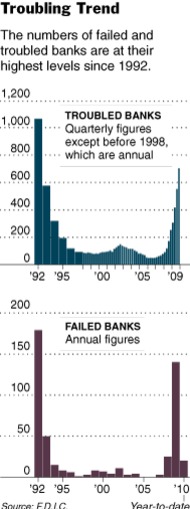

“With bank failures running at their highest level in nearly two decades, the F.D.I.C. is racing to keep up with rising losses to its insurance fund, which safeguards savers’ deposits. On Tuesday, the agency announced that it had placed 702 lenders on its list of “problem” banks, the highest number since 1993.

Not all of those banks are destined to founder, and F.D.I.C. officials said Tuesday that they expected failures to peak this year. But they also warned that the fund might have to cover $20 billion in additional losses by 2013 — a bill that could be even greater if the economy worsens…

With so many banks failing, the federal deposit insurance fund has been severely depleted. At the end of 2009, it carried a negative balance of $20.9 billion.”

Surprisingly, the FDIC’s reserves are somewhat better than they appear:

“The insurance fund is in better shape than such numbers might suggest, however. Officials estimate that bank failures would drain about $100 billion from the fund from 2009 through 2013. But of that amount, a total of roughly $80 billion in losses were recognized last year or projected for 2010. By that math, the agency is expecting an additional $20 billion of losses over the next three years.”

Of allt he regulators who were thwarted by politicians or who missed the crisis, the FDIC did the best job heading into the crisis. And for the record, the FDIC fund, unlike TARP, is NOT taxpayer monies. Rather, its paid for with bank fees. Even if they deplete the fund, they are looking for a line of credit, not actual cash.

>

Source:

At F.D.I.C. , Bracing for a Wave of Failures

ERIC DASH

NYT, February 23, 2010

http://www.nytimes.com/2010/02/24/business/24fdic.html

What's been said:

Discussions found on the web: