Roger Nusbaum is the Chief Investment Officer of Your Source Financial, a Phoenix based financial planning firm. Roger also writes about portfolio construction and management, investment products and economics on the Random Roger blog, is an outside contributor to TheStreet.com as well as providing commentary to numerous other media outlets. He has worked in the financial services industry since 1984. Roger lives in Prescott, AZ with his wife Joellyn and their five dogs and is very actively involved with the local volunteer fire department as a wildland firefighter

~~~

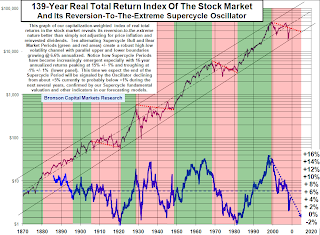

Earlier in the week Barry Ritholtz posted this chart from Bronson Capital Markets Research. It shows 139 years of nominal returns for equities (probably somewhat familiar to you) along with 139 years of real returns.

The real return component is called the Reversion To The Extreme Supercycle Oscillator. The fist observation one might make is uh-oh. I imagine the big thing should be the consistency in where the market has reverted to in the bottom of the channel and the very long period of time that these cycles encompass.

has reverted to in the bottom of the channel and the very long period of time that these cycles encompass.

While there is some variation in where past cycles bottom out the chart obviously implies several more years of stock market malaise. The fundamental condition of the US economy, balance sheet, housing market, underfunded liabilities, employment situation and so on certainly creates visibility for a poor result for several more years.

I have no idea whether the current “reversion” will last as long as is implied by the chart and it is reasonable to question the utility of extrapolating from 1920 but as a supporting nugget to the more important current events it provides perspective for how long cycles can potentially last and how big some of the counter-trend rallies have been.

You can do with this what you want but not surprisingly I view this as yet another argument for learning about foreign markets and investing in them selectively.

David Kotok had what I will call a peculiar moment Friday morning on CNBC. He always says that his firm only uses ETFs in client accounts. The segment was titled Consumer Headwinds (based on the graphic on the screen anyway) and along the way Kotok disclosed being overweight discretionary ETFs and that they use two funds; the iShares DJ US Consumer Services Fund (IYC) and the Vanguard Consumer Discretionary ETF (VCR). So far so good I suppose, overweighting discretionary is either right or its wrong–not sure why they use two funds but ok.

Then he said “Melissa (Lee) pointed out to me earlier that one of them (the ETFs) has been lagging because Walmart is a heavy weight and has been dragging it down.” Melissa then explained the point a little more and asked the reasonable question of whether, based on Walmart, the ETF will be “dead money.” Kotok went on to sort of defend the ETF as being a way in for people who not pick stocks which he reiterated that they do not.

IYC is the ETF with Walmart, it has 8% and if VCR has any Walmart it is not in the top ten (I am quite certain there is not WMT in VCR given that it is cap weighted but I did not look at all the holdings). As far as IYC lagging VCR because of Walmart it was not clear what the time frame was in the conversation but YTD IYC is trailing by about 2% and for the trailing 12 months the lag for IYC was about 25%.

What was peculiar to me was that Kotok seemed to not know that IYC was heavy in Walmart. I believe he is the CIO of the firm and depending on how big they are the situation could be such where he says overweight discretionary stocks and then portfolio managers come back after the fact and tell him that this is how they did it. This sort of scenario is very easy to imagine.

The important thing is the point made by Melissa. As obvious as it should be it is vital to understand what is under the hood of any investment product. If you think iShares DJ US Telecom is the best way to own the sector you should probably know a thing or two about AT&T which has a 16.43% weighting in the fund.

As a quick reiteration of an old point it is unclear to me why any investment professional (and do-it-yourselfer for that matter) would limit themselves to only one type of product. Favoring something is easy to argue for but as useful as ETFs are there are of course gaps in what is available.

With some ETF segments all the choices could be bad. I have to think that for a while there every financial sector ETF was a bad choice. During the worst of it I was pretty open about the type of banks I owned–there were places that offered relative outperformance which is important for people not wanting to completely zero out a sector (this is true of many advisors). I have to think that if I found these things they were not that difficult to find but whether that is true or not, the typical financial sector ETF did not cut it.

If you are familiar with Kotok and have read his stuff you know he is no lightweight so I am not sure why he of all people is ETF-only.

What's been said:

Discussions found on the web: