he will vote against Bernanke when the Senate Banking Committee meets tomorrow.

This latest news is significant because Merkley is the first Democrat on the committee to announce his opposition to Bernanke and, while it is all but certain that the group will forward his nomination to the full Senate for a vote in January, a lot can happen over the next month.

This latest news is significant because Merkley is the first Democrat on the committee to announce his opposition to Bernanke and, while it is all but certain that the group will forward his nomination to the full Senate for a vote in January, a lot can happen over the next month.

In a statement, Merkley’s objections were squarely based on Bernanke’s failure as a regulator, noting, “For too many years, federal regulators turned a blind eye to signs of an impending financial crisis. Dr. Bernanke supported each of these decisions, failing to take the necessary precautionary steps that could have averted or mitigated financial collapse.”

As for monetary policy, what seems to be low on the list of Bernanke news today, the statement that was released following the FOMC meeting a short while ago had a good deal for people to talk about, even though the key phrases of “exceptionally low” short-term rates for an “extended period” were unchanged.

Below are the last two policy statements, side-by-side:

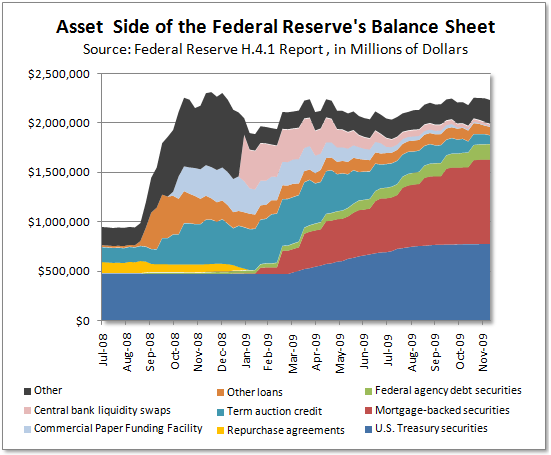

While the improving economy is acknowledged in the first few paragraphs and there are no changes to be seen for the ongoing purchases of mortgage backed securities or GSE debt, they seem to have gone out of their way to make clear that most of the emergency lending facilities will be winding down early next year.

That much should have already been clear to anyone looking at their balance sheet.

It appears as though it is taking markets a little while to digest this news, which, really doesn’t seem to be news at all.

ooo

Tim Iacono is a retired software engineer and writes the financial blog “The Mess That Greenspan Made” which chronicles the many and varied after-effects of the Greenspan term at the Federal Reserve. Tim is also the founder of the investment website “Iacono Research” that provides weekly updates to subscribers on the economy, natural resources, and financial markets.

What's been said:

Discussions found on the web: