There is a huge front page article in the NYT discussing what we already know — that AIG extracted billions from AIG before ($5.9B) and after ($12.9B)their collapse.

There is a huge front page article in the NYT discussing what we already know — that AIG extracted billions from AIG before ($5.9B) and after ($12.9B)their collapse.

We know that Goldie got paid 100 cents on the dollar post-bailout.But what insured party gets to set their own valuation of losses? According to the article, GS nabbed closer to 300 cents on the dollar pre-collapse of losses.

AIG balked, but the matter never seemed to be settled.

Lucky for Goldman we didn’t do an official reorg for this. Consider what the judge would have rightfully done in what should have been a very complex bankruptcy instead of a smash and grab.

Here’s the TImes:

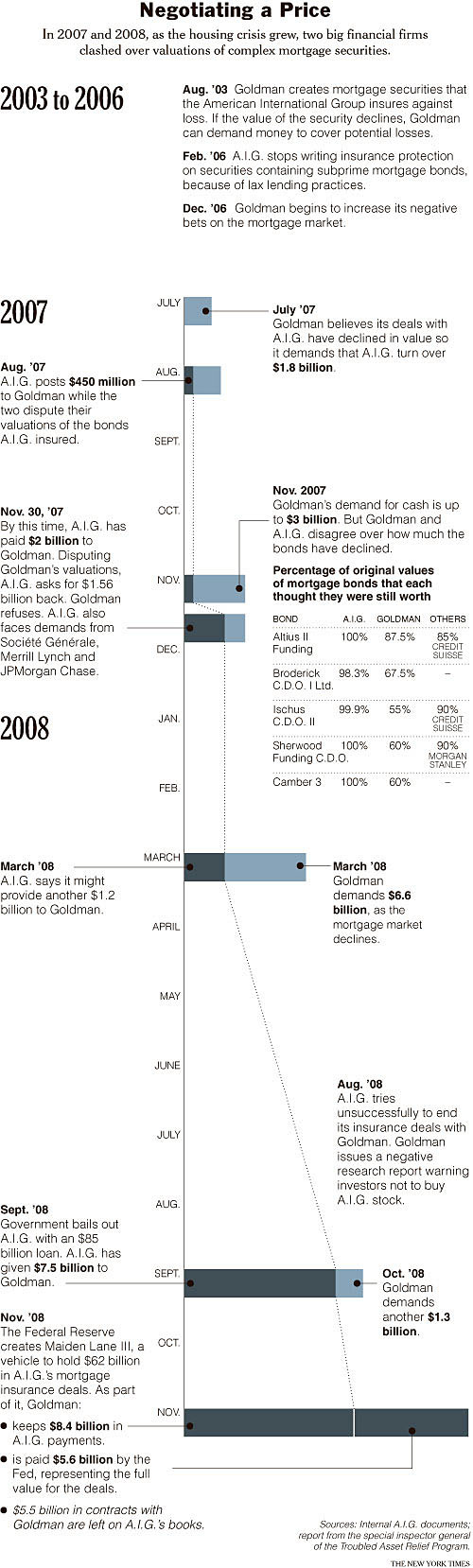

“By July 2007, when Goldman demanded its first payment from A.I.G. — $1.8 billion — the investment bank had already taken trading positions that would pay out if the mortgage market weakened, according to seven former Goldman employees.

Still, Goldman’s initial call surprised A.I.G. officials, according to three A.I.G. employees with direct knowledge of the situation. The insurer put up $450 million on Aug. 10, 2007, to appease Goldman, but A.I.G. remained resistant in the following months and, according to internal messages, was convinced that Goldman was also pushing other trading partners to ask A.I.G. for payments . . .

Later that month, Mr. Cassano noted in another e-mail message that Goldman’s demands for payment were becoming problematic. “The overhang of the margin call from the perceived righteous Goldman Sachs has impacted everyone’s judgment,” he wrote to five employees in his division.

By the end of November 2007, Goldman was holding $2 billion in cash from A.I.G. when the insurer notified Goldman that it was disputing the firm’s calculations and seeking a return of $1.56 billion. Goldman refused, the documents show.”

Now, AIG’s claims that it was Goldman that forced them into collapse, that “the payment demands were a major contributor to A.I.G.’s downfall,” are sheer nonsense. AIG wrote 3 trillion dollars worth of derivatives with precisely ZERO held in reserve. A drunk driver who drives off the road might as well blame the guy who planted those trees 50 years earlier. Given AIG’s massive mortgage exposure, they were going down anyway. GS just happened to be the one who made the opposite bet. In this zero sum game, AIG’s losses were GS profits.

Be sure to click on the graphic to see the full timeline . . .

>

Source:

Testy Conflict With Goldman Helped Push A.I.G. to Edge

Gretchen Morgenson and Louise Story

NYT February 6, 2010

http://www.nytimes.com/2010/02/07/business/07goldman.html

What's been said:

Discussions found on the web: