China ordered banks to hold greater reserves in lending in an effort to cool off their fast growing economy surging real estate prices. The reserve requirement was increased 50 basis points (0.5%) effective February 25th. This comes on top of reserve requirement of 16% for larger banking institutions and 14% for smaller ones.

It was the second increase in a month. That’s the problem with Chinese Central bank tightening — 2 weeks later, you are still hungry for another.

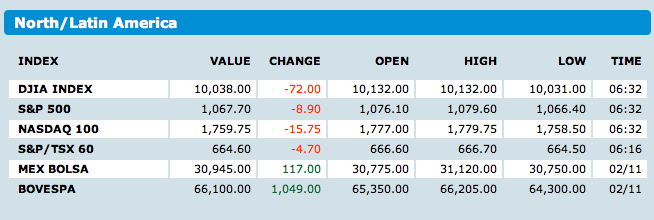

European stocks and US futures dropped significantly, although I suspect that is a mere knee jerk reaction.

>

What's been said:

Discussions found on the web: